Get the free YES BANK Loans, Accounts, Cards, Deposits & Other Banking ...

Show details

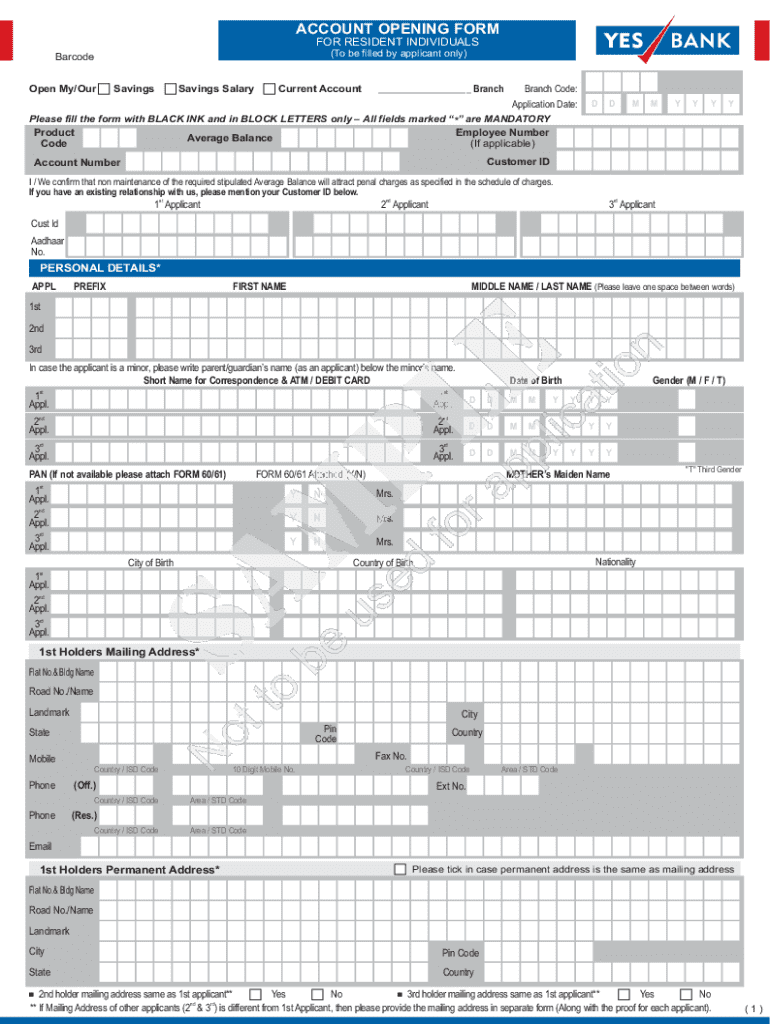

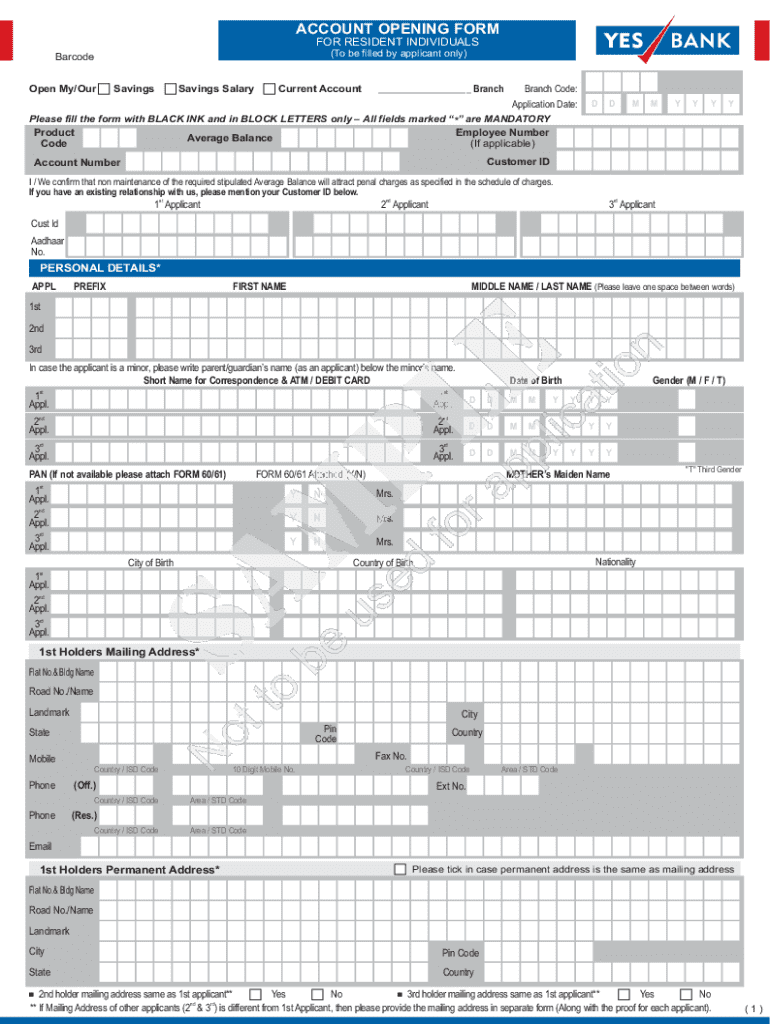

ACCOUNT OPENING FORM FOR RESIDENT INDIVIDUALS (To be filled by applicant only)BarcodeOpen My/OurSavingsSavings SalaryCurrent AccountBranch Code:___ BranchApplication Date: Please fill the form with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign yes bank loans accounts

Edit your yes bank loans accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your yes bank loans accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing yes bank loans accounts online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit yes bank loans accounts. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out yes bank loans accounts

How to fill out yes bank loans accounts

01

Visit the official Yes Bank website or go to a local branch.

02

Select the type of loan account you want to apply for (personal, home, business, etc.).

03

Gather required documents such as identity proof, address proof, income proof, and credit score.

04

Fill out the loan application form with personal and financial details accurately.

05

Submit the application form along with the required documents to the bank.

06

Wait for the bank to review your application and get back with a loan offer.

07

If approved, review the terms of the loan, including interest rates and repayment schedules.

08

Sign the loan agreement and fulfill any additional requirements set by the bank.

09

Receive the loan amount as per the bank's process.

Who needs yes bank loans accounts?

01

Individuals looking for personal loans to cover expenses.

02

Homebuyers requiring financing to purchase a house.

03

Business owners needing capital for business operations or expansion.

04

Students seeking education loans for higher studies.

05

Investors who wish to finance property investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute yes bank loans accounts online?

Completing and signing yes bank loans accounts online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit yes bank loans accounts on an iOS device?

Create, modify, and share yes bank loans accounts using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out yes bank loans accounts on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your yes bank loans accounts, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is yes bank loans accounts?

Yes Bank loans accounts refer to the financial accounts maintained by Yes Bank that detail the various loan products offered, including personal, home, auto loans, and business loans, along with the terms and conditions associated with each.

Who is required to file yes bank loans accounts?

Individuals and businesses that have taken loans from Yes Bank are required to comply with the bank’s reporting requirements, which may include providing account statements and documentation for tax and regulatory purposes.

How to fill out yes bank loans accounts?

To fill out Yes Bank loans accounts, borrowers typically need to provide personal and financial information, details of the loan taken, repayment schedules, and any other relevant documentation as specified by the bank.

What is the purpose of yes bank loans accounts?

The purpose of Yes Bank loans accounts is to track the financial transactions related to the loans, monitor repayment progress, manage financial liabilities, and ensure compliance with banking regulations.

What information must be reported on yes bank loans accounts?

Information that must be reported on Yes Bank loans accounts includes loan amount, interest rate, repayment schedule, payment history, outstanding balance, and any applicable fees or charges.

Fill out your yes bank loans accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Yes Bank Loans Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.