Get the free Tax Levy Revenues

Show details

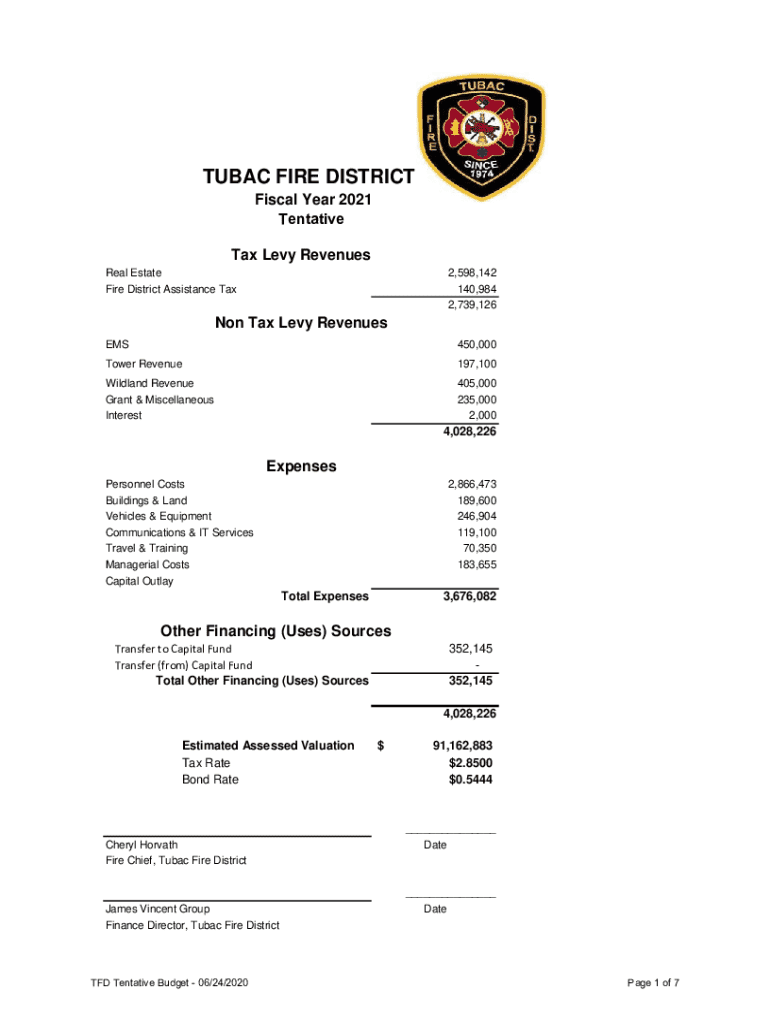

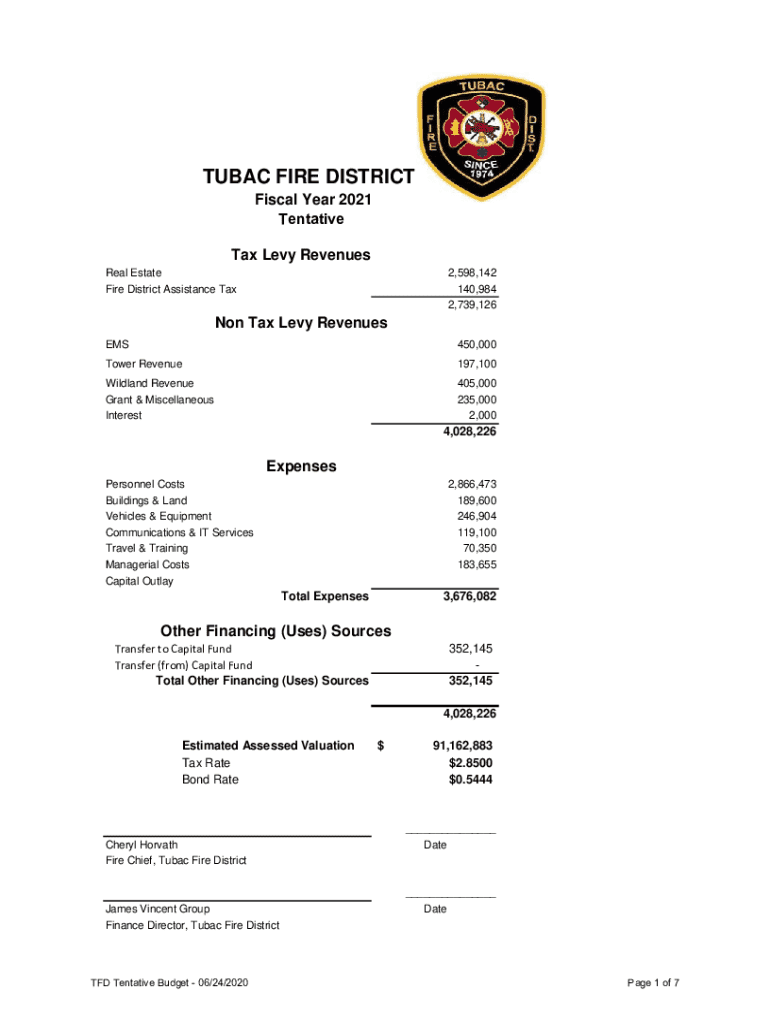

TUBAC FIRE DISTRICT Fiscal Year 2021 Tentative Tax Levy Revenues Real Estate Fire District Assistance Tax2,598,142 140,984 2,739,126Non Tax Levy Revenues EMS450,000Tower Revenue197,100Wildland Revenue Grant & Miscellaneous Interest405,000 235,000 2,0004,028,226Expenses Personnel Costs Buildings & Land Vehicles & Equipment Communications & IT Services Travel & Training Managerial Costs Capital Outlay2,866,473 189,600 246,904 119,100 70,350 183,655Total Expenses3,676,082Other

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax levy revenues

Edit your tax levy revenues form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax levy revenues form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax levy revenues online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax levy revenues. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax levy revenues

How to fill out tax levy revenues

01

Gather necessary financial documents related to property taxes.

02

Determine the total amount of revenue needed from the tax levy.

03

Identify the specific tax rate to be applied based on local regulations.

04

Calculate the projected revenue by multiplying the tax rate with the assessed value of properties.

05

Consult with local government or financial advisors to ensure compliance and accuracy.

06

Submit the completed tax levy proposal to the appropriate governmental body for approval.

Who needs tax levy revenues?

01

Local governments needing funding for public services.

02

School districts requiring funds for educational programs.

03

Municipalities implementing infrastructure projects.

04

Fire and emergency services needing financial support.

05

Public health agencies addressing community health needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax levy revenues for eSignature?

When you're ready to share your tax levy revenues, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the tax levy revenues electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your tax levy revenues in seconds.

How do I fill out tax levy revenues on an Android device?

Use the pdfFiller mobile app to complete your tax levy revenues on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is tax levy revenues?

Tax levy revenues refer to the total amount of money collected by a governmental entity through taxes imposed on property, income, sales, or other taxable activities. These revenues are used to fund public services and governmental operations.

Who is required to file tax levy revenues?

Typically, local governments, municipalities, and school districts are required to file tax levy revenues. Individuals and businesses do not file tax levy revenues but may be subject to the taxes that contribute to these revenues.

How to fill out tax levy revenues?

To fill out tax levy revenues, government entities need to gather data on assessed valuations, tax rates, and any relevant exemptions. They must then report this information on the appropriate tax forms, following local guidelines and regulations.

What is the purpose of tax levy revenues?

The purpose of tax levy revenues is to provide funding for essential public services such as education, transportation, public safety, infrastructure, and other community needs.

What information must be reported on tax levy revenues?

The information that must be reported on tax levy revenues typically includes the total assessed value of properties, the tax rate set by the governing body, any exemptions or deductions, and the total amount of revenue expected to be collected.

Fill out your tax levy revenues online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Levy Revenues is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.