IRS 8892 2024-2026 free printable template

Show details

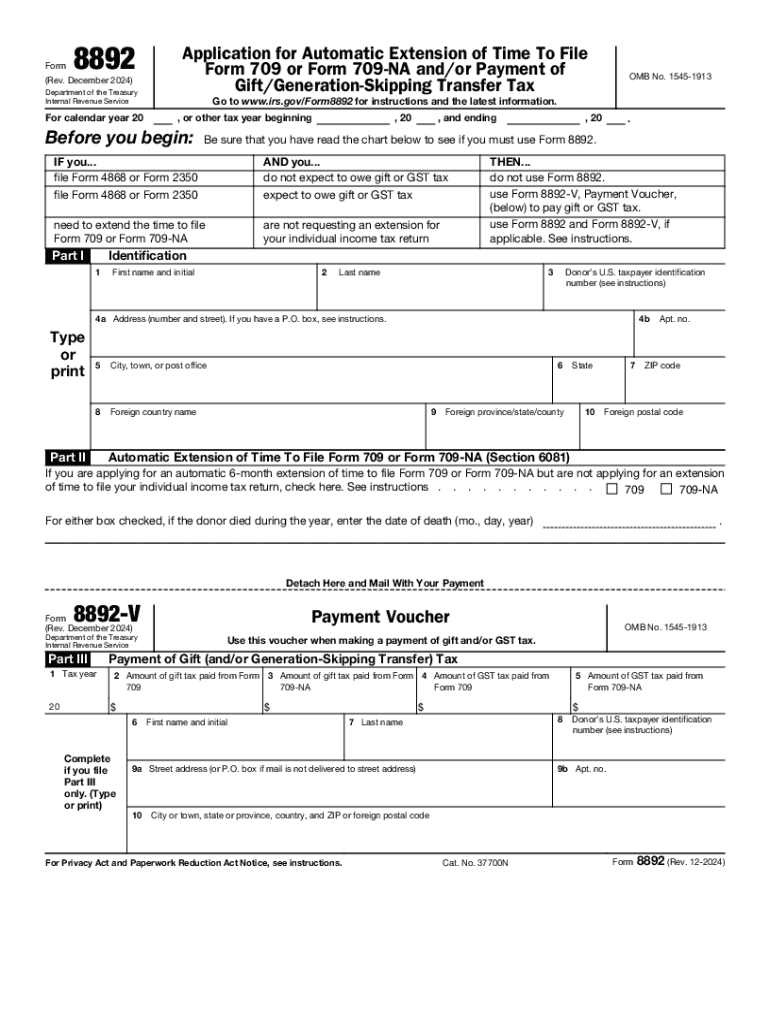

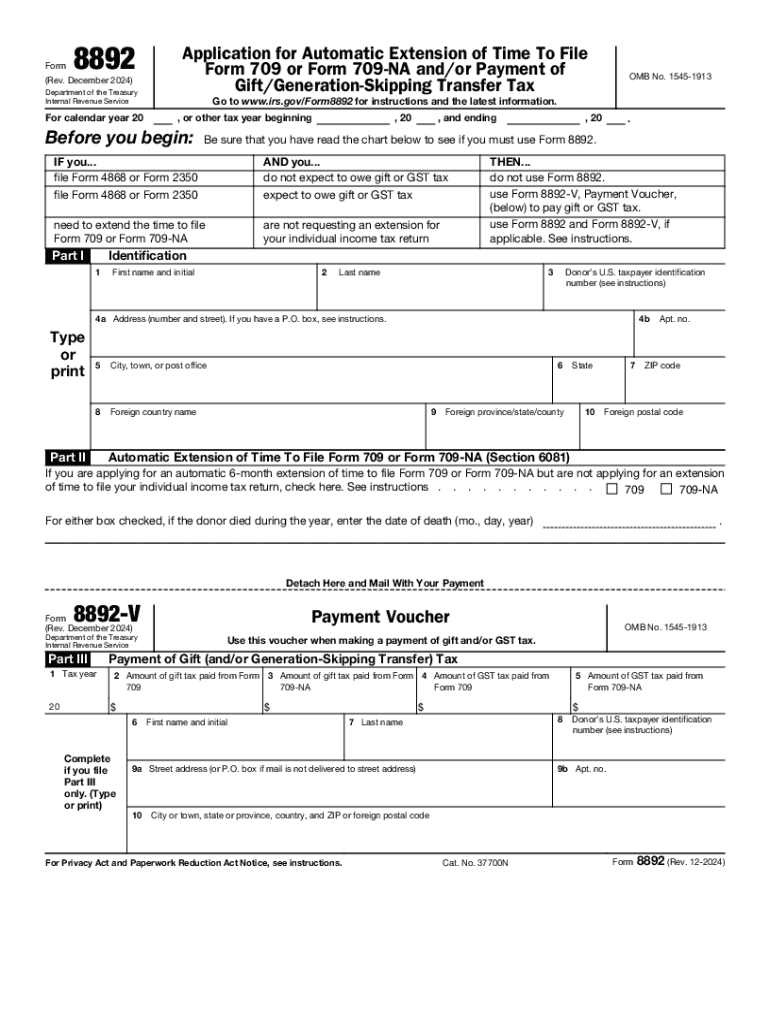

Form 8892 (Rev. December 2024) Department of the Treasury Internal Revenue Service For calendar year 20 Application for Automatic Extension of Time To File Form 709 or Form 709-NA and/or Payment of

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 8892 form

Edit your IRS 8892 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8892 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8892 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 8892. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8892 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8892

How to fill out IRS 8892

01

Obtain Form 8892 from the IRS website or your tax professional.

02

Fill in your name, address, and identifying number (such as Social Security Number or Employer Identification Number).

03

Indicate the type of tax return you are filing.

04

Complete any necessary sections regarding your tax situation.

05

Review the form for accuracy and complete any additional required documentation.

06

Sign and date the form.

07

Submit the form as per the instructions provided, either electronically or by mail.

Who needs IRS 8892?

01

Individuals or entities who need to request a refund of an overpayment of taxes.

02

Taxpayers expecting a refund but who have not received it within the expected timeframe.

Fill

form

: Try Risk Free

People Also Ask about

How do I file late 709?

A Form 709, Gift Tax Return, must be filed between January 1 and April 15 in the calendar year that the gift was made. In the event that Form 709 cannot be filed by the deadline, Form 8892 should be filed (Application for Automatic Extension of Time to File Form 709).

Is 709 automatically extended with 1040?

11315: 709 - Gift Tax Extension Any extension of time granted for filing your individual federal income tax return will also automatically extend the time to file your federal gift tax return.

Does Form 4868 extend gift tax return?

An extension of time to file your 2021 calendar year income tax return also extends the time to file Form 709 for 2021. However, it doesn't extend the time to pay any gift and GST tax you may owe for 2021.

Do I need to attach extension to Form 709?

Extending the time to file Form 709. If you obtained an extension of time to file your individual income tax return by using Form 4868 or Form 2350, the time to file your Form 709 is automatically extended. In this case, you don't need to file Form 8892 to extend the time to file Form 709.

Is there an extension for Form 709?

Use Form 8892 to: To request an automatic 6-month extension of time to file Form 709, when you are not applying for an extension of time to file your individual income tax return using Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

Can you file an extension for Form 709?

Use Form 8892 to: To request an automatic 6-month extension of time to file Form 709, when you are not applying for an extension of time to file your individual income tax return using Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

Can you get an extension on a gift tax return?

There are two ways to request an extension for Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return: Any extension of time granted for filing your individual federal income tax return will also automatically extend the time to file your federal gift tax return.

Is Form 709 Extended Due Date?

Key Points. April 18, 2022, is the deadline for filing the gift tax return Form 709 for 2021. Generally, you must file a gift tax return for 2021 if you made gifts that exceeded the $15,000 per recipient annual gift tax exclusion.

Do you get an automatic extension on taxes?

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty. The deadline is October 17, 2022. An extension to file your tax return is not an extension to pay.

What is the extended due date for gift tax returns?

When to File. Generally, the estate tax return is due nine months after the date of death. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The gift tax return is due on April 15th following the year in which the gift is made.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 8892 directly from Gmail?

IRS 8892 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit IRS 8892 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your IRS 8892, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit IRS 8892 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share IRS 8892 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is IRS 8892?

IRS Form 8892 is a tax form used to request a suspension of collection on the pending voluntary disclosure of certain unpaid taxes to the Internal Revenue Service.

Who is required to file IRS 8892?

Individuals or entities seeking a voluntary disclosure of unpaid taxes are required to file IRS 8892.

How to fill out IRS 8892?

To fill out IRS 8892, taxpayers must provide their personal information, details of the unpaid taxes, and select the appropriate options in the form as indicated in the IRS instructions.

What is the purpose of IRS 8892?

The purpose of IRS 8892 is to facilitate taxpayers in disclosing unpaid taxes while requesting a suspension of collection during the process.

What information must be reported on IRS 8892?

The information that must be reported on IRS 8892 includes taxpayer identification details, a description of the tax liabilities being disclosed, and the reasons for the voluntary disclosure.

Fill out your IRS 8892 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8892 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.