OK Form 512-S 2024 free printable template

Show details

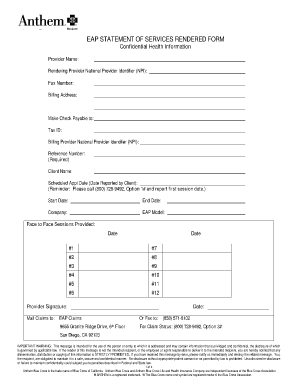

2024 Oklahoma Small Business Corporation Income Tax Forms and Instructions This packet contains: • Instructions for completing the Oklahoma Small Business Corporation Income Tax Return Form 512-S

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Form 512-S

Edit your OK Form 512-S form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Form 512-S form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK Form 512-S online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OK Form 512-S. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Form 512-S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK Form 512-S

How to fill out OK Form 512-S

01

Obtain a copy of OK Form 512-S from the relevant agency or website.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal information in the designated fields, including your name, address, and contact details.

04

Provide the necessary identification information requested on the form.

05

Fill in specific details related to the purpose of the form as required.

06

Review the completed form for any errors or missing information.

07

Sign and date the form where indicated.

08

Submit the form according to the instructions provided (via mail, online, or in person).

Who needs OK Form 512-S?

01

Individuals or entities seeking to apply for certain benefits or permits in Oklahoma.

02

Those who need to provide verification of eligibility for a specific program related to the form.

Fill

form

: Try Risk Free

People Also Ask about

What taxes does an LLC pay in Oklahoma?

The State of Oklahoma, like almost every other state, has a corporation income tax. In Oklahoma, the corporate tax is a flat 6% of Oklahoma taxable income. If your LLC is taxed as a corporation you'll need to pay this tax. The state's corporate income tax return (Form 512) is filed with the Oklahoma Tax Commission.

How are LLCs taxed in Oklahoma?

In Oklahoma, LLCs do not pay state taxes, but are still responsible for filing a federal income tax return and paying taxes on profits earned.

Does an LLC pay franchise tax in Oklahoma?

A penalty of 10% with 1.25% interest per month is due on payments made after the due date. What is the Oklahoma Annual Certificate? Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate.

Does an LLC have to file an Oklahoma franchise tax Return?

Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate. Like an annual report, the annual certificate ensures that the state has up-to-date contact and ownership information for your LLC. LLCs submit a report each year to Oklahoma's Secretary of State.

Are LLCs subject to Oklahoma franchise tax?

Since LLCs aren't subject to Oklahoma's Franchise Tax, they are required to submit the Oklahoma Annual Certificate. Like an annual report, the annual certificate ensures that the state has up-to-date contact and ownership information for your LLC. LLCs submit a report each year to Oklahoma's Secretary of State.

What taxes do LLC pay in Oklahoma?

Step 1: Establish your Oklahoma business's corporate income tax obligations. Oklahoma corporations must file an Oklahoma income tax return and pay corporate income tax. As of 2021, the rate is 6%. For tax years beginning on January 1, 2022, the corporate income tax rate will reduce to 4%.

Who is exempt from Oklahoma franchise tax?

If a taxpayer computes the franchise tax due and determines that it amounts to $250.00 or less, the taxpayer is exempt from the tax and a “no tax due” Form 200 is required to be filed.

When did partnership returns need to be filed?

If all of the members of a partnership are corporations, then the partnership information return must be filed within 5 months of the end of the partnership's fiscal period.

Who has to file a franchise tax return in Oklahoma?

The franchise tax applies solely to corporations with capital of $201,000 or more. Eligible entities are required to annually remit the franchise tax. In Oklahoma, the maximum amount of franchise tax a corporation can pay is $20,000. Corporations reporting zero franchise tax liability must still file an annual return.

Do I have to file Oklahoma State Income Tax?

Every resident individual whose gross income from both within and outside of Oklahoma exceeds the standard deduction plus personal exemption is required to file an Oklahoma income tax return. Every part-year resident, during the period of residency, has the same filing requirements as a resident.

Who Must File Oklahoma partnership tax return?

If federal and Oklahoma distributive net incomes are the same, you may complete Part Three, Columns A and B, line 15; then complete Part Five. A copy of your Federal Form 1065 and K-1s must be provided with your Oklahoma return. An Oklahoma return must be filed by all partnerships having Oklahoma source income.

Are you required to file state taxes in Oklahoma?

Every resident individual whose gross income from both within and outside of Oklahoma exceeds the standard deduction plus personal exemption is required to file an Oklahoma income tax return. Every part-year resident, during the period of residency, has the same filing requirements as a resident.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OK Form 512-S to be eSigned by others?

When you're ready to share your OK Form 512-S, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in OK Form 512-S?

With pdfFiller, it's easy to make changes. Open your OK Form 512-S in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out OK Form 512-S using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign OK Form 512-S and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is OK Form 512-S?

OK Form 512-S is a tax form used in Oklahoma for reporting and calculating the gross receipts tax for certain entities.

Who is required to file OK Form 512-S?

Entities that have gross receipts subject to the Oklahoma gross receipts tax are required to file OK Form 512-S.

How to fill out OK Form 512-S?

To fill out OK Form 512-S, gather all required financial data, follow the instructions provided on the form, and accurately report your gross receipts and any deductions.

What is the purpose of OK Form 512-S?

The purpose of OK Form 512-S is to ensure proper reporting and payment of the gross receipts tax owed by eligible entities in Oklahoma.

What information must be reported on OK Form 512-S?

Information required on OK Form 512-S includes total gross receipts, allowable deductions, and the calculated tax owed.

Fill out your OK Form 512-S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Form 512-S is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.