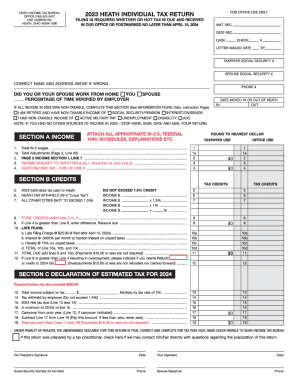

OH Heath Individual Tax Return 2024-2026 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH Heath Individual Tax Return

Edit your OH Heath Individual Tax Return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH Heath Individual Tax Return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH Heath Individual Tax Return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OH Heath Individual Tax Return. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH Heath Individual Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

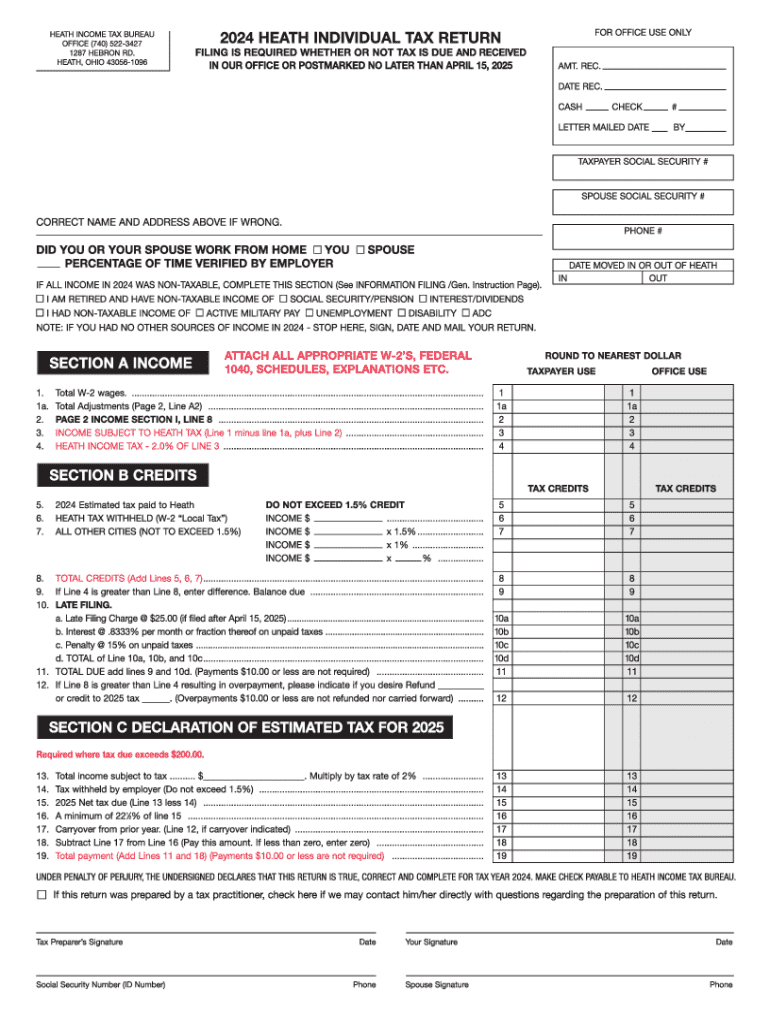

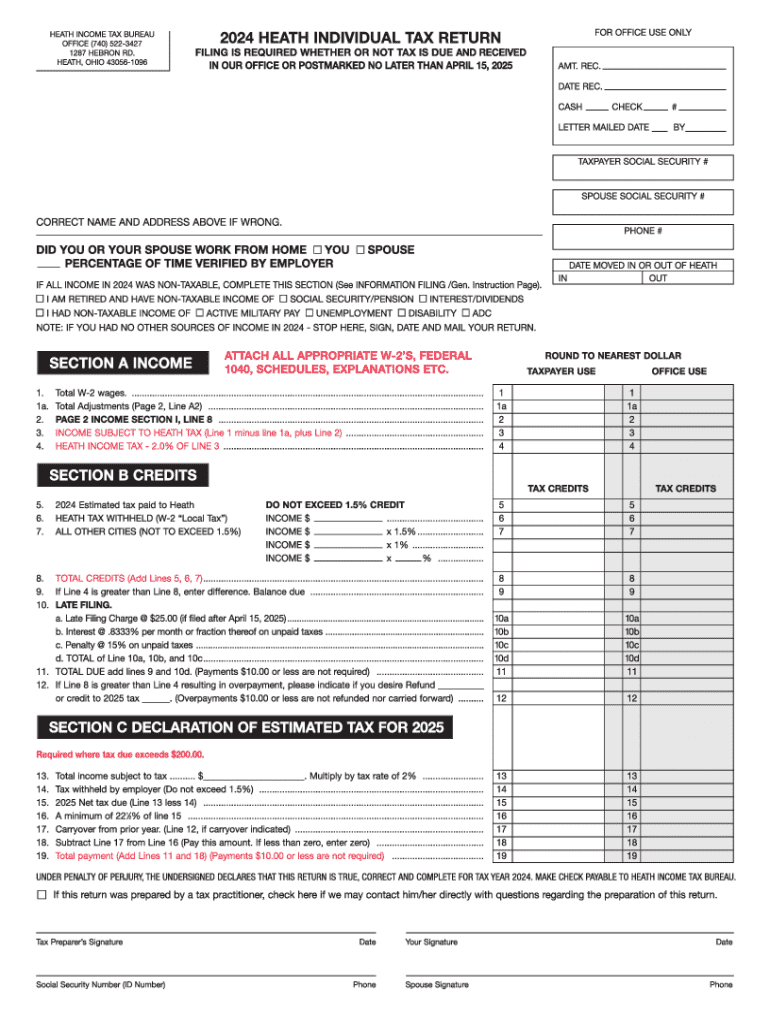

How to fill out OH Heath Individual Tax Return

How to fill out OH Heath Individual Tax Return

01

Gather all necessary documents including W-2s, 1099s, and any other income statements.

02

Obtain the OH Heath Individual Tax Return form from the Ohio Department of Taxation website or local tax office.

03

Fill in personal information such as your name, address, and Social Security number at the top of the form.

04

Report your total income by entering amounts from your income statements in the designated fields.

05

Apply any deductions or credits you are eligible for as outlined in the instructions provided with the tax return form.

06

Calculate your tax liability based on the income and deductions reported.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the return before submitting.

09

Submit the completed form by mail or electronically if applicable.

Who needs OH Heath Individual Tax Return?

01

Individuals residing in Ohio who earn income and are required to file a tax return.

02

Residents who have received income from self-employment or freelance work.

03

Individuals who receive unemployment benefits or government assistance.

04

Anyone who has earned income through rental properties or investments.

05

Residents seeking to claim tax credits or refunds.

Fill

form

: Try Risk Free

People Also Ask about

Does Newark have a city income tax?

Newark's Ordinance also has a mandatory filing requirement. All residents who are 18 or older are required to file an annual Newark City Tax Return regardless of their income. There are three forms to simplify meeting your filing requirement.

What are the 5 steps to filing your tax return?

Your Fast and Easy Guide to Filing Taxes Step 1: Gather Your Documents. Step 2: Make Your Decision Between Itemizing and the Standard Deduction. Step 3: State Your Status. Step 4: Officially File. Step 5: Tie Up Loose Tax Ends and Sit Back.

How do I fill out where's my refund?

To use Where's My Refund?, taxpayers must enter their Social Security number or Individual Taxpayer Identification Number, their filing status and the exact whole dollar amount of their refund. The IRS updates the tool once a day, usually overnight, so there's no need to check more often.

Does Newark have local income tax?

Residents of Newark pay a flat city income tax of 1.00% on earned income, in addition to the New Jersey income tax and the Federal income tax. Nonresidents who work in Newark also pay a local income tax of 1.00%, the same as the local income tax paid by residents.

How to fill out tax return?

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents. Step 2: Report Your Income. Step 3: Claim Your Deductions. Step 4: Calculate Your Tax. Step 5: Claim Tax Credits.

How do I fill out a W 4?

We've got the steps here; plus, important considerations for each step. Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

What is the city tax in Heath Ohio?

The Income Tax Department is under the direction of the Tax Administrator who is responsible for the collection and administration of the City's 2% earnings tax and the 3% hotel excise tax. The Income Tax Department offers direct tax assistance via e-mail, telephone, and walk-in service to all residents and businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my OH Heath Individual Tax Return in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your OH Heath Individual Tax Return right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I fill out OH Heath Individual Tax Return on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your OH Heath Individual Tax Return. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit OH Heath Individual Tax Return on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as OH Heath Individual Tax Return. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is OH Heath Individual Tax Return?

The OH Heath Individual Tax Return is a tax form used by individuals in Ohio to report their income and calculate their state tax liability.

Who is required to file OH Heath Individual Tax Return?

Individuals who are residents of Ohio and have earned income during the tax year, as well as those who meet certain income thresholds, are required to file the OH Heath Individual Tax Return.

How to fill out OH Heath Individual Tax Return?

To fill out the OH Heath Individual Tax Return, individuals need to gather their income statements, complete the designated sections for income, deductions, and credits, and ensure all necessary documentation is attached before submitting it to the appropriate tax authority.

What is the purpose of OH Heath Individual Tax Return?

The purpose of the OH Heath Individual Tax Return is to allow individuals to report their income and calculate the amount of state tax they owe to Ohio, ensuring compliance with state tax laws.

What information must be reported on OH Heath Individual Tax Return?

Information that must be reported includes total income earned, applicable deductions, tax credits, and any other relevant financial information necessary for calculating state tax liability.

Fill out your OH Heath Individual Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH Heath Individual Tax Return is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.