CA FTB 3563 2024-2025 free printable template

Show details

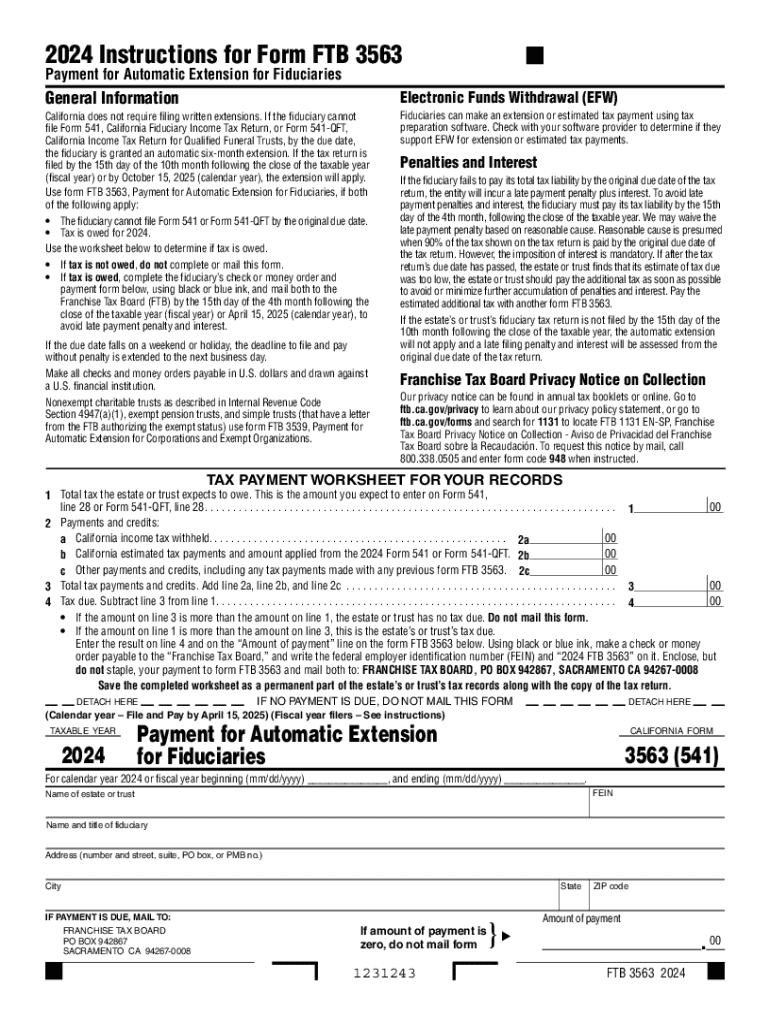

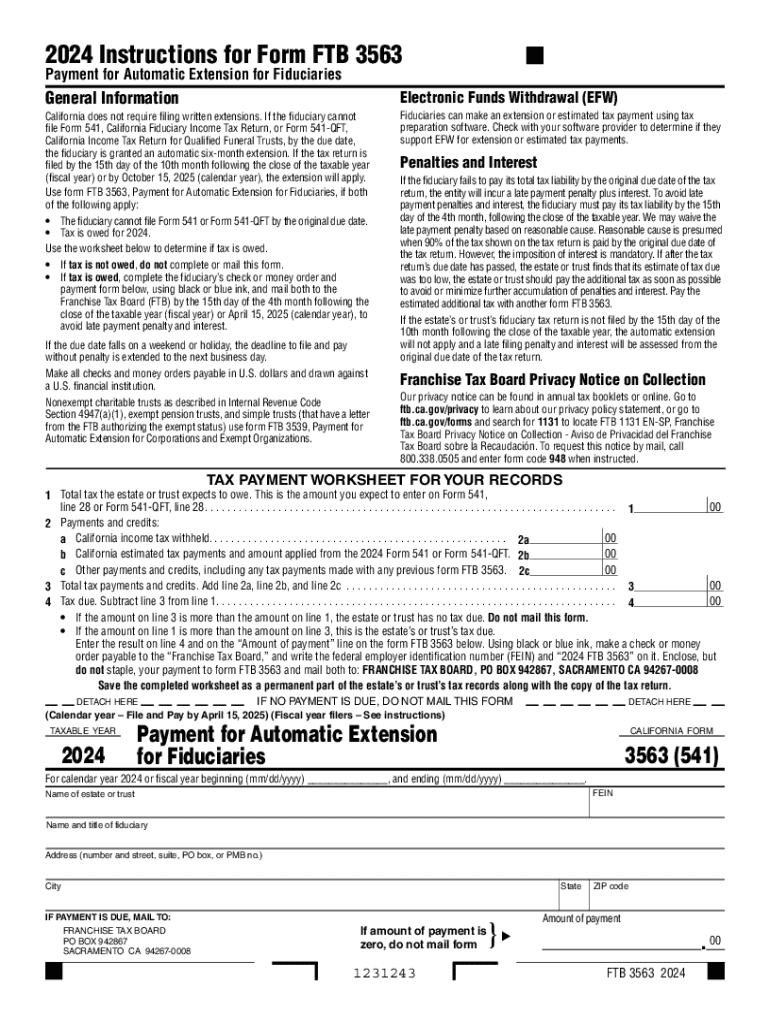

2024 Instructions for Form FTB 3563 Payment for Automatic Extension for Fiduciaries General Information Electronic Funds Withdrawal (EFW) California does not require filing written extensions. If

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 3563 form

Edit your ftb 3563 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2024 ftb 3563 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ca 3563 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA FTB 3563. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3563 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 3563

How to fill out CA FTB 3563

01

Obtain the CA FTB 3563 form from the California Franchise Tax Board website or your local tax office.

02

Fill in your name and Social Security Number (SSN) at the top of the form.

03

Indicate your current address, including city, state, and ZIP code.

04

Provide information regarding your filing status by checking the appropriate box.

05

Complete the sections related to your income, deductions, and credits as applicable.

06

If you are claiming a specific credit or deduction, ensure you include any required documentation or schedules.

07

Review the completed form for accuracy and make sure all required fields are filled.

08

Sign and date the form.

09

Submit the completed CA FTB 3563 form by mail or online, as per the instructions provided.

Who needs CA FTB 3563?

01

Individuals who are applying for a California income tax credit.

02

Taxpayers seeking refunds for excessive withholding or overpayment of tax.

03

Residents or non-residents of California who have income sourced from California.

Fill

form

: Try Risk Free

People Also Ask about

Can form 541 be filed electronically?

Accepted forms Forms you can e-file for fiduciary: California Fiduciary Income Tax Return (Form 541) Capital Gain of Loss (Schedule D-541) Trust Allocation of an Accumulation Distribution (Schedule J)

What is the annual fee for an S Corp in California?

The annual tax for S corporations is the greater of 1.5% of the corporation's net income or $800.

Do you have to pay the $800 California S Corp fee the first-year?

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

Is the California tax extension automatic?

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty.

Do you have to pay the $800 California C Corp fee the first year?

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

Do you have to pay a $800 California S Corp fee every year?

S corporations are subject to the annual $800 minimum franchise tax.

Can I pay my federal income taxes online?

Make a payment today, or schedule a payment, without signing up for an IRS Online Account. Pay from your bank account, your Debit or Credit Card, or even with digital wallet.

Can Form 541 be filed electronically?

Accepted forms Forms you can e-file for fiduciary: California Fiduciary Income Tax Return (Form 541) Capital Gain of Loss (Schedule D-541) Trust Allocation of an Accumulation Distribution (Schedule J)

How do I pay my California taxes electronically?

To pay California state taxes, follow these steps: Navigate to the website State of California Franchise Tax Board website. Choose the payment method. Your payment options include drawing from your bank account, credit card, check, money order, or electronic funds withdrawal. You can also set up a payment plan.

Is CA 541 automatic extension?

Estates and Trusts - California does not require filing written extensions. If the fiduciary cannot file Form 541, California Fiduciary Income Tax Return, by the due date, the fiduciary is granted an automatic six-month extension.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA FTB 3563 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your CA FTB 3563 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send CA FTB 3563 for eSignature?

Once you are ready to share your CA FTB 3563, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out CA FTB 3563 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign CA FTB 3563 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is CA FTB 3563?

CA FTB 3563 is a form used by individuals in California to report and claim a California tax credit for certain wages paid to employees.

Who is required to file CA FTB 3563?

Employers who have paid qualifying wages to employees and wish to claim the associated tax credit are required to file CA FTB 3563.

How to fill out CA FTB 3563?

To fill out CA FTB 3563, you need to provide your identifying information, details about the eligible employees, and the total wages paid that qualify for the credit.

What is the purpose of CA FTB 3563?

The purpose of CA FTB 3563 is to allow eligible employers to claim tax credits for wages paid to employees, encouraging job creation and retention in California.

What information must be reported on CA FTB 3563?

The information that must be reported on CA FTB 3563 includes employer identification details, employee details, qualifying wages, and claimed tax credit amounts.

Fill out your CA FTB 3563 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3563 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.