KS DoR Schedule S 2024-2025 free printable template

Show details

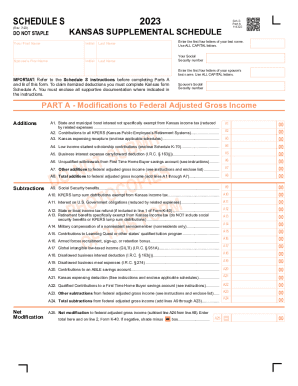

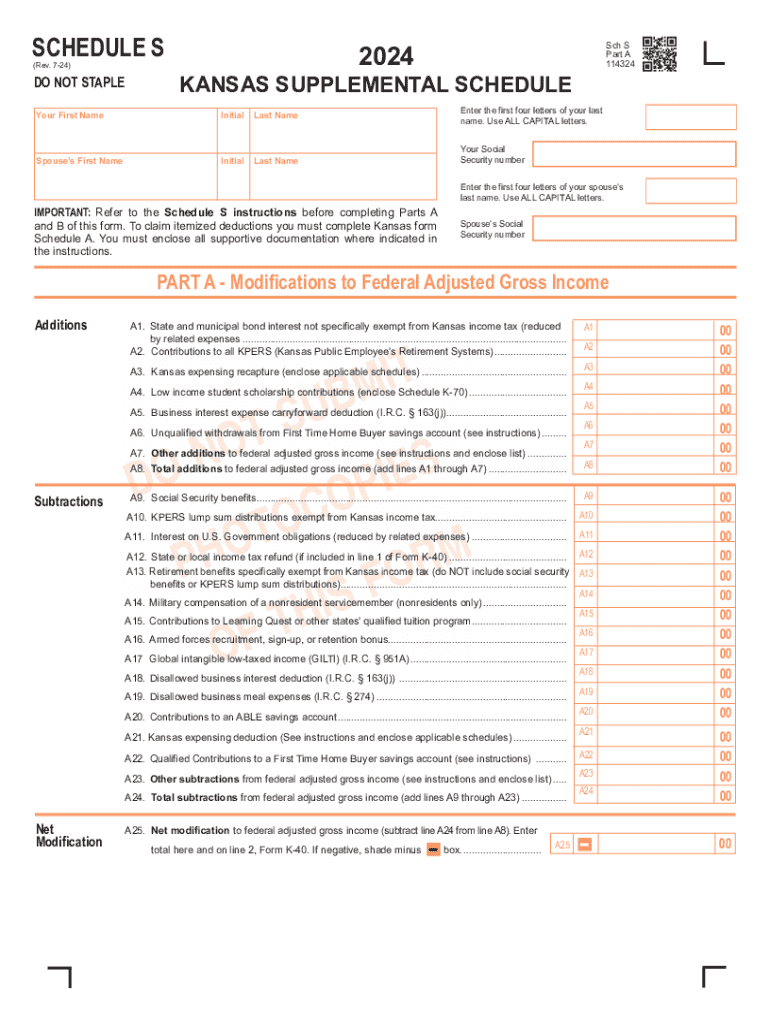

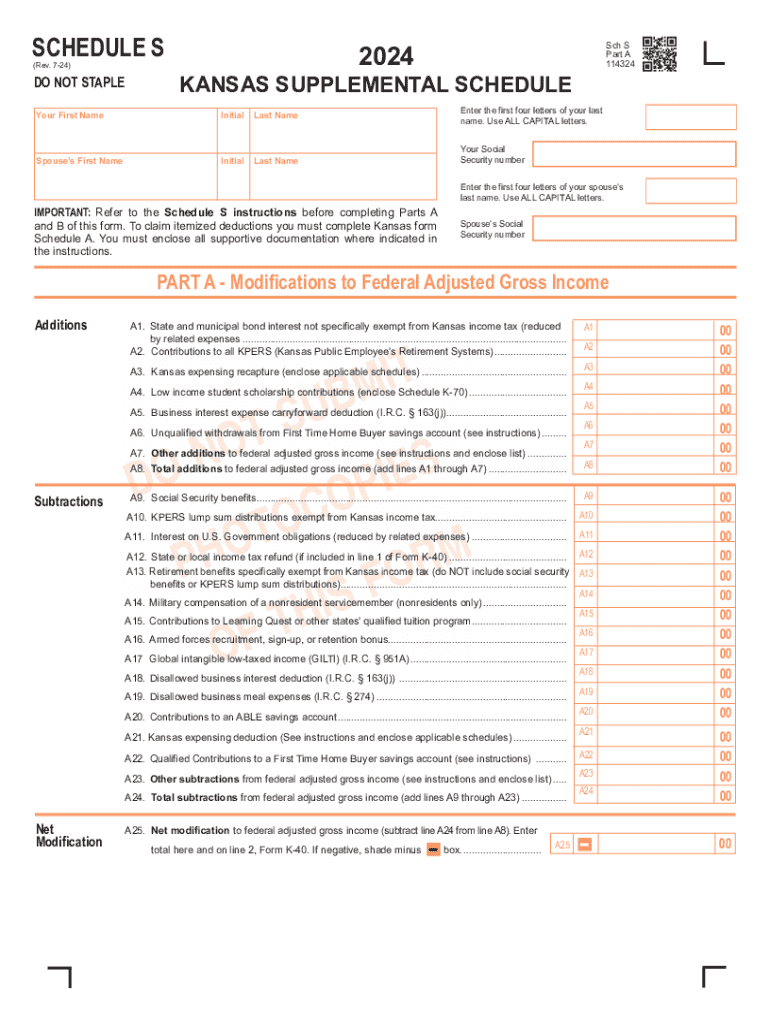

SCHEDULE S (Rev. 7-24) DO NOT STAPLE 2024 Sch S Part A 114324 KANSAS SUPPLEMENTAL SCHEDULE Your First Name Initial Last Name Spouse’s First Name Initial Last Name Enter the first four letters of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ks schedule s schedule form

Edit your kansas schedule s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kansas dor schedule s schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kansas schedule s schedule online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit kansas schedule s fillable form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR Schedule S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kansas schedule s schedule form

How to fill out KS DoR Schedule S

01

Obtain the KS DoR Schedule S form from the Kansas Department of Revenue website or your tax software.

02

Fill out the taxpayer information section, including your name, address, and Social Security number.

03

Enter the requested financial information, including income sources and any applicable deductions.

04

Review and confirm all entries to ensure accuracy.

05

Sign and date the form at the bottom.

Who needs KS DoR Schedule S?

01

Individuals and businesses who are required to report Kansas income or withholdings.

02

Taxpayers who have specific financial circumstances that require additional reporting.

03

Those participating in tax-related benefits or deductions applicable in Kansas.

Fill

ks schedule s form

: Try Risk Free

People Also Ask about ks schedule s schedule

What is s schedule?

Schedule S (Form 1120-F) is used by foreign corporations to claim an exclusion from gross income under section 883 and to provide reporting information required by the section 883 regulations.

What is considered Kansas source income?

Kansas source income includes all income earned while a Kansas resident; income from services performed in Kansas Kansas lottery, pari-mutuel, and gambling winnings; income from real or tangible personal property located in Kansas; income from a business, trade, profession or occupation operating in Kansas,

What is the standard deduction for seniors over 65 in 2022?

Example 2: Ellen is single, over the age of 65, and not blind. For 2022, she'll get the regular standard deduction of $12,950, plus one additional standard deduction of $1,750 for being a single filer over age 65. Her total standard deduction amount will be $14,700.

What retirement benefits are exempt from Kansas income tax?

Other common Kansas pension plan retirement benefits that are not taxable on the Kansas return are Kansas Police and Fireman's Retirement System Pensions, Kansas Teacher's Retirement Annuities, Kansas Highway Patrol pensions, Justices and Judges Retirement system, Board of Public Utilities and State Board of Regents.

What is Schedule S used for?

Schedule S (Form 1120-F) is used by foreign corporations to claim an exclusion from gross income under section 883 and to provide reporting information required by the section 883 regulations.

Can you take a standard deduction on federal itemize on Kansas?

Itemized Deductions. Individual taxpayers may choose to either itemize their individual nonbusiness deductions or claim a standard deduction. If your Kansas itemized deductions are greater than the Kansas standard deduction for your filing status, it will be to your advantage to complete and file Kansas Schedule A.

What is the standard deduction for KS?

For most taxpayers, the 2021 standard deduction amounts are: Single: $3,500. Married filing separately: $4,000. Head of household: $6,000.

What is the new standard deduction for 2022?

2022 Standard Deduction Amounts Filing Status2022 Standard DeductionSingle; Married Filing Separately$12,950Married Filing Jointly; Qualifying Widow(er)$25,900Head of Household$19,400 Dec 5, 2022

What are the Kansas tax brackets for 2022?

Individual Income Tax taxable income not over $30,000: 3.1 % (K.S.A. 79-32,110) taxable income over $30,000 but not over $60,000: $930 plus 5.25 % of excess over $30,000 (K.S.A. 79-32,110) taxable income over $60,000: $2,505 plus 5.7 % of excess over $60,000 (K.S.A. 79-32,110)

What is a Schedule S for Kansas?

These are items of income that are not taxed or included on your Federal return but are taxable to Kansas. Enter interest income received, credited, or earned by you during the taxable year from any state or municipal obligations such as bonds and mutual funds.

What is the standard deduction for individuals over 65?

Taxpayers who are at least 65 years old or blind can claim an additional standard deduction of $1,500 is allowed for 2023 ($1,850 if you're claiming the single or head of household filing status). As with the 2022 standard deduction, the additional deduction amount is doubled if you're both 65 or older and blind.

What is a supplemental schedule for taxes?

Supplemental wages These wages generally include commissions and bonuses, any severance payments upon termination of your employment, taxable prizes and awards, retroactive pay increases, reimbursements of nondeductible moving expenses, taxable fringe benefits and certain kinds of expense reimbursements and allowances.

Do I have to file a Québec tax return?

You may have to file an income tax return in Québec even if you are a resident of another province or a territory of Canada for tax purposes on December 31 of a particular year. For more information, see Your Tax Obligations as a Resident of Another Province or a Territory of Canada.

What is the tax schedule?

A tax schedule is a form the IRS requires you to prepare in addition to your tax return when you have certain types of income or deductions. These commonly include things like significant amounts of interest income, mortgage interest or charitable contributions.

What are the standard deduction amounts for Kansas?

Effective for tax years beginning after 2020, Kansas increases the standard deduction to: $3,500 for single taxpayers; $6,000 for heads of households; and. $8,000 for married taxpayers filing jointly.

Where can I pick up Québec tax forms?

Quebec corporate income tax forms Corporate tax forms are available from the Quebec Revenue Ministry website.

What is the Kansas standard deduction for 2022?

(2) For tax year years 2021 and 2022, and all tax years thereafter, the standard deduction amount of an individual, including husband and wife who are either both residents or who file a joint return as if both were residents, shall be as follows: Single individual filing status, $3,500; married filing status, $8,000;

What is the standard deduction for seniors this year?

For 2022, they'll get the regular standard deduction of $25,900 for a married couple filing jointly. They also both get an additional standard deduction amount of $1,400 per person for being over 65. They get one more $1,400 standard deduction because Susan is blind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ks dor schedule s form without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 2024 kansas s. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the ks schedule s fillable electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your 2024 schedule s in seconds.

Can I edit kansas schedule s tax form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share kansas schedule s schedule get on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is KS DoR Schedule S?

KS DoR Schedule S is a tax form used by the Kansas Department of Revenue to report certain types of income, deductions, credits, and other information for individuals and businesses.

Who is required to file KS DoR Schedule S?

Individuals and entities that have income that falls under the categories specified on the form, such as pass-through income, need to file KS DoR Schedule S along with their Kansas tax return.

How to fill out KS DoR Schedule S?

To fill out KS DoR Schedule S, taxpayers need to provide detailed information about their income sources, deductions, and any applicable credits as outlined on the form. It's important to follow the instructions provided with the form carefully.

What is the purpose of KS DoR Schedule S?

The purpose of KS DoR Schedule S is to collect specific income information for accurate tax calculation and ensure compliance with Kansas tax laws.

What information must be reported on KS DoR Schedule S?

Taxpayers must report various types of income, including wages, interest, dividends, and gains, as well as any deductions, credits, and other pertinent financial information required by the form.

Fill out your kansas schedule s form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ks Schedule S Schedule Get is not the form you're looking for?Search for another form here.

Keywords relevant to ks dor schedule s get

Related to kansas dor schedule s search

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.