Get the free Tax Exempt Organizations - SC Department of Revenue

Show details

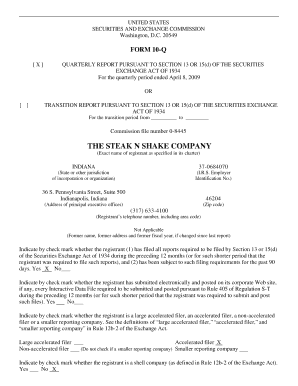

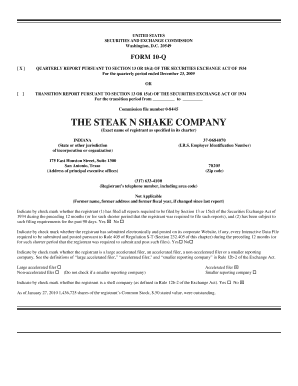

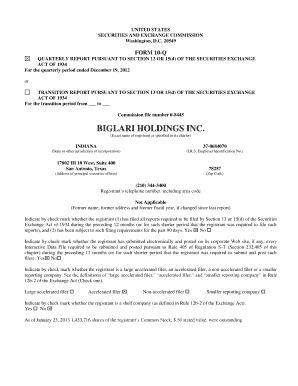

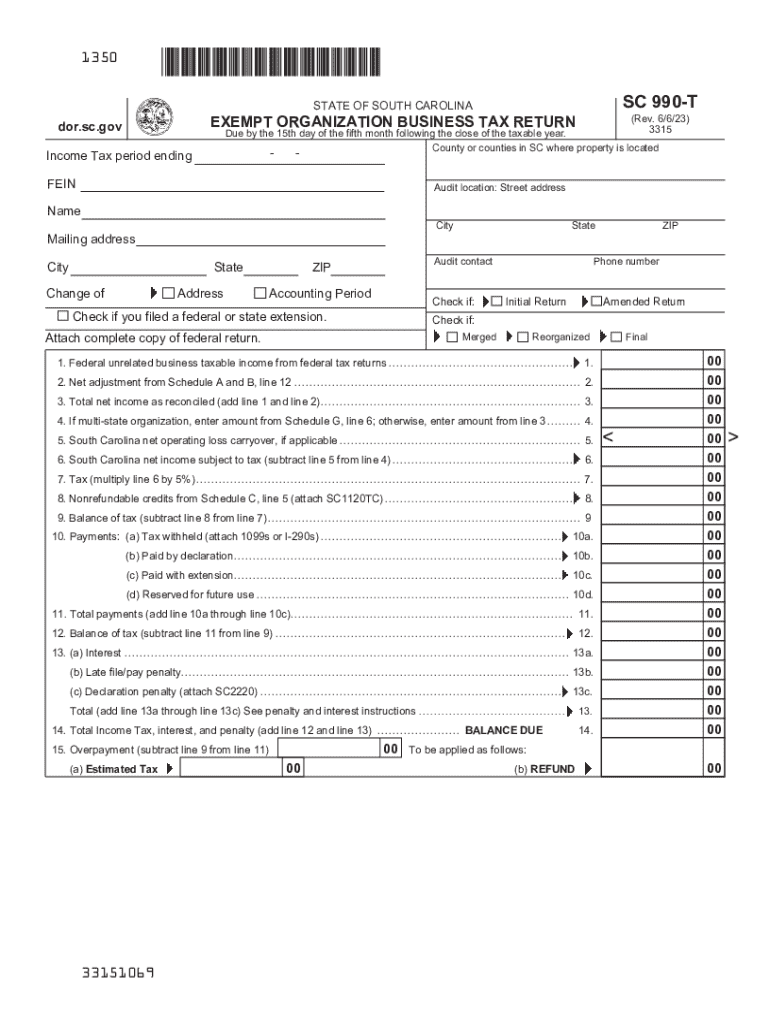

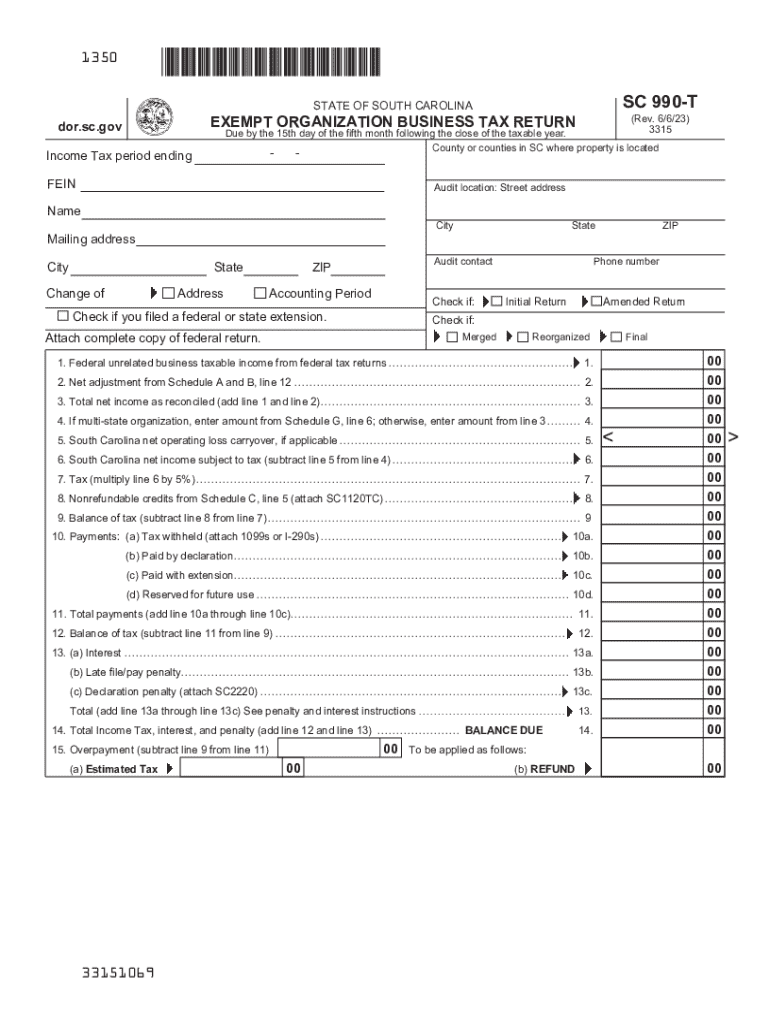

1350SC 990TSTATE OF SOUTH CAROLINAEXEMPT ORGANIZATION BUSINESS TAX RETURNdor.sc.gov(Rev. 6/6/23) 3315 Due by the 15th day of the fifth month following the close of the taxable year. County or counties

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax exempt organizations

Edit your tax exempt organizations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt organizations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax exempt organizations online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax exempt organizations. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax exempt organizations

How to fill out tax exempt organizations

01

Determine if your organization qualifies for tax-exempt status under IRS guidelines.

02

Complete the appropriate IRS form (Form 1023 for 501(c)(3) organizations or Form 1024 for other types).

03

Provide detailed information about your organization’s structure, mission, and activities.

04

Prepare a narrative description of your organization's programs and how they serve the public.

05

Compile your organization's governing documents, such as articles of incorporation and bylaws.

06

Include a financial statement, and a specific budget for the upcoming years.

07

Submit the completed application form, along with the required fee, to the IRS.

08

Wait for IRS review and respond to any requests for additional information or clarification.

Who needs tax exempt organizations?

01

Non-profit organizations aimed at charitable, religious, educational, scientific, or literary purposes.

02

Schools and educational institutions seeking tax advantages.

03

Organizations involved in the prevention of cruelty to animals or children.

04

Social welfare organizations desiring to operate without tax liability.

05

Foundations and grant-making entities that support charitable activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax exempt organizations without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including tax exempt organizations, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find tax exempt organizations?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific tax exempt organizations and other forms. Find the template you want and tweak it with powerful editing tools.

Can I edit tax exempt organizations on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign tax exempt organizations right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is tax exempt organizations?

Tax exempt organizations are entities that are exempt from paying federal income taxes because they serve a specific public benefit, such as charitable, religious, educational, or scientific purposes.

Who is required to file tax exempt organizations?

Organizations seeking tax-exempt status under the Internal Revenue Code must file specific forms with the IRS, typically including 501(c)(3) organizations and other charitable organizations.

How to fill out tax exempt organizations?

To fill out tax exempt organization forms, you need to gather necessary documentation, complete the required IRS form (such as Form 1023 or Form 1024), and provide detailed information regarding your organization’s structure, activities, and finances.

What is the purpose of tax exempt organizations?

The purpose of tax exempt organizations is to promote charitable causes, provide benefits to the public, or serve specific community interests without the pressure of taxation.

What information must be reported on tax exempt organizations?

Tax exempt organizations must report information such as revenue, expenses, the organization's purpose, and governance structure, typically using forms like IRS Form 990, 990-EZ, or 990-N.

Fill out your tax exempt organizations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exempt Organizations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.