Get the free DEFFERED PRESENTMENT SERVICES AGREEMENT

Show details

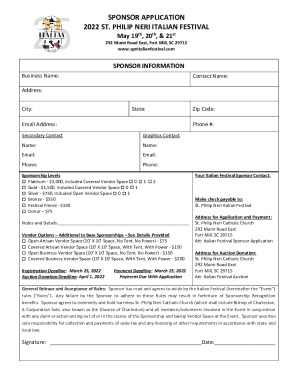

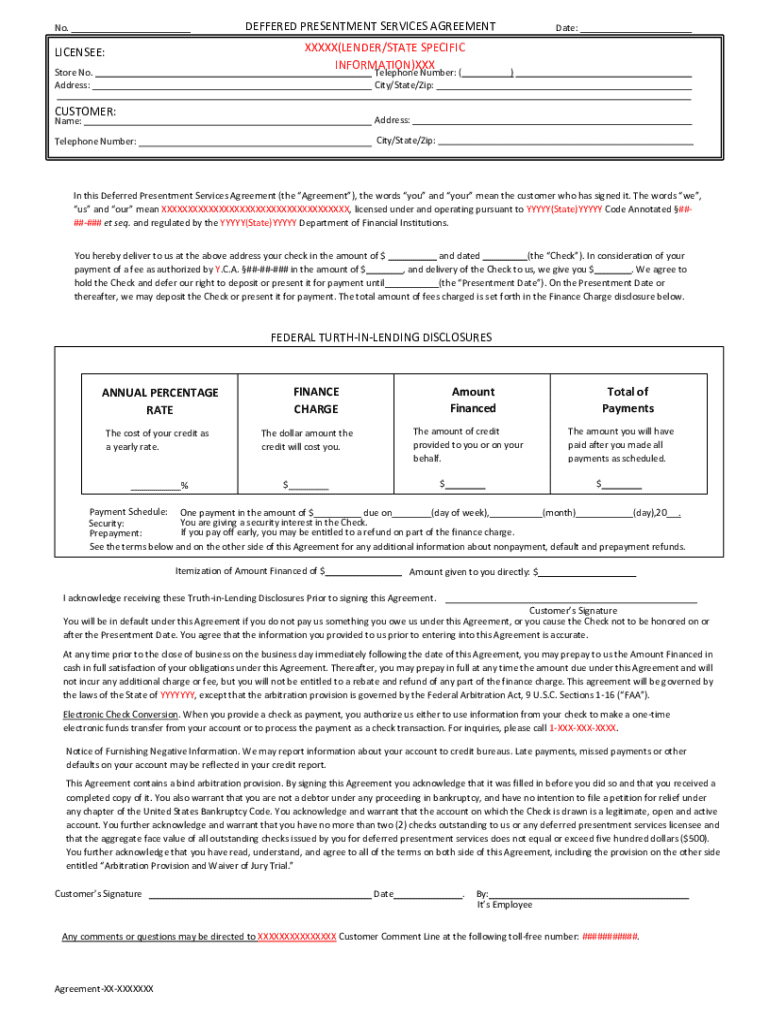

DEFFERED PRESENTMENT SERVICES AGREEMENTNo.XXXXX(LENDER/STATE SPECIFIC INFORMATION)XXXLICENSEE: Store No. Address:Telephone Number: ( City/State/Zip:CUSTOMER: Name:Address:Telephone Number:City/State/Zip:Date:)In

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deffered presentment services agreement

Edit your deffered presentment services agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deffered presentment services agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deffered presentment services agreement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit deffered presentment services agreement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deffered presentment services agreement

How to fill out deffered presentment services agreement

01

Obtain the deferred presentment services agreement form from the service provider.

02

Carefully read the terms and conditions outlined in the agreement.

03

Fill in your personal information, including your name, address, and identification details.

04

Specify the amount of money you wish to borrow and the associated fees.

05

Indicate the repayment date and method of repayment you plan to use.

06

Review any additional statements regarding interest rates and default conditions.

07

Sign and date the agreement at the designated section.

Who needs deffered presentment services agreement?

01

Individuals who require immediate cash for unexpected expenses.

02

People on short-term financial constraints needing a quick loan.

03

Those who may not have access to traditional bank loans or credit.

04

Anyone looking for a short-term financial solution with a clear repayment timeline.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit deffered presentment services agreement online?

The editing procedure is simple with pdfFiller. Open your deffered presentment services agreement in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an eSignature for the deffered presentment services agreement in Gmail?

Create your eSignature using pdfFiller and then eSign your deffered presentment services agreement immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out deffered presentment services agreement using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign deffered presentment services agreement and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is deferred presentment services agreement?

A deferred presentment services agreement is a legal contract between a borrower and a lender where the borrower receives a loan in exchange for a future payment, typically in the form of a check that is held by the lender until the agreed-upon date.

Who is required to file deferred presentment services agreement?

Typically, lenders providing deferred presentment services are required to file the agreement, ensuring compliance with state regulations governing payday loans and similar financial transactions.

How to fill out deferred presentment services agreement?

To fill out a deferred presentment services agreement, include information such as the borrower's name, address, loan amount, payment terms, interest rate, and the date when the check will be presented for payment.

What is the purpose of deferred presentment services agreement?

The purpose of a deferred presentment services agreement is to formalize the loan transaction, outlining the terms and conditions under which a borrower receives funds and agrees to repay them in the future.

What information must be reported on deferred presentment services agreement?

The information that must be reported on a deferred presentment services agreement includes the borrower's personal details, loan amount, fees, repayment terms, and due dates, along with any other disclosures required by law.

Fill out your deffered presentment services agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deffered Presentment Services Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.