Get the free A. Internal Audit Methodologies - hkma org

Show details

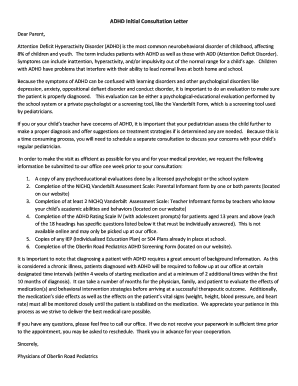

A. Internal Audit Methodologies Conducting Internal Audits from Beginning to End COURSE OBJECTIVES To become a successful auditor, a strong base of knowledge and an understanding of basic audit skills

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a internal audit methodologies

Edit your a internal audit methodologies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a internal audit methodologies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a internal audit methodologies online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit a internal audit methodologies. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a internal audit methodologies

How to fill out internal audit methodologies:

01

Understand the purpose: Begin by familiarizing yourself with the purpose and objectives of internal audit methodologies. This will help you have a clear understanding of what needs to be accomplished and the outcomes expected.

02

Gather relevant information: Collect all the necessary information that will be required to conduct the internal audit. This may include documents, reports, policies, procedures, and any other relevant data.

03

Determine the scope: Define the scope of your internal audit by identifying the areas or processes that will be assessed. This will help in focusing your efforts and ensuring that you cover all critical aspects.

04

Develop audit procedures: Create a detailed plan or set of procedures that will guide you through the audit process. These procedures should outline the steps to be followed, the criteria to be used, and the methods for collecting and analyzing data.

05

Conduct the audit: Implement the audit procedures by following the planned steps. This may involve interviewing employees, observing processes, reviewing documents, or using specialized auditing software.

06

Document findings: Record all the findings during the audit process accurately. This includes any non-compliance, areas of improvement, or potential risks identified. Use a standardized format or template to ensure consistency and ease of understanding.

07

Analyze and evaluate findings: Analyze the gathered information and evaluate the findings against the established criteria or standards. This step will help in identifying any deviations, trends, or patterns that need attention.

08

Develop recommendations: Based on the identified findings, develop clear and actionable recommendations for improving the internal control procedures or addressing the identified risks. Ensure that the recommendations are practical, feasible, and aligned with the organization's goals.

09

Communicate results: Prepare a comprehensive audit report that summarizes the findings, recommendations, and any other relevant information. Share this report with the appropriate stakeholders, such as management, board members, or auditors.

Who needs internal audit methodologies:

01

Organizations: Internal audit methodologies are essential for organizations of all sizes and industries. They help in ensuring compliance with laws and regulations, identifying operational inefficiencies, detecting and preventing fraud, and enhancing overall governance and risk management.

02

Audit professionals: Internal audit methodologies provide a structured and systematic approach for auditors to conduct their work. They serve as a guide in planning, executing, and reporting on internal audits, enabling auditors to deliver consistent and high-quality results.

03

Management and stakeholders: Internal audit methodologies are valuable for management and stakeholders as they provide assurance on the effectiveness of internal controls and risk management processes. They help in identifying areas for improvement, addressing potential risks, and enhancing overall organizational performance.

In conclusion, filling out internal audit methodologies involves understanding the purpose, gathering information, determining the scope, developing audit procedures, conducting the audit, documenting findings, analyzing and evaluating the results, developing recommendations, and communicating the outcomes. Internal audit methodologies are essential for organizations, audit professionals, and management and stakeholders to ensure compliance, enhance governance, and manage risks effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is a internal audit methodologies?

Internal audit methodologies are the strategies and techniques used by organizations to assess and evaluate their internal controls, processes, and procedures.

Who is required to file a internal audit methodologies?

Internal audit methodologies are typically conducted by internal auditors within the organization.

How to fill out a internal audit methodologies?

Internal audit methodologies are filled out by conducting assessments, documenting findings, and making recommendations for improvement.

What is the purpose of a internal audit methodologies?

The purpose of internal audit methodologies is to ensure that an organization's internal controls are adequate, effective, and in compliance with regulations and best practices.

What information must be reported on a internal audit methodologies?

Information reported on internal audit methodologies includes findings, recommendations, and actions taken or planned to address any identified issues.

How can I send a internal audit methodologies to be eSigned by others?

Once you are ready to share your a internal audit methodologies, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I edit a internal audit methodologies on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign a internal audit methodologies. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out a internal audit methodologies on an Android device?

On an Android device, use the pdfFiller mobile app to finish your a internal audit methodologies. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your a internal audit methodologies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Internal Audit Methodologies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.