Get the free Insurance Business (Solvency II Transitional Provisions) ...

Show details

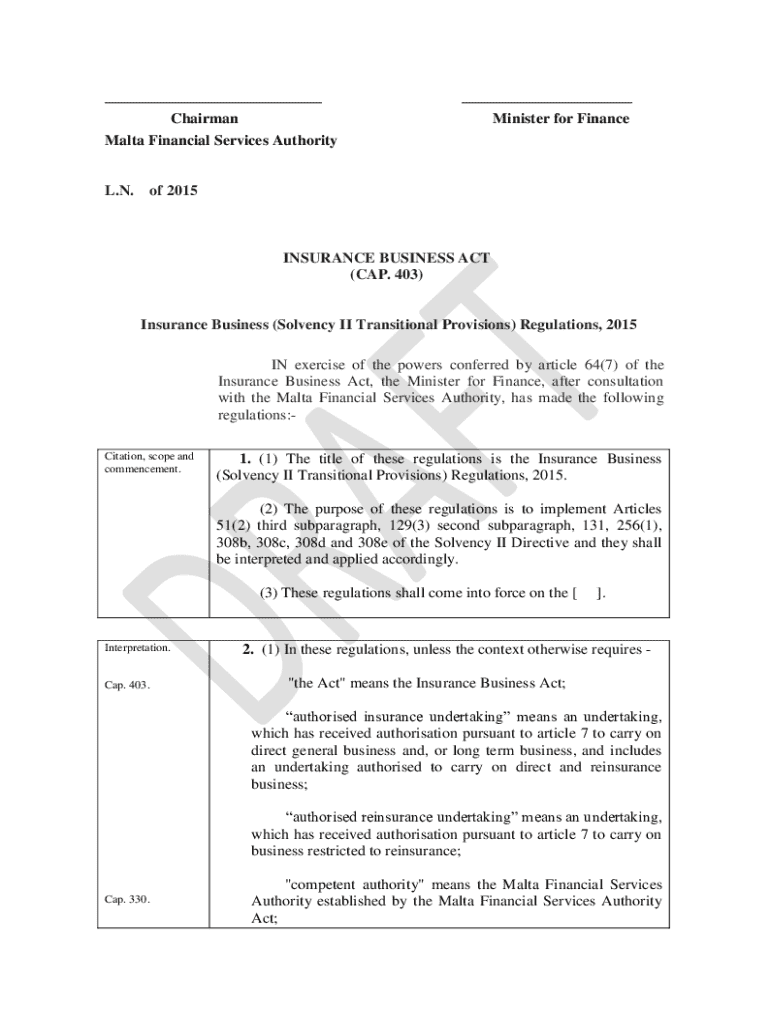

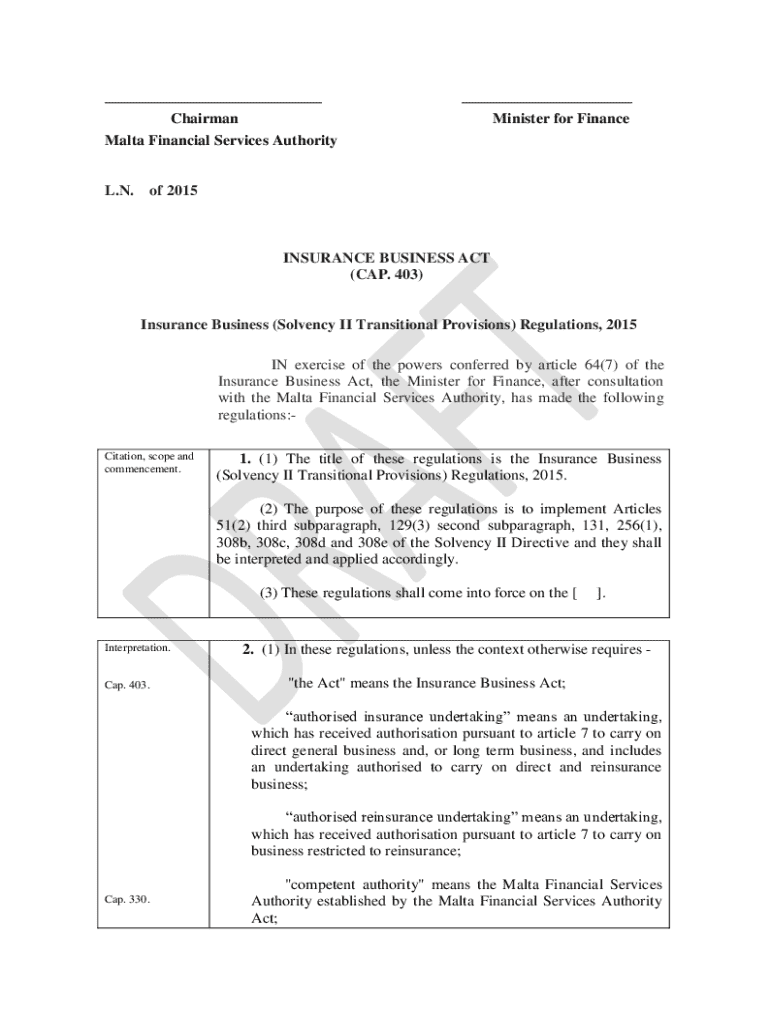

______Chairman Malta Financial Services AuthorityL.N.Minister for Financeof 2015INSURANCE BUSINESS ACT (CAP. 403)Insurance Business (Solvency II Transitional Provisions) Regulations, 2015 IN exercise

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance business solvency ii

Edit your insurance business solvency ii form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance business solvency ii form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance business solvency ii online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insurance business solvency ii. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance business solvency ii

How to fill out insurance business solvency ii

01

Gather relevant financial data including assets, liabilities, and underwriting performance.

02

Understand the Solvency II capital requirements, including the Solvency Capital Requirement (SCR) and Minimum Capital Requirement (MCR).

03

Conduct a risk assessment to identify potential risks and their impact on the business.

04

Calculate the Solvency II ratio by comparing eligible capital to the SCR.

05

Prepare and submit the annual Solvency and Financial Condition Report (SFCR) outlining the solvency position and risk management practices.

06

Ensure compliance with reporting requirements set by local regulators, including Pillar I, II, and III requirements.

Who needs insurance business solvency ii?

01

Insurance companies operating within the European Union.

02

Reinsurance firms that provide coverage to insurance companies.

03

Regulatory bodies that oversee insurance markets.

04

Investors and stakeholders interested in the financial health of insurance firms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify insurance business solvency ii without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including insurance business solvency ii, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute insurance business solvency ii online?

Easy online insurance business solvency ii completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete insurance business solvency ii on an Android device?

Use the pdfFiller Android app to finish your insurance business solvency ii and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is insurance business solvency ii?

Insurance Business Solvency II is a regulatory framework designed to ensure that insurance companies in the European Union maintain sufficient capital to meet their liabilities and obligations, while promoting financial stability and protecting policyholders.

Who is required to file insurance business solvency ii?

All insurance and reinsurance companies operating in the European Union are required to file under Solvency II regulations, including both large firms and smaller entities.

How to fill out insurance business solvency ii?

Filling out Solvency II reports typically involves gathering data on assets, liabilities, risk management practices, and capital adequacy. Companies must use specific templates provided by regulatory authorities and adhere to the guidelines and standards set within the Solvency II framework.

What is the purpose of insurance business solvency ii?

The primary purpose of Solvency II is to ensure that insurance companies are financially sound and capable of meeting their future policyholder obligations, thus enhancing the protection of policyholders and fostering stability in the insurance sector.

What information must be reported on insurance business solvency ii?

Insurers must report a variety of information including their balance sheet, risk assessment, capital requirements, solvency ratios, governance structures, and quantitative and qualitative data related to their financial health and risk profile.

Fill out your insurance business solvency ii online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Business Solvency Ii is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.