Bankruptcy B 410 2024 free printable template

Show details

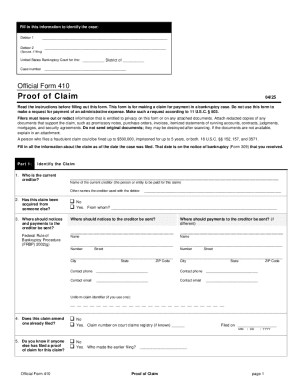

Fill in this information to identify the case Debtor 1 Spouse if filing United States Bankruptcy Court for the District Districtofof Case number Official Form 410 Proof of Claim 04/16 Read the instructions before filling out this form. This form is for making a claim for payment in a bankruptcy case. Attach redacted copies of any documents supporting the claim required by Bankruptcy Rule 3001 c. Limit disclosing information that is entitled to privacy such as health care information. 9. Is...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Bankruptcy B 410

Edit your Bankruptcy B 410 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Bankruptcy B 410 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Bankruptcy B 410 online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Bankruptcy B 410. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Bankruptcy B 410 Form Versions

Version

Form Popularity

Fillable & printabley

Instructions and Help about Bankruptcy B 410

Fill

form

: Try Risk Free

People Also Ask about

Is it true that after 7 years your credit is clear?

Highlights: Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

How do you write a proof of claim?

Completing a Proof of Claim Form Name of debtor: Case number: Name of creditor: Name and address where notices should be sent: Account or other number by which creditor identifies debtor: If this claim replaces or amends a previously filed claim:

What is proof of claim examples?

Examples: Goods sold, money loaned, lease, services performed, personal injury or wrongful death, or credit card. Attach redacted copies of any documents supporting the claim required by Bankruptcy Rule 3001(c). Limit disclosing information that is entitled to privacy, such as health care information.

What happens 7 years after bankruptcies?

Bankruptcy stays on your Equifax credit report for 6 years after your discharge date or 7 years after the date filed without a discharge date. If a second bankruptcy is filed, then the first re-appears on your credit report, and both bankruptcies remain for 14 years after the discharge dates.

What are proofs of claim in bankruptcy?

A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

How long does bankruptcy stay on your file?

if you want your credit record to show you've been discharged, you should send confirmation to each of the credit reference agencies and ask them to update your file - remember the bankruptcy will show on your file for 6 years after the bankruptcy order.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Bankruptcy B 410 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your Bankruptcy B 410 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in Bankruptcy B 410?

With pdfFiller, the editing process is straightforward. Open your Bankruptcy B 410 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit Bankruptcy B 410 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your Bankruptcy B 410, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your Bankruptcy B 410 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bankruptcy B 410 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.