Get the free Welfare Exemption Supplemental Affidavit

Show details

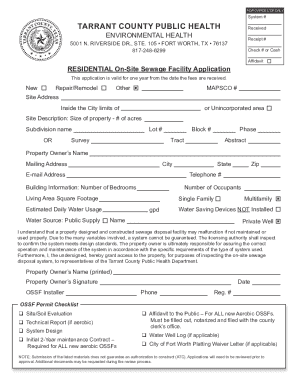

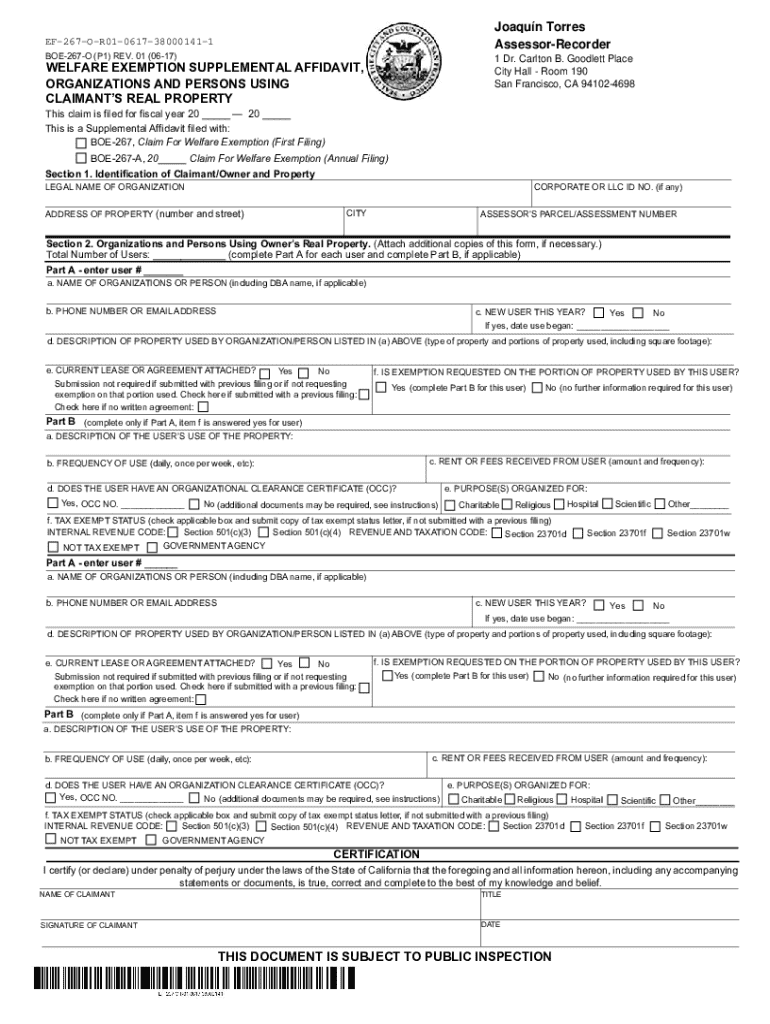

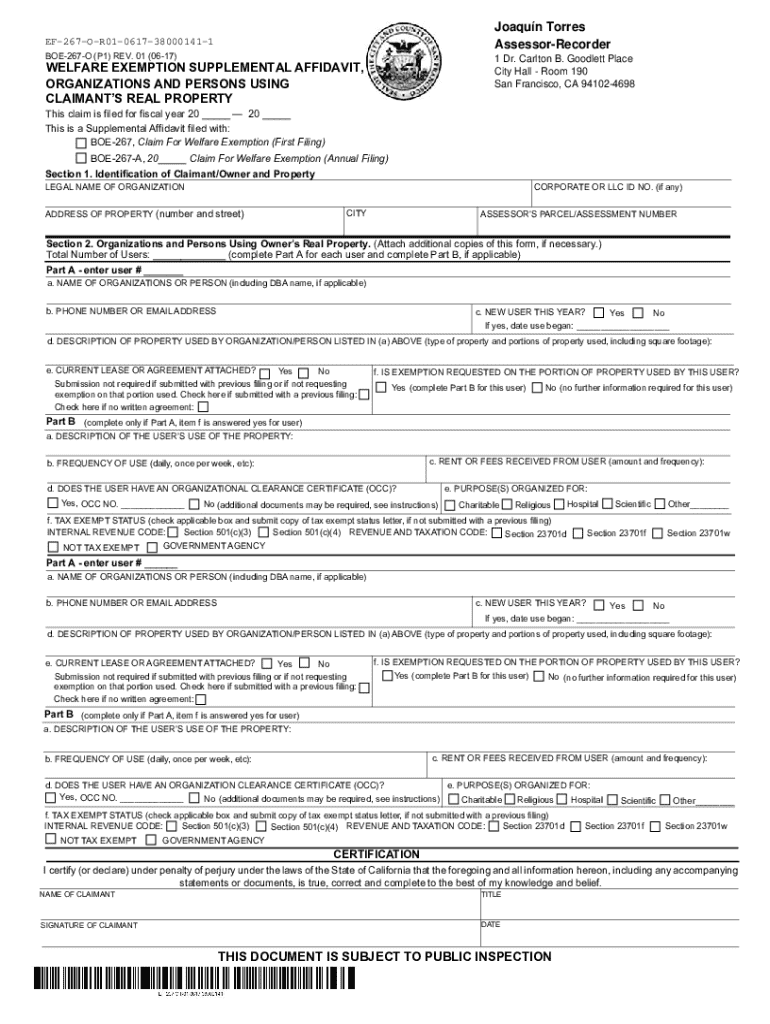

Este es un formulario que debe ser presentado por el propietario de una propiedad inmobiliaria cuando otra organización o persona utiliza esa propiedad. Este affidavit complementa la solicitud de exención de bienestar, que debe presentarse al evaluador del condado antes del 15 de febrero para evitar una penalización por presentación tardía. La información aquí proporcionada se utilizará para determinar cómo se está utilizando la propiedad.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign welfare exemption supplemental affidavit

Edit your welfare exemption supplemental affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your welfare exemption supplemental affidavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing welfare exemption supplemental affidavit online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit welfare exemption supplemental affidavit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out welfare exemption supplemental affidavit

How to fill out welfare exemption supplemental affidavit

01

Obtain the welfare exemption supplemental affidavit form from your local tax assessor's office or their website.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill in the property owner's information, including name, address, and contact details.

04

Provide details about the property for which you are claiming the welfare exemption, such as the property's address and identification number.

05

Indicate the specific type of welfare exemption you are applying for.

06

Include any required documentation that supports your claim for the welfare exemption, such as proof of income or other eligibility criteria.

07

Review the completed form for accuracy and completeness before submission.

08

Sign and date the affidavit as required.

09

Submit the completed affidavit along with any supporting documents to the local tax assessor's office, either in person or by mail.

Who needs welfare exemption supplemental affidavit?

01

Individuals or organizations that own property and meet specific income or disability criteria set forth by local tax authorities.

02

Residents applying for property tax relief under welfare programs.

03

Non-profit organizations that use property for charitable purposes may also be required to submit this affidavit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute welfare exemption supplemental affidavit online?

pdfFiller has made filling out and eSigning welfare exemption supplemental affidavit easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in welfare exemption supplemental affidavit?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your welfare exemption supplemental affidavit to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit welfare exemption supplemental affidavit on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share welfare exemption supplemental affidavit from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is welfare exemption supplemental affidavit?

The welfare exemption supplemental affidavit is a document that organizations must submit to qualify for property tax exemptions under the welfare exemption, which benefits charitable, religious, or educational institutions.

Who is required to file welfare exemption supplemental affidavit?

Organizations that are claiming a welfare exemption on their property taxes must file the supplemental affidavit to confirm their eligibility and compliance with the exemption criteria.

How to fill out welfare exemption supplemental affidavit?

To fill out the welfare exemption supplemental affidavit, an organization must provide details about its tax-exempt status, describe the property for which the exemption is claimed, and include any required financial information or supporting documents.

What is the purpose of welfare exemption supplemental affidavit?

The purpose of the welfare exemption supplemental affidavit is to provide necessary information that verifies an organization's eligibility for the welfare exemption, thereby allowing it to receive a reduction in property taxes.

What information must be reported on welfare exemption supplemental affidavit?

The welfare exemption supplemental affidavit must report information such as the organization's name, address, tax identification number, the specific property details, and statements verifying its charitable purpose and activities.

Fill out your welfare exemption supplemental affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Welfare Exemption Supplemental Affidavit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.