Get the free Fannie Mae Homeready Program

Show details

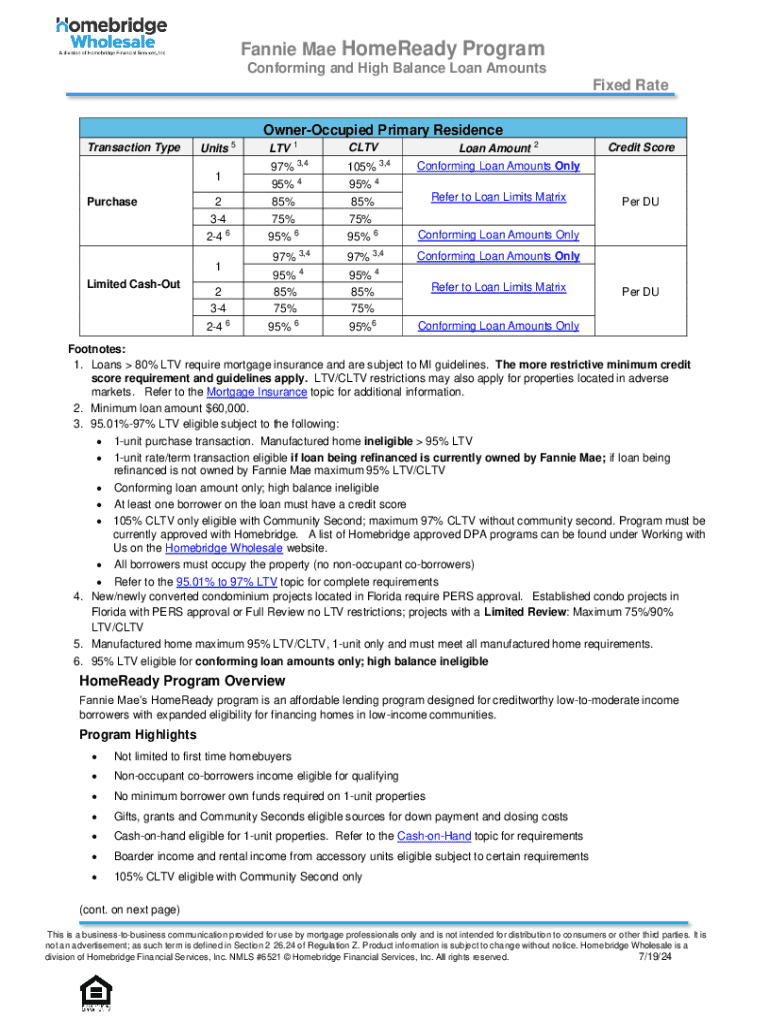

El programa HomeReady de Fannie Mae es un programa de financiamiento asequible diseñado para prestatarios de bajos a moderados ingresos con elegibilidad ampliada para la financiación de viviendas en comunidades de bajos ingresos. Incluye información sobre requisitos de LTV, financiación, tipos de transacciones, ingresos elegibles, así como pautas específicas para propiedades y prestatarios.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fannie mae homeready program

Edit your fannie mae homeready program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fannie mae homeready program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fannie mae homeready program online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fannie mae homeready program. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fannie mae homeready program

How to fill out fannie mae homeready program

01

Determine eligibility based on income limits and location.

02

Gather required documentation, including proof of income, employment history, and assets.

03

Complete the loan application with a lender who participates in the Fannie Mae HomeReady program.

04

Provide additional information about household members and their income.

05

Review and understand the loan terms, including mortgage insurance requirements.

06

Submit the application and documentation to get pre-approved.

07

Work with the lender to complete the underwriting process.

08

Close on the loan and fulfill any additional requirements.

Who needs fannie mae homeready program?

01

Low to moderate-income borrowers.

02

First-time homebuyers or repeat buyers seeking affordable options.

03

Those looking for flexible underwriting and down payment assistance.

04

Individuals who want to purchase properties in designated areas.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fannie mae homeready program directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your fannie mae homeready program as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit fannie mae homeready program on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign fannie mae homeready program right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out fannie mae homeready program on an Android device?

Use the pdfFiller Android app to finish your fannie mae homeready program and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is fannie mae homeready program?

The Fannie Mae HomeReady program is a mortgage option designed to help low- to moderate-income borrowers become homeowners, offering features like low down payments and flexible underwriting.

Who is required to file fannie mae homeready program?

Lenders offering HomeReady mortgages must adhere to Fannie Mae's guidelines, which include verification of borrower eligibility based on income and other factors.

How to fill out fannie mae homeready program?

To fill out the HomeReady program application, borrowers must provide personal financial information, including income documentation, credit history, and details about the property being financed.

What is the purpose of fannie mae homeready program?

The purpose of the HomeReady program is to promote sustainable homeownership by providing low-interest loans and reducing barriers for low- to moderate-income borrowers.

What information must be reported on fannie mae homeready program?

Lenders must report borrower income, debt-to-income ratio, credit score, and property details, as well as compliance with HomeReady program guidelines.

Fill out your fannie mae homeready program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fannie Mae Homeready Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.