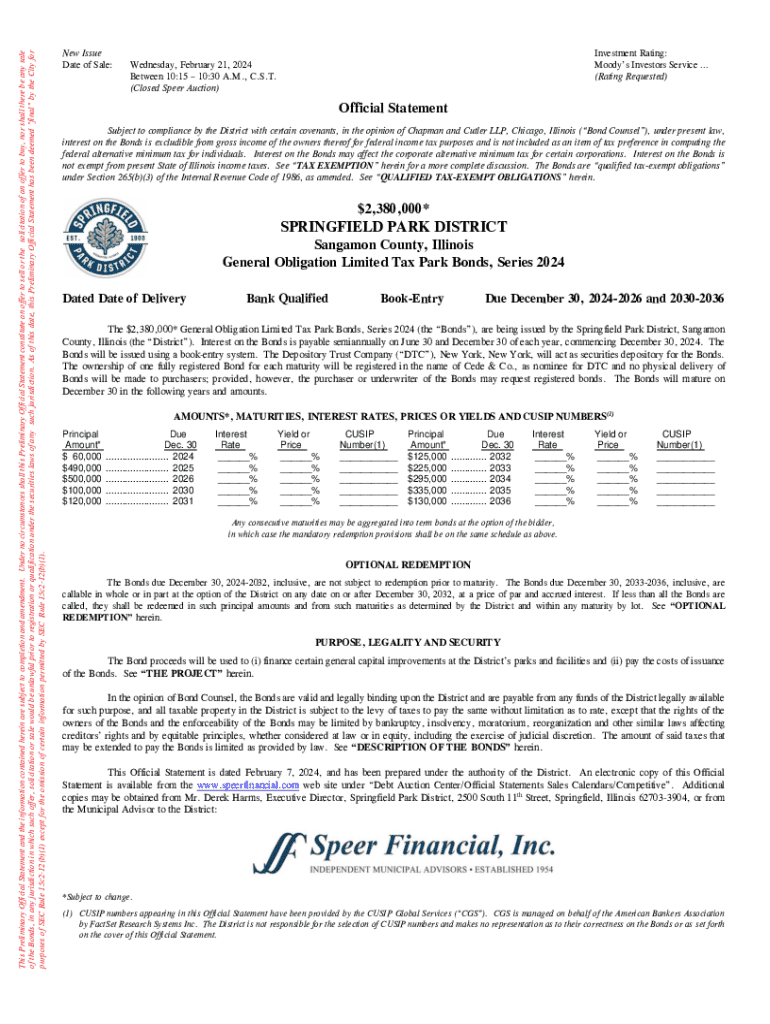

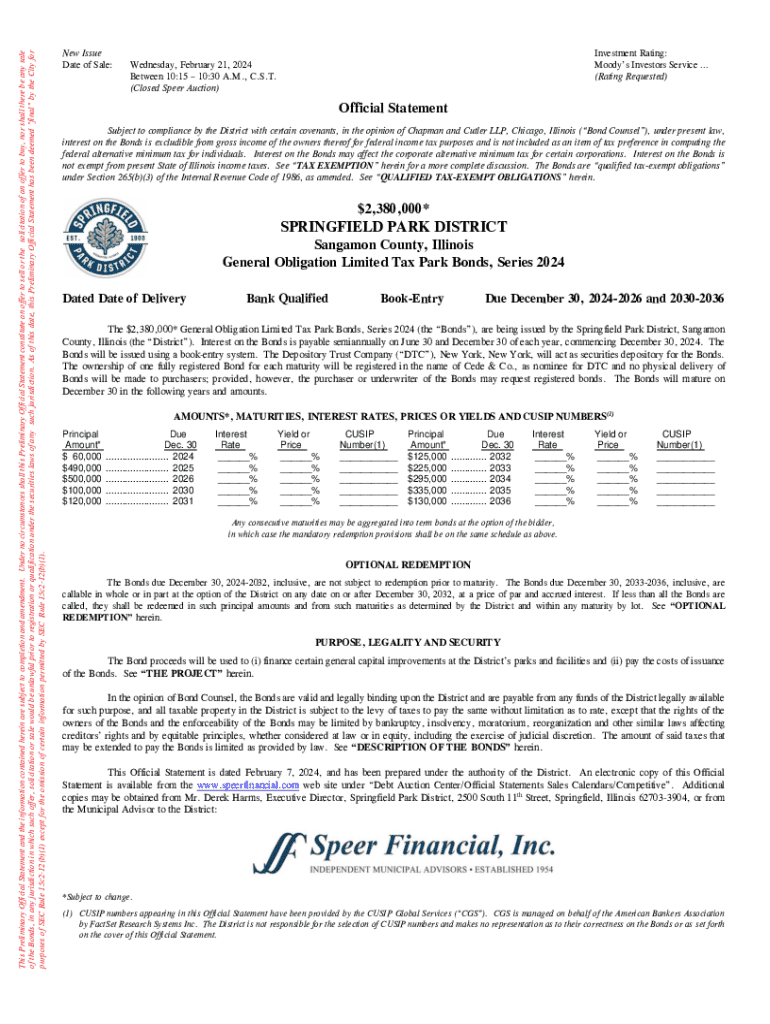

Get the free General Obligation Limited Tax Park Bonds, Series 2024

Show details

This document outlines the issuance details and terms for the Springfield Park District\'s General Obligation Limited Tax Park Bonds, Series 2024, totaling $2,380,000, intended for financing capital improvements and covering costs of the bond issuance. It includes information on tax exemptions, bond maturity schedules, interest rates, investment ratings, and legal covenants related to the bond offering.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general obligation limited tax

Edit your general obligation limited tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general obligation limited tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing general obligation limited tax online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit general obligation limited tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit general obligation limited tax from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your general obligation limited tax into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send general obligation limited tax for eSignature?

Once your general obligation limited tax is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an eSignature for the general obligation limited tax in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your general obligation limited tax right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is general obligation limited tax?

General obligation limited tax refers to a type of municipal bond or tax levy where the government entity pledges to repay the bondholders or tax funders from a specific revenue source, typically limited tax revenue, rather than the general tax revenue.

Who is required to file general obligation limited tax?

Entities that issue general obligation limited tax bonds, such as local governments or municipalities, are required to file the necessary paperwork to comply with regulatory requirements.

How to fill out general obligation limited tax?

Filling out general obligation limited tax forms typically involves providing information about the issuing entity, the purpose of the tax, the expected revenue, and how it will be used. Instructions and forms can usually be found on the local government’s finance department website.

What is the purpose of general obligation limited tax?

The purpose of general obligation limited tax is to provide a consistent funding source for essential projects and services, such as infrastructure development, education, and public safety, while ensuring that tax levies are kept within certain limits.

What information must be reported on general obligation limited tax?

Information that must be reported includes the amount of debt being issued, the specific tax rate, the expected revenue generation, details of the project being financed, and how the tax revenues will be allocated.

Fill out your general obligation limited tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Obligation Limited Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.