Get the free Extraordinary Savings

Show details

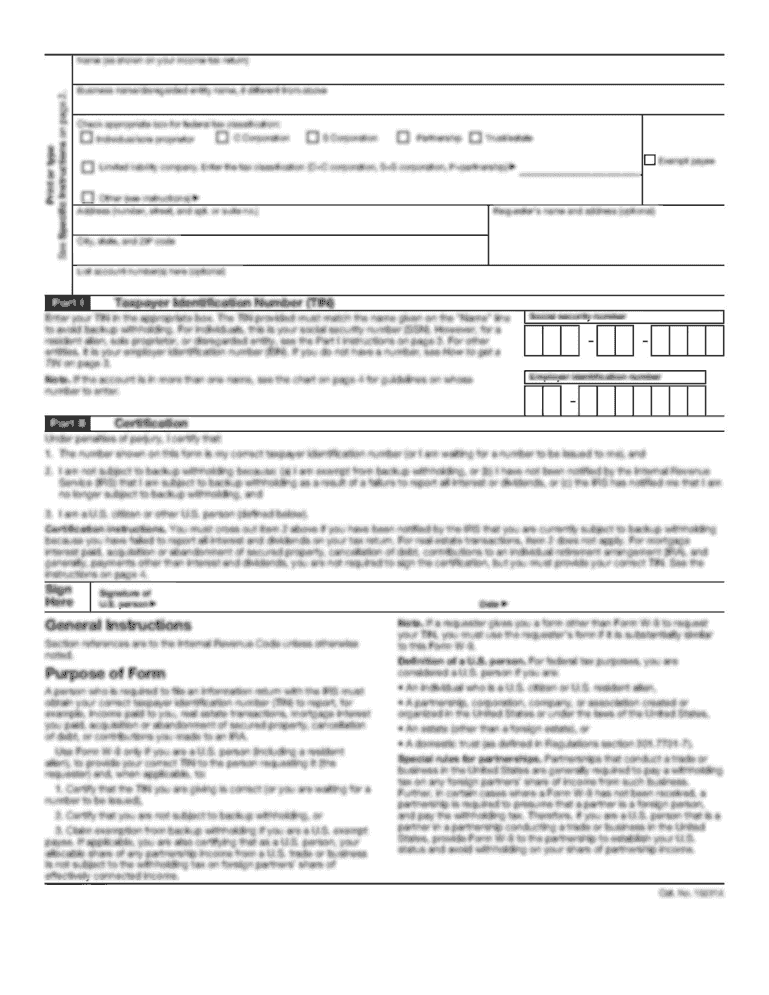

Offer Valid June 30 July 14, 2013 MAIL-IN REBATE FORM Extraordinary Savings Receive up to a $675 MasterCard Prepaid Card by mail with purchase of select Whirlpool Brand appliances Please indicate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign extraordinary savings

Edit your extraordinary savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your extraordinary savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing extraordinary savings online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit extraordinary savings. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out extraordinary savings

How to fill out extraordinary savings:

01

Start by assessing your financial goals and determining how much money you want to save. This could be for emergencies, a down payment on a house, or any other large expenses you have planned.

02

Create a budget to track your income and expenses. This will help you identify areas where you can cut back on spending and allocate more towards your savings.

03

Set up automatic transfers to a separate savings account dedicated to extraordinary savings. This will ensure that a portion of your income is saved consistently without you having to manually transfer the money each time.

04

Research and explore different investment options that can help grow your savings. This could include stocks, bonds, mutual funds, or real estate. Consult with a financial advisor to understand the risks and potential returns associated with each investment option.

05

Cut back on unnecessary expenses and find ways to save money in your daily life. This could involve cooking at home instead of eating out, using public transportation instead of owning a car, or negotiating lower utility bills.

06

Regularly review and adjust your saving strategy based on your progress and changing financial circumstances. It's important to stay flexible and adapt your savings plan as needed.

Who needs extraordinary savings:

01

Anyone who wants to have a financial safety net for unexpected events like job loss, medical emergencies, or unforeseen expenses.

02

Individuals who are planning for major life milestones such as buying a house, getting married, having children, or retiring.

03

Entrepreneurs or self-employed individuals who need to save for business expenses, taxes, or investment opportunities.

04

People who want to build wealth and achieve financial independence by accumulating significant savings over time.

05

Individuals with high-risk jobs or unstable income sources who need to have extra funds to navigate during periods of instability.

06

Individuals who want to leave a legacy, donate to charity, or support causes close to their hearts with their accumulated savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute extraordinary savings online?

Easy online extraordinary savings completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out extraordinary savings using my mobile device?

Use the pdfFiller mobile app to complete and sign extraordinary savings on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out extraordinary savings on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your extraordinary savings, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is extraordinary savings?

Extraordinary savings refer to a specific type of savings or funds that are saved for emergency or unexpected expenses.

Who is required to file extraordinary savings?

Individuals or organizations who have extraordinary savings must file for it if required by the regulations of their jurisdiction.

How to fill out extraordinary savings?

Extraordinary savings can be filled out by providing details such as the amount saved, purpose of the savings, and any relevant supporting documentation.

What is the purpose of extraordinary savings?

The purpose of extraordinary savings is to have funds readily available for unforeseen events or emergencies.

What information must be reported on extraordinary savings?

Information such as the amount saved, purpose of the savings, and any supporting documentation must be reported on extraordinary savings.

Fill out your extraordinary savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Extraordinary Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.