Get the free Professional Indemnity Insurance Application for Loss Assessor

Show details

Professional Indemnity Insurance Application for Loss Assessor PO Box W123 Parramatta Westfield NSW 2150 Suite 22/Level 3 27 Hunter Street Parramatta www.isginsurance.com.au info isginsurance.com.AU

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professional indemnity insurance application

Edit your professional indemnity insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional indemnity insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professional indemnity insurance application online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit professional indemnity insurance application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professional indemnity insurance application

How to fill out professional indemnity insurance application?

01

Gather all necessary information: Before beginning the application, gather all relevant information such as your business details, financial records, claims history (if applicable), and any other information required by the insurance provider.

02

Understand the coverage requirements: Familiarize yourself with the coverage requirements for professional indemnity insurance. Different professions may have specific liability risks, so ensure that you tailor the application to address those risks adequately.

03

Provide accurate business information: Fill out the application form with accurate and up-to-date information about your business, including its legal name, address, contact details, and business structure.

04

Outline your professional services: Clearly describe the professional services or advice you offer. Include details such as the nature of your work, client base, and any specialized or high-risk services you provide.

05

Disclose claims history: If you or your business have previously faced any claims or lawsuits, disclose them truthfully in the application. Failure to disclose past claims can lead to coverage denial or cancellation in the future.

06

Attach supporting documents: Most applications require you to attach supporting documents, such as financial statements, licenses, certifications, or contracts. Make sure to include all relevant documents to support your application.

07

Complete the proposal form: The insurance provider may provide a specific proposal form that asks for detailed information about your business operations, risk management practices, and previous insurance coverage. Carefully fill out this form, providing accurate and comprehensive answers.

08

Review and double-check: Before submitting your application, carefully review all the information you have provided. Make sure it is accurate, complete, and free of errors.

Who needs professional indemnity insurance application?

01

Professionals offering specialized services: Individuals or businesses that provide professional services, like architects, engineers, doctors, lawyers, consultants, and financial advisors, should consider a professional indemnity insurance application. These professions often face specific liability risks arising from their expertise or advice.

02

Business owners who handle client data: If your business involves handling sensitive client information or data, such as in IT consulting, software development, marketing, or financial services, it is wise to have professional indemnity insurance. Protecting clients' confidential information is crucial in today's data-driven world.

03

Freelancers and contractors: Freelancers and independent contractors who provide services to clients may also benefit from professional indemnity insurance. It helps protect them from claims arising due to errors or omissions in their work, which could lead to financial loss or damage for their clients.

04

Small and medium-sized businesses: Even small and medium-sized businesses can greatly benefit from professional indemnity insurance. Any business that provides services, advice, or expertise to clients is exposed to potential liability claims. Having the right insurance coverage can offer financial protection against such claims.

Remember, it's always best to consult with an insurance professional or broker who specializes in professional indemnity insurance to ensure you have the appropriate coverage for your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

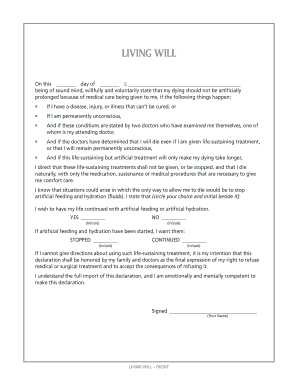

What is professional indemnity insurance application?

Professional indemnity insurance application is a form that professionals fill out to apply for insurance coverage that protects them against claims of negligence or inadequate work.

Who is required to file professional indemnity insurance application?

Professionals such as doctors, lawyers, architects, engineers, accountants, and consultants are required to file professional indemnity insurance application.

How to fill out professional indemnity insurance application?

To fill out a professional indemnity insurance application, professionals need to provide information about their business, services offered, previous claims history, and coverage limits.

What is the purpose of professional indemnity insurance application?

The purpose of professional indemnity insurance application is to secure insurance coverage that will protect professionals from financial losses due to claims of negligence or inadequate work.

What information must be reported on professional indemnity insurance application?

Information such as business details, services provided, claims history, coverage limits, and any other relevant information must be reported on professional indemnity insurance application.

How can I send professional indemnity insurance application for eSignature?

When you're ready to share your professional indemnity insurance application, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit professional indemnity insurance application straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit professional indemnity insurance application.

How do I fill out the professional indemnity insurance application form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign professional indemnity insurance application and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your professional indemnity insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professional Indemnity Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.