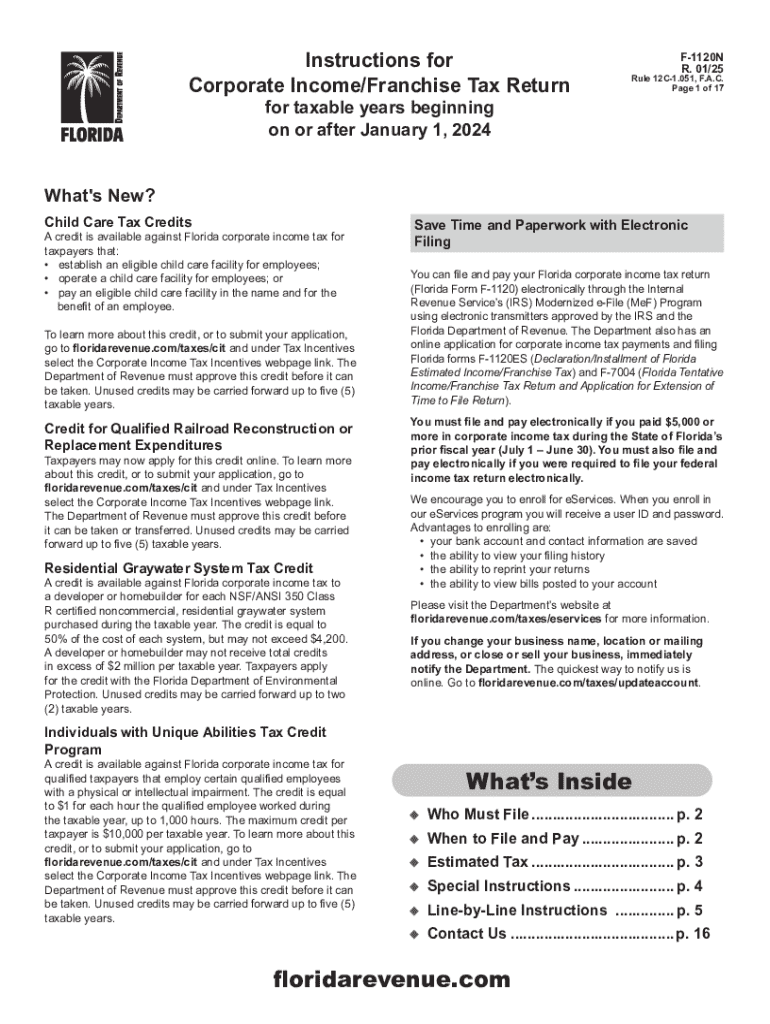

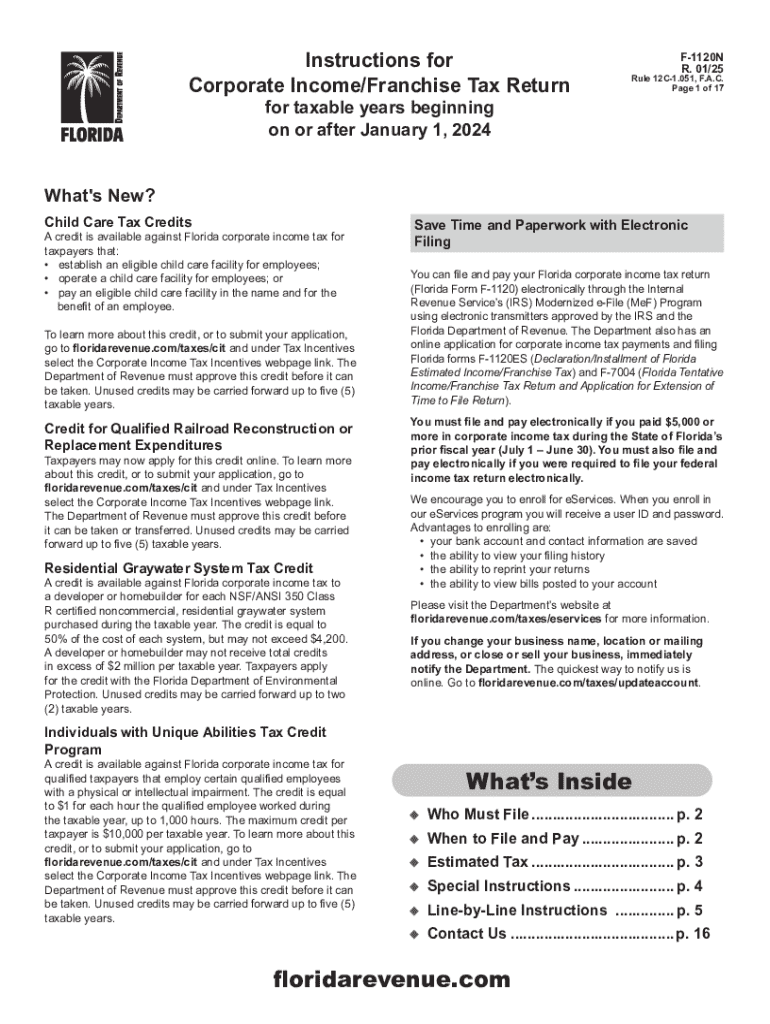

FL DoR F-1120N 2024-2025 free printable template

Get, Create, Make and Sign pdf editor form

How to edit fl corporate return form online

Uncompromising security for your PDF editing and eSignature needs

FL DoR F-1120N Form Versions

How to fill out florida corporate tax form

How to fill out FL DoR F-1120N

Who needs FL DoR F-1120N?

Video instructions and help with filling out and completing florida f 1120 form

Instructions and Help about florida franchise tax printable

Law.com legal forms guide form f dash 1120 corporate income excise tax return corporations doing business in Florida file their income and franchise taxes using a form f dash 1120 this document is found on the website of the Florida Department of Revenue step one at the top right-hand corner enter the corporation name and address step 2 give your federal employer identification number if not filing on a calendar year basis give the beginning and ending dates of your fiscal year step 3 give your federal taxable income on line one a copy of pages one through five of your federal return must be attached step 4 enter the state income taxes deducted when computing your federal taxable income online to step five complete schedule one on the third page to compute adjustments to your federal taxable income and to the result on line three steps 6 enter the sum of lines one through three online for step seven complete schedule two on the fourth page to compute subtractions from your federal taxable income enter the result on line five step 8 subtract line five from line for enter the difference on line 6 step 9 follow the instructions to determine your Florida portion of adjusted federal income online seven step 10 complete schedule are on the sixth page to compute non-business income allocated to Florida on line 8 step 11 follow the instructions on lines 9 through 20 to compute the balance due or refund owed you by the state step 12 all taxpayers must complete the coupon at the bottom of the first page and answer the additional questions at the bottom of the second page to watch more videos please make sure to visit laws calm

People Also Ask about 2024 florida return

Who must file form 1120-F?

Who needs to file form 1120-F?

What is the penalty for filing 1120-F?

What is the difference between form 1120 and 1120-F?

What is form 1120-F used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fl corporate franchise return without leaving Google Drive?

How do I edit fl f1120n tax form on an iOS device?

How do I fill out fl corporate return fillable on an Android device?

What is FL DoR F-1120N?

Who is required to file FL DoR F-1120N?

How to fill out FL DoR F-1120N?

What is the purpose of FL DoR F-1120N?

What information must be reported on FL DoR F-1120N?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.