IRS Form 15272 2024-2025 free printable template

Show details

The document you are trying to load requires Adobe Reader 8 or higher. You may not have the

Adobe Reader installed or your viewing environment may not be properly configured to use

Adobe Reader.

For

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Form 15272

Edit your IRS Form 15272 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Form 15272 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Form 15272 online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS Form 15272. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Form 15272 Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to process 4506-t?

Form 4506-T is free, and transcripts generally arrive in about three weeks. When you file the Form 4506-T, you'll receive a printout of most of the line items on your tax return (rather than a copy of the actual return). This document is called a tax return transcript.

What is an IRS Form 14446?

Form 14446. (November 2022) Department of the Treasury - Internal Revenue Service. Virtual VITA/TCE Taxpayer Consent. This form is required when any part of the tax return preparation process is completed without in-person interaction between the taxpayer and the VITA/TCE volunteer.

What is a 13615 form?

Use of Form 13615: This form provides information on a volunteer's certification. All VITA/TCE volunteers (whether paid or unpaid) must pass the Volunteer Standards of Conduct certification, and sign and date Form 13615, Volunteer Standards of Conduct Agreement - VITA/TCE Programs, prior to working at a VITA/TCE site.

How long does it take the IRS to accept AE file?

When you e-file, it typically takes 24 to 48 hours for the IRS to accept your return. Once your return is accepted, you are on the IRS' refund timetable. The IRS typically issues refunds in less than 21 days after your e-filed return is accepted.

What is the IRS consent form 4506 C?

Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

What is a taxpayer first act consent form?

The Taxpayer First Act, (the “Act”) includes a provision (Section 2202) that requires the taxpayer's consent to be obtained prior to using and sharing the tax return or tax return information with a third party.

What is a 4506 t form used for?

Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript.

Why do lenders need a 4506-T form?

The 4506-T allows lenders to access your financial records from the past few years to verify your income with the IRS. In addition to helping you with a loan application, Form 4506-T can help you gain access to your own tax information when you need to fill out an accurate return or provide information to the IRS.

What is 4506-T form used for SBA?

This form gives permission for the IRS to provide SBA your tax return information when applying for COVID EIDL disaster loan assistance.

Is the taxpayer consent form required?

This form is required when any part of the tax return preparation process is completed without in-person interaction between the taxpayer and the VITA/TCE volunteer. The site must explain to the taxpayer the process used to prepare the taxpayer's return.

What does it mean when it says your taxes have been acknowledged?

Acknowledged: Your return has been submitted and accepted by the IRS/state!

Is SBA still requiring 4506-T?

All COVID EIDL applicants are required to submit a signed and dated Form 4506-T authorizing the IRS to release business tax transcripts for SBA to verify their revenue. If you receive repeated requests to submit your Form 4506-T, there may have been an error on your previous submission.

What is tax payer consent?

Consent to Disclose: A consent to “disclose” allows the partner to disclose the taxpayer's tax return information to determine whether the taxpayer will benefit from services offered such as financial advisory and asset planning.

What should the certified volunteer preparer do before starting the tax return?

It is a requirement for all IRS tax law-certified volunteers to use a complete intake and interview process when preparing tax returns. To promote accuracy, this process must include an interview with the taxpayer while reviewing and completing or correcting Form 13614-C prior to preparing the return.

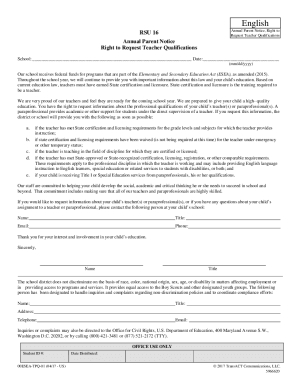

What is Form 15272?

Form 15272. (October 2021) Department of the Treasury - Internal Revenue Service. VITA/TCE Security Plan.

Who fills out form 9325?

Form 9325 is a confirmation form from the IRS that the individual tax return or extension has been received through the electronic filing process and accepted by the IRS. Form 9325 is not required, but some taxpayers may request this form to prove their returns have been e-filed and accepted by the IRS.

Who fills out 9325?

Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically can be used to convey information to customers by an Electronic Return Originator (ERO), and would be completed by the ERO as the filer of the return.

What is Form 9325 Acknowledgement and General Information?

Form 9325 is a confirmation form from the IRS that the individual tax return or extension has been received through the electronic filing process and accepted by the IRS. Form 9325 is not required, but some taxpayers may request this form to prove their returns have been e-filed and accepted by the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS Form 15272 in Chrome?

Install the pdfFiller Google Chrome Extension to edit IRS Form 15272 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I sign the IRS Form 15272 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your IRS Form 15272 and you'll be done in minutes.

Can I edit IRS Form 15272 on an Android device?

You can make any changes to PDF files, like IRS Form 15272, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is form 15272 rev 10?

Form 15272 rev 10 is a document used in specific regulatory or reporting contexts, typically related to financial or operational disclosures.

Who is required to file form 15272 rev 10?

Entities or individuals required to file Form 15272 rev 10 usually include organizations or persons who meet specific regulatory criteria set forth by the governing authority.

How to fill out form 15272 rev 10?

To fill out Form 15272 rev 10, one must provide all required information accurately, including personal or business identification details, necessary financial information, and any supporting documents as specified in the instructions.

What is the purpose of form 15272 rev 10?

The purpose of Form 15272 rev 10 is to collect necessary information for compliance with regulations and to enable the governing authority to assess the status or activity of the reporting entity or individual.

What information must be reported on form 15272 rev 10?

Information required on Form 15272 rev 10 may include identification details of the filer, financial data, compliance statements, and other relevant disclosures specific to the reporting requirements outlined by the governing authority.

Fill out your IRS Form 15272 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Form 15272 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.