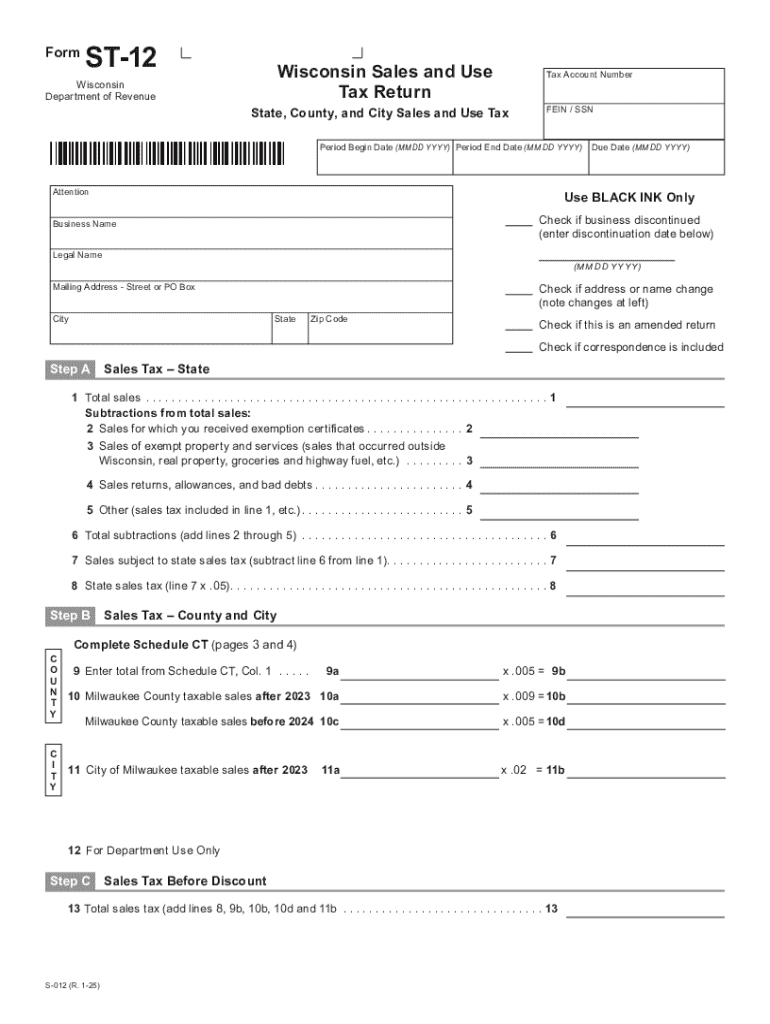

Who needs a WI For ST-12 form?

This is a Sales and Use Tax Return for taxpayers in Wisconsin. It must be submitted by all entrepreneurs registered for sales and use tax purposes in the State.

What is this return for?

It’s a regular report to the Department of Revenue from individuals, business entities and organizations who made sales or provided services on the territory of the state. All taxpayers have to report their taxable sales and can calculate penalty and interest monthly, quarterly and annually based on this form. If no tax is due, the WI Department of Revenue still obliges the qualifying entrepreneurs to file the return.

The form can also be submitted as an amended return.

Is it accompanied by other forms?

Typically, the form WI ST-12 does not require any attachments. However, if it is being submitted as an amended return, filing Schedule CT (County Sales and Use Tax Schedule) can be necessary too.

When is form WI For ST-12 due?

Typically, the payments are to be made by the last day of the month following the reported period not later than 4 p.m. However, there is an exception for early monthly sales tax filers -- their returns are due by the 20th of the month following the end of the reporting period.

How do I fill out this tax return?

The taxpayers are supposed to provide the following information:

- Their company business and legal name;

- Address;

- Sales tax for the State;

- Sales tax for County and Stadium;

- Amount of sales tax before discount;

- Discount and Net Sales Tax;

- State use tax;

- County and Stadium use tax;

- Total amount due.

Finally, the filer has to sign the document and provide their mailing information.

More details about filling out the form can be found in this instruction manual

Where do I send it?

Mail a completed copy to the following address:

Wisconsin Department of Revenue

PO Box 8921

Madison WI 53708-8921.