Get the free Notice of Wrap-around Mortgage Financing

Show details

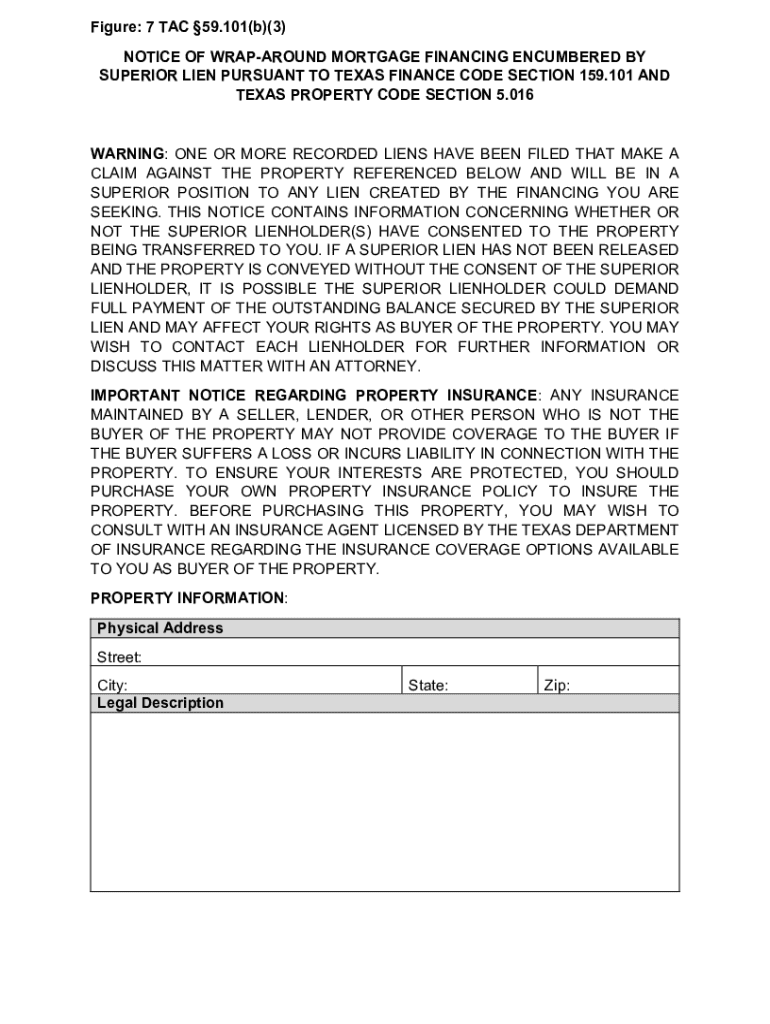

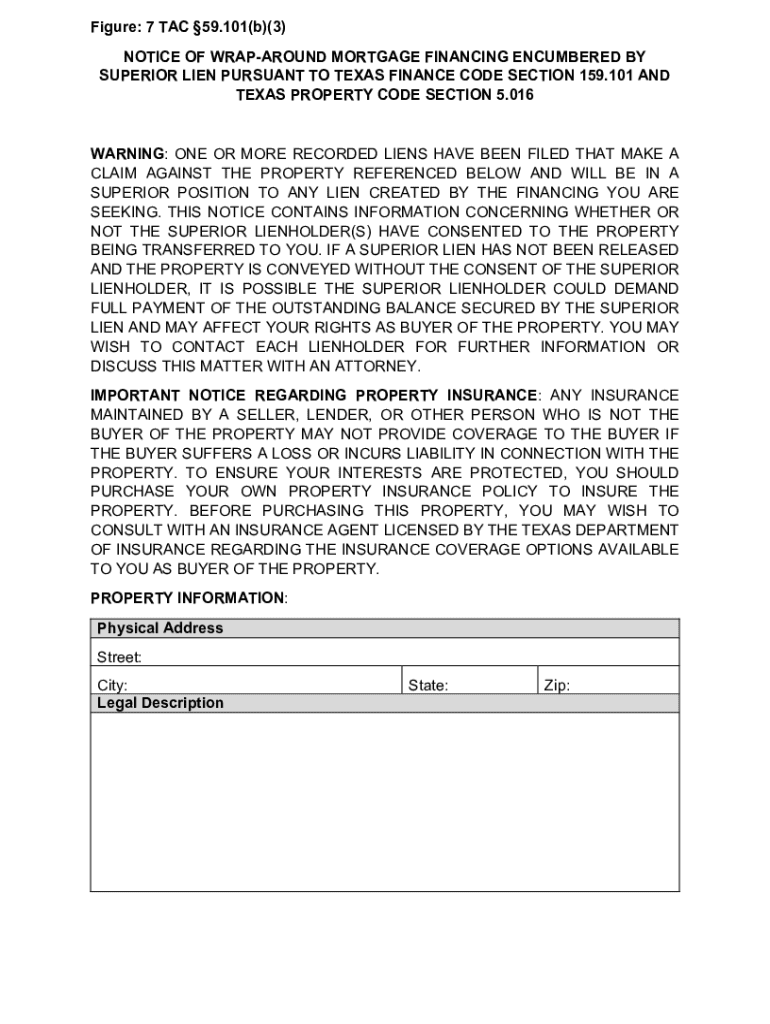

Este documento sirve como aviso sobre el financiamiento de una hipoteca tipo wrap-around que está gravada por un lien superior según el Código Financiero de Texas y el Código de Propiedad de Texas. Informa a los compradores sobre la existencia de gravámenes registrados que pueden afectar sus derechos en la propiedad.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of wrap-around mortgage

Edit your notice of wrap-around mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of wrap-around mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice of wrap-around mortgage online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit notice of wrap-around mortgage. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of wrap-around mortgage

How to fill out notice of wrap-around mortgage

01

Obtain the notice of wrap-around mortgage form from your local government or a legal document provider.

02

Fill out the names and addresses of both the borrower and the lender at the top of the form.

03

Include the legal description of the property being wrapped in the mortgage.

04

Detail the original mortgage information, including the lender, loan number, and outstanding balance.

05

Specify the terms of the wrap-around mortgage, including the interest rate and payment schedule.

06

State the amount of the wrap-around mortgage and how it relates to the original mortgage.

07

Include any additional terms or conditions that apply to the wrap-around mortgage.

08

Have all parties sign and date the document in the presence of a notary, if required.

09

File the notice with the appropriate county or state office to officially record the wrap-around mortgage.

Who needs notice of wrap-around mortgage?

01

Real estate investors who are financing a property using a wrap-around mortgage.

02

Homebuyers who may not qualify for traditional financing and seek alternative financing options.

03

Sellers who are offering seller financing to attract buyers without requiring immediate cash up front.

04

Mortgage brokers and attorneys who are facilitating wrap-around mortgage transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send notice of wrap-around mortgage to be eSigned by others?

notice of wrap-around mortgage is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get notice of wrap-around mortgage?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific notice of wrap-around mortgage and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the notice of wrap-around mortgage in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your notice of wrap-around mortgage and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is notice of wrap-around mortgage?

A notice of wrap-around mortgage is a legal document that notifies interested parties that a wrap-around mortgage exists. A wrap-around mortgage is a type of financing where a new mortgage includes the existing loan, allowing the buyer to make payments to the seller, who continues to pay off the original loan.

Who is required to file notice of wrap-around mortgage?

Typically, the seller or the party providing the wrap-around mortgage is required to file a notice of wrap-around mortgage to inform involved parties and protect their interests.

How to fill out notice of wrap-around mortgage?

To fill out a notice of wrap-around mortgage, one must include details such as the names of the parties involved, the property address, the total amount of the new mortgage, the existing mortgage details, and any terms and conditions agreed upon by both parties.

What is the purpose of notice of wrap-around mortgage?

The purpose of the notice of wrap-around mortgage is to provide public notice of the mortgage arrangement, ensuring that all parties are informed of the existing loans and protecting the rights of the mortgage holder.

What information must be reported on notice of wrap-around mortgage?

The notice of wrap-around mortgage must report information such as the names of the borrower and lender, property description, original loan details, the total amount secured by the wrap-around mortgage, and any pertinent loan terms.

Fill out your notice of wrap-around mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Wrap-Around Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.