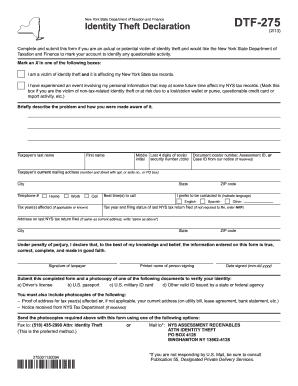

NY DTF-275 2016-2025 free printable template

Get, Create, Make and Sign dtf 275 form

Editing nys dtf 275 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF-275 Form Versions

How to fill out NY DTF-275

How to fill out NY DTF-275

Who needs NY DTF-275?

Video instructions and help with filling out and completing dtf 275 form

Instructions and Help about NY DTF-275

While everyone this is Latoya with Keystone tech solutions today this video is going to show you how to fill out your questions for your due diligence which is your Eddie 867 form once you've internet all your information for your federal side the person information for this has para dependent information and comm deductions anything like that this is going to be the next page you come to it's just let you know that your federal site is complete we want to click on to the summary it's going to summarize to return and break down the AGI now we're just going to clip to continue this is your due diligence checklist basically your any x67 form, so we're going to go through these questions the first question was the taxpayer or spousal non-resident alien for part of the year no usually that's the answer is going to be no is the taxpayer qualifying child another person going to click no did you complete the return based on information for tax year 2017 provided by the taxpayer or reasonably obtained by you yes it's going to ask you if you interviewed the taxpayer and view any documentation to determine the eligibility for the taxpayer going to click yes that you review adequate information to determine the taxpayer eligible to claim credits yes it's going to ask you if any information look incomplete inconsistent or incorrect you're going to click no did you satisfy the record retention basically did you check the documentation that they clamp provided you and whatever documentation that climb provided, so we want to put a w-2 here if they provided their ID information or social security cards whatever documentation they provided you can enter that there the next question that you ask the taxpayer whether he or she could provide documentation to substantiate eligibility for and the amount of credit claims on the return yes that you ask the taxpayer if any credits would disallow or reduced in prior year yes, and it's going to ask if any of those credits were disallowed or reduce now if it was just of course you're going to clean yes on that question, and it's going to ask you about the dependent is this child currently or intended to be qualifying child of any other individual status return no next question for EIC have you determined that the test pair is in fact eligible to claim the ESC for the number of children from home the ESC is claimed yes did you explain to the taxpayer that he or she may not claim EFC if the test pair has not lived with the child for over half the year even if the taxpayer has supported the child yes did you explain the taxpayer the rules about claiming EIC when a child is to qualify a child more than one person yes, and it gives you the tiebreaker rules down here if you want to read all those questions' child tax credit questions thus to child reside with the taxpayer who is claiming CTC or a CTC yes the child has to live with that that taxpayer has you determined that the taxpayer has not released a claim to another person...

People Also Ask about

Can I file my taxes if someone claimed me?

What to do if someone illegally claimed you on their taxes?

What happens when someone else claims you on their taxes?

What to do if someone claimed me on their taxes without my permission?

Can someone claim you on their taxes without your knowledge?

What is a DTF 5 form?

How do I contact the IRS about identity theft?

How long does it take to get your tax refund after identity theft?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY DTF-275 for eSignature?

How can I edit NY DTF-275 on a smartphone?

How do I complete NY DTF-275 on an Android device?

What is NY DTF-275?

Who is required to file NY DTF-275?

How to fill out NY DTF-275?

What is the purpose of NY DTF-275?

What information must be reported on NY DTF-275?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.