Get the free Indirect Cost Rate Certificate

Show details

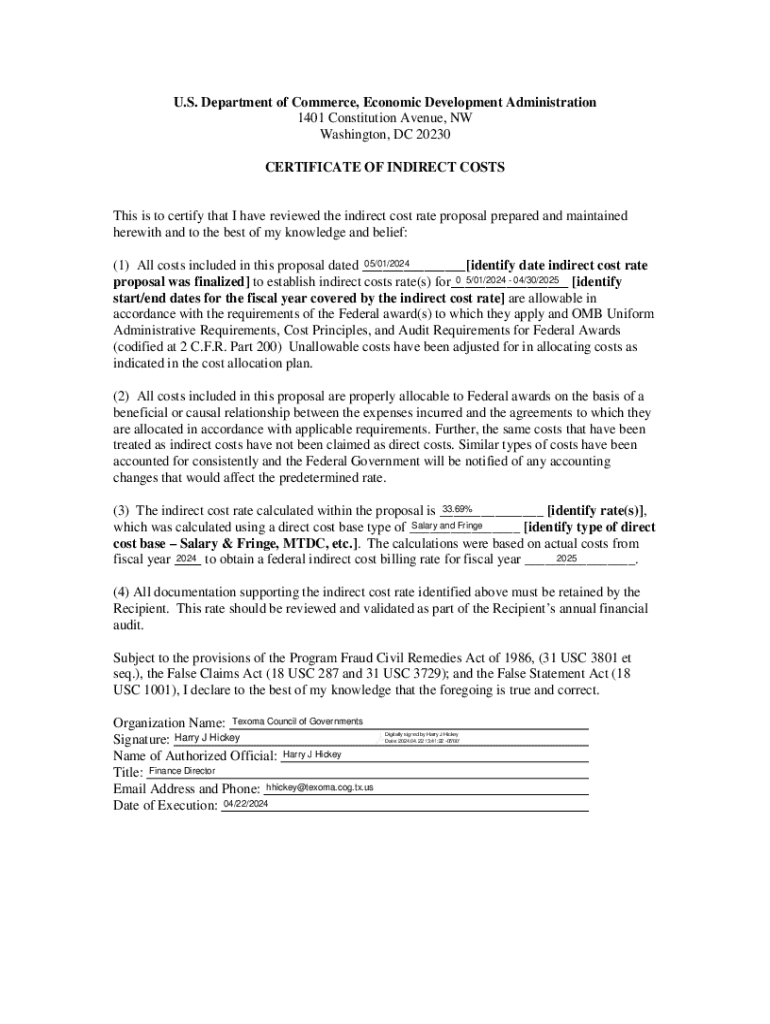

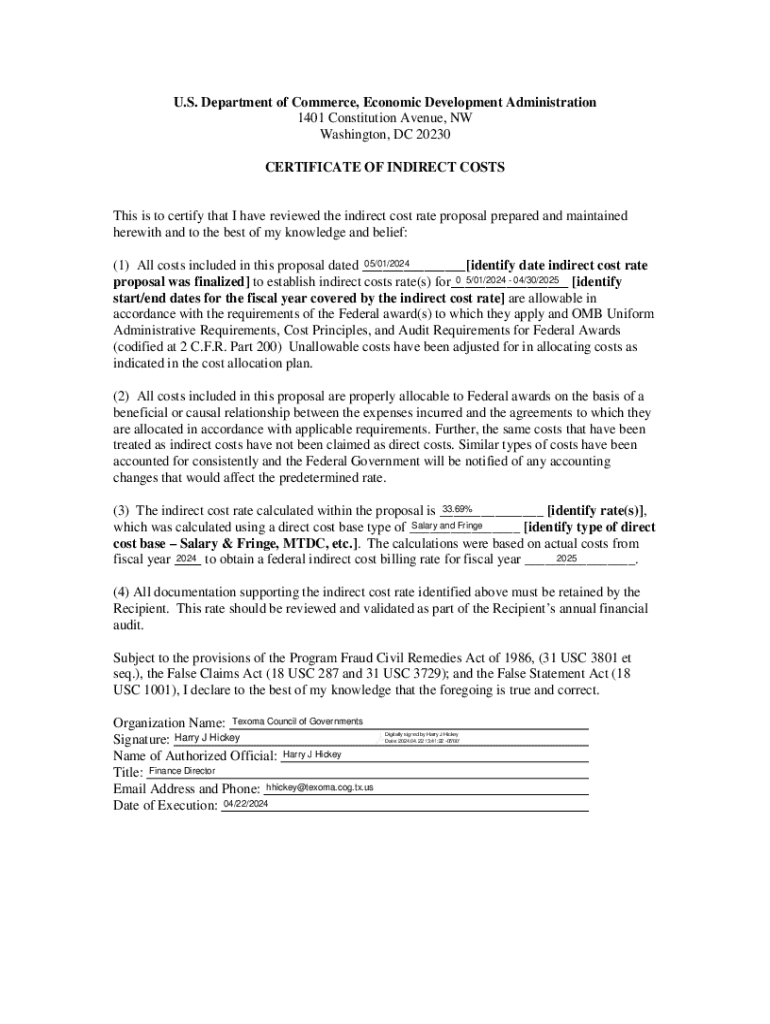

This certificate acknowledges the review and compliance of the indirect cost rate proposal for Texoma Council of Governments, confirming the expenditures and their allocation to federal awards as per the requirements set by OMB Uniform Administrative Requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indirect cost rate certificate

Edit your indirect cost rate certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indirect cost rate certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indirect cost rate certificate online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit indirect cost rate certificate. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indirect cost rate certificate

How to fill out indirect cost rate certificate

01

Begin by gathering necessary financial documents, including your organization's financial statements and prior indirect cost rates.

02

Identify the applicable indirect cost pools and allocate direct costs appropriately.

03

Complete the certification form, ensuring all required sections are filled out accurately.

04

Calculate your indirect cost rate by dividing total indirect costs by total direct costs.

05

Include supporting documentation that justifies your indirect cost calculations.

06

Review the completed certificate for accuracy and ensure all required signatures are included.

07

Submit the completed certificate to the appropriate federal agency or funding organization.

Who needs indirect cost rate certificate?

01

Organizations that receive federal funding or grants, including non-profits, educational institutions, and state or local governments.

02

Entities that wish to claim indirect costs as part of their grant or contract funding.

03

Any organization that wants to establish a negotiated indirect cost rate for their operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send indirect cost rate certificate to be eSigned by others?

Once your indirect cost rate certificate is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit indirect cost rate certificate on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing indirect cost rate certificate.

How can I fill out indirect cost rate certificate on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your indirect cost rate certificate, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is indirect cost rate certificate?

An indirect cost rate certificate is a document that establishes the allowable indirect cost rates which can be charged to federal grants and contracts. It outlines the organization’s methodologies for calculating these rates.

Who is required to file indirect cost rate certificate?

Organizations that receive federal funding and wish to recover indirect costs from federal grants are required to file an indirect cost rate certificate. This includes non-profit organizations, educational institutions, and state and local governments.

How to fill out indirect cost rate certificate?

To fill out an indirect cost rate certificate, organizations must gather financial data that includes direct costs, indirect costs, allocation bases, and any necessary supporting documentation. They then complete the certificate form according to the guidelines provided by the federal agency, ensuring accuracy and compliance with applicable regulations.

What is the purpose of indirect cost rate certificate?

The purpose of the indirect cost rate certificate is to ensure that organizations can appropriately allocate and recover indirect costs associated with federal funding, thereby providing financial stability while adhering to federal guidelines.

What information must be reported on indirect cost rate certificate?

The information required on an indirect cost rate certificate includes the organization’s total direct and indirect costs, the proposed indirect cost rate, a detailed explanation of the calculation method, supporting financial statements, and any relevant justifications or documentation.

Fill out your indirect cost rate certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indirect Cost Rate Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.