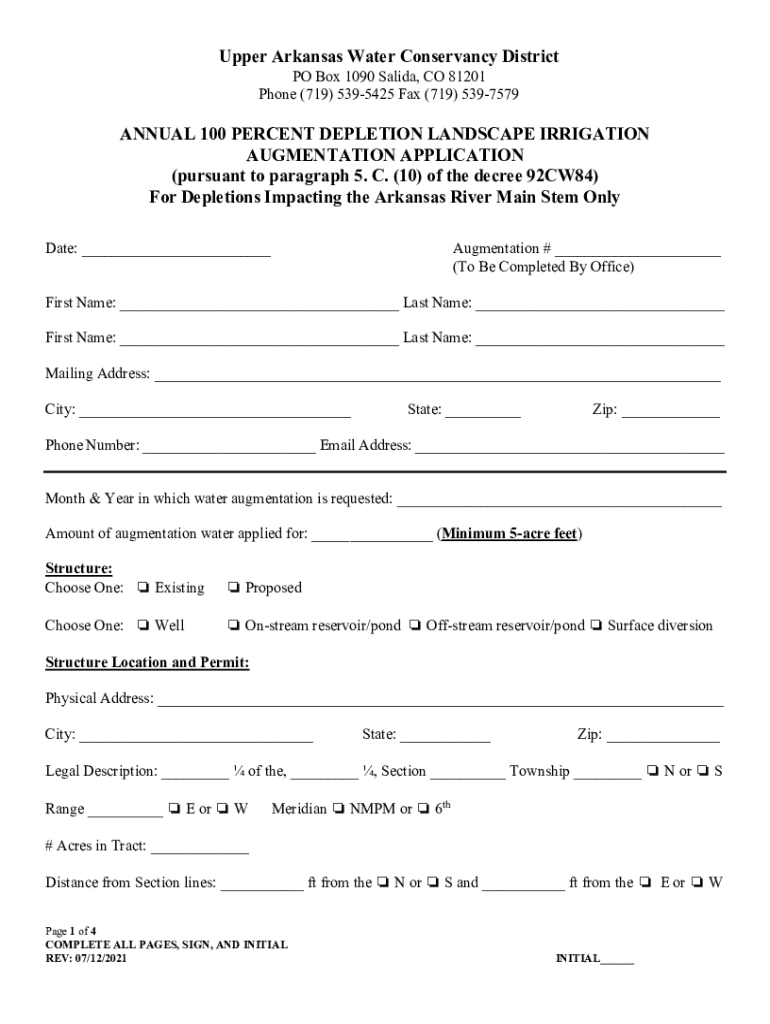

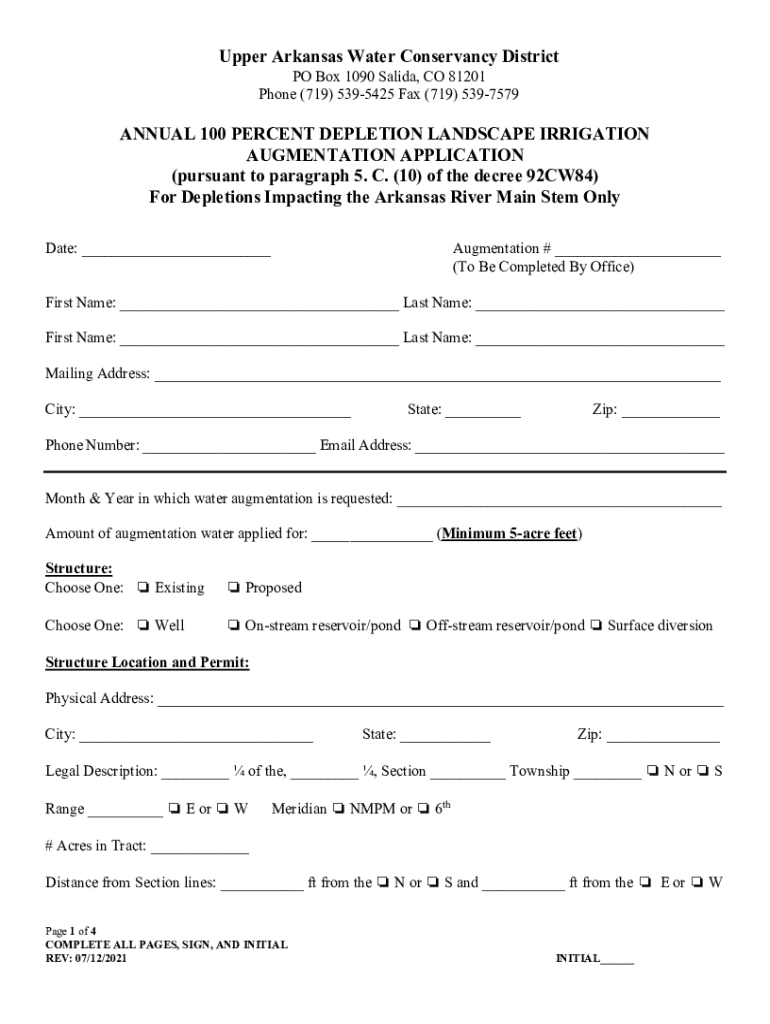

Get the free Annual 100 Percent Depletion Landscape Irrigation Augmentation Application

Show details

Este formulario es para solicitar agua de aumento para el riego de paisajes afectando solo el arroyo principal de Arkansas. El solicitante debe completar toda la información requerida sobre su estructura de agua y la ubicación, incluyendo datos de contacto y detalles sobre el uso solicitado.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual 100 percent depletion

Edit your annual 100 percent depletion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual 100 percent depletion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual 100 percent depletion online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual 100 percent depletion. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual 100 percent depletion

How to fill out annual 100 percent depletion

01

Gather all necessary documentation, including financial statements and records of resource extraction.

02

Determine the total amount of depletable resources available for the year.

03

Calculate the depletion deduction based on the percentage allowed for your resource type.

04

Complete the relevant tax forms (such as IRS Form 4562) with the depletion amounts.

05

Ensure all calculations and documentation are accurate and neatly organized for submission.

Who needs annual 100 percent depletion?

01

Mineral resource companies involved in extraction of resources like oil, gas, and minerals.

02

Businesses or individuals engaged in the exploitation of tangible assets that can qualify for depletion.

03

Taxpayers who wish to recover the cost of resource extraction over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in annual 100 percent depletion?

The editing procedure is simple with pdfFiller. Open your annual 100 percent depletion in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit annual 100 percent depletion in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your annual 100 percent depletion, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete annual 100 percent depletion on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your annual 100 percent depletion, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is annual 100 percent depletion?

Annual 100 percent depletion refers to a tax provision that allows resource companies to deduct the entire cost of depleted natural resources from their taxable income in a given year. This provision is typically applicable to certain types of natural resources such as minerals and oil.

Who is required to file annual 100 percent depletion?

Taxpayers involved in the extraction of natural resources, such as mining or oil and gas companies, are required to file for annual 100 percent depletion to claim the deduction on their taxes.

How to fill out annual 100 percent depletion?

To fill out the annual 100 percent depletion, taxpayers must complete the appropriate tax forms, providing specific information about the resource extracted, the costs associated, and any other pertinent financial data that supports the depletion claim.

What is the purpose of annual 100 percent depletion?

The purpose of annual 100 percent depletion is to allow companies in the natural resource sector to recover the costs associated with resource extraction and to account for the diminishing value of the natural resource over time, ultimately reducing taxable income.

What information must be reported on annual 100 percent depletion?

On the report for annual 100 percent depletion, taxpayers must provide details such as the type of resource, extraction costs, amounts of resource sold, and any relevant deductions taken related to the depletion calculation.

Fill out your annual 100 percent depletion online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual 100 Percent Depletion is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.