HI N-15 2024-2025 free printable template

Show details

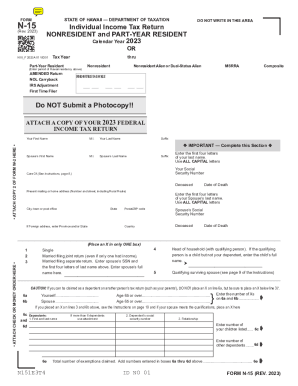

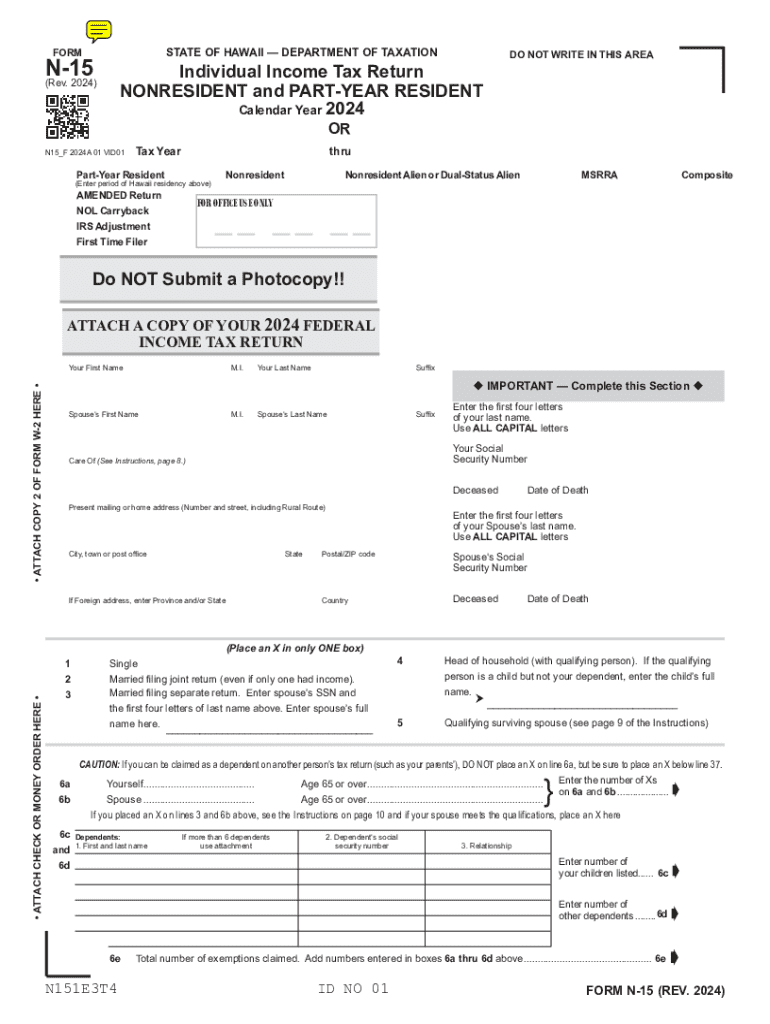

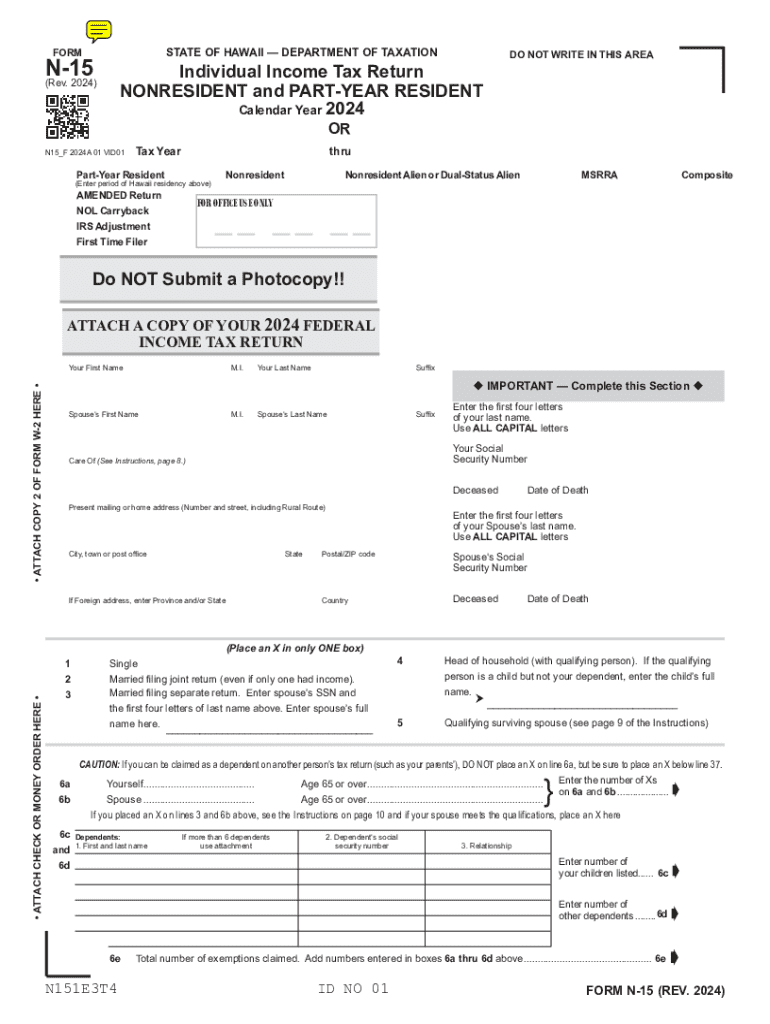

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATIONFORMN15 (Rev. 2024)Individual Income Tax Return NONRESIDENT and PARTYEAR RESIDENT Calendar Year 2024OR N15_F 2024A 01 VID01Tax YearDO NOT WRITE IN

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hawaii n 15 form

Edit your hawaii non resident tax form n 15 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hawaii n15 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hawaii form n 15 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit n 15 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI N-15 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out non resident form hawaii

How to fill out HI N-15

01

Download the HI N-15 form from the official website.

02

Read the instructions provided on the form carefully.

03

Fill in your personal information, including your name, address, and Social Security Number.

04

Indicate your residency status and the tax year you are filing for.

05

Complete the income section by reporting all relevant income sources.

06

Claim any deductions or credits you are eligible for.

07

Review your completed form for accuracy.

08

Sign and date the form before submission.

Who needs HI N-15?

01

Individuals who are residents of Hawaii and are required to file a state income tax return.

02

Taxpayers who need to report their income and deductions for the state of Hawaii.

Fill

hawaii tax form n 15

: Try Risk Free

People Also Ask about hawaii n 15 tax

What is Hawaii tax Form N 11?

N-11, Rev. 2021, Individual Income Tax Return (Resident)

Do I need to attach federal return to Hawaii return?

A completed copy of the federal return must be attached to the Form N-15. Full-year Hawaiʻi residents filing a federal return should file state Form N-11.

What is Hawaii form N 2?

Hawaii — Individual Housing Account This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Hawaii government.

What is Form N-15?

Form N-15 (nonresident or part-year resident) requires attachment of completed federal return. Nonresident is taxed on Hawaii source income only and may exclude most intangible income. Hawaii source deductions are allowed in full; other deductions are prorated. Personal exemption(s) is/are prorated.

What is Hawaii income State tax?

The state of Hawaii requires you to pay taxes if you are a resident or nonresident and receive income from a Hawaii source. The state income tax rates range from 1.4% to 11%, and the Aloha State doesn't charge sales tax.

Does Hawaii have a State tax return?

Hawaii Income Taxes. Hawaii State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a HI state return). The Hawaii tax filing and tax payment deadline is April 18, 2023.

Where to get Hawaii state tax forms?

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators (FTA) Secure Exchange System (SES) website. The SES website is a secure way to provide files to those that reproduce our forms.

Does Hawaii have a state tax form?

All state tax forms, instructions, and publications are available on the State of Hawaiʻi Department of Taxation's website, but if additional assistance is needed, the Department of Tax can be contacted toll-free at 1-800-222-3229.

Who needs Hawaii tax ID number?

All businesses must obtain a Hawaii Tax Identification Number (HI Tax ID) and all required tax licenses. licenses? Complete Form BB-1, State of Hawaii Basic Business Application, and pay a one-time $20 registration fee.

What is Hawaii tax Form N 15?

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

Who must file a Hawaii partnership return?

Every partnership engaging in trade or business, or having income from sources within the State, shall file a partnership return pursuant to section 235-95, HRS, and this section, regardless of the partnership's principal place of business or the residency status of the partners.

What is an N 11?

An N11: “Agreement to End the Tenancy” - is a form stating that the landlord and tenant both want to end a lease, and has to be signed by both of them. If you want to stay in your unit, you can refuse to sign the N11.

Who has to pay general excise tax in Hawaii?

Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

What is a form N 11?

N-11. Individual Income Tax Return (Resident Form)

What is Hawaii tax form N-15?

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in hawaii form n 15 instructions 2024 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing tax return and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my what is form n 15 s is are prorated in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your hawaii income tax forms and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit n15 hawaii instructions on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing hawaii nonresident return.

What is HI N-15?

HI N-15 is a specific form used for reporting certain tax-related information to the relevant tax authority.

Who is required to file HI N-15?

Individuals or entities that meet specific tax criteria set by the tax authority are required to file HI N-15.

How to fill out HI N-15?

To fill out HI N-15, one must provide accurate personal and financial information as outlined in the form's instructions.

What is the purpose of HI N-15?

The purpose of HI N-15 is to ensure compliance with tax regulations and to report necessary financial information to the tax authority.

What information must be reported on HI N-15?

The HI N-15 form requires the reporting of personal information, income details, deductions, and any other relevant financial data as specified.

Fill out your HI N-15 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hawaii N 15 Instructions 2024 is not the form you're looking for?Search for another form here.

Keywords relevant to hawaii n 15 instructions

Related to form tax hawaii

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.