Get the free Individual Joint Account Opening Form

Show details

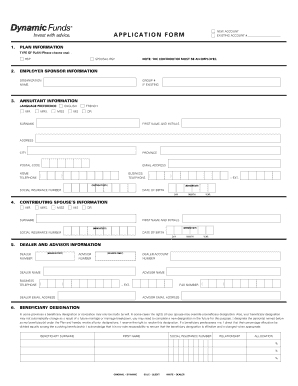

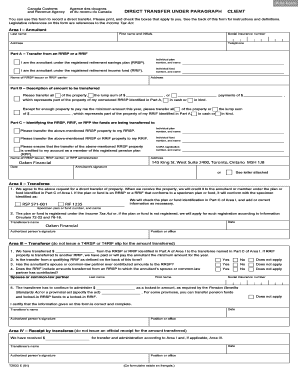

??/???????? Individual / Joint Account Opening Form ???????? Chief Securities Limited ???? A/C No SFC Licensed Corporation ?????????(CE#: ADI983) ????/?? Process Location /AE A. ???? AE Code ????

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual joint account opening

Edit your individual joint account opening form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual joint account opening form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit individual joint account opening online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit individual joint account opening. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual joint account opening

How to fill out an individual joint account opening:

01

Gather the necessary documents: Before filling out the account opening form, gather the required documents such as identification proof, address proof, passport-size photographs, and any other documents required by the bank.

02

Visit the bank or access the online application: Decide whether you want to visit the bank in person or opt for an online application, if available. If visiting the bank, ensure you have all the required documents with you.

03

Fill out the account opening form: Provide accurate information in the account opening form, including personal details, contact information, and the type of joint account you wish to open. Make sure to fill in all the mandatory fields.

04

Choose the type of joint account: Specify the type of joint account you want, such as a joint savings account or a joint current account. You may need to include the name(s) of the joint account holder(s) and their relationship to you.

05

Decide on operating instructions: Determine how the account will be operated by specifying the mode of operation, such as whether each account holder can operate the account independently or if all account holders need to provide consent for any transactions.

06

Provide signatures: Each account holder should sign the account opening form. Ensure that the signatures match the ones on the identification proof provided.

07

Submit the application: If applying in-person, submit the completed form along with the required documents to the bank representative. If applying online, follow the instructions provided to submit the necessary documents digitally.

08

Complete the verification process: The bank may require additional verification steps, such as KYC (Know Your Customer) verification, to authenticate your information and identity. Cooperate with the bank during this process.

09

Fund the account: Once the account is successfully opened, deposit the required minimum balance or any initial funds specified by the bank to activate the account.

Who needs an individual joint account opening?

01

Couples: Couples who wish to manage their finances together or have joint expenses often opt for an individual joint account to streamline their financial transactions.

02

Business partners: Individuals in a business partnership may find it convenient to open an individual joint account to manage joint expenses, monitor cash flow, and keep track of business transactions.

03

Family members: Family members, such as parents and children, siblings, or extended family living together, may choose to open an individual joint account for joint expenses like household bills, groceries, or family vacations.

04

Guardians for minors: Legal guardians appointed to manage the finances of minors may open an individual joint account to manage the minor's funds while ensuring transparency and accountability.

05

Roommates: Individuals sharing a rented space may opt for an individual joint account to handle shared expenses like rent, utilities, or groceries, making financial management easier and hassle-free.

06

Trusts or organizations: Trusts, clubs, associations, or organizations with multiple authorized signatories may open an individual joint account to simplify financial operations and ensure transparency among members.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit individual joint account opening online?

With pdfFiller, the editing process is straightforward. Open your individual joint account opening in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the individual joint account opening in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your individual joint account opening in seconds.

Can I edit individual joint account opening on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign individual joint account opening right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is individual joint account opening?

Individual joint account opening is when two or more individuals open a single account together.

Who is required to file individual joint account opening?

All individuals who are opening the joint account are required to file individual joint account opening.

How to fill out individual joint account opening?

To fill out individual joint account opening, each individual must provide their personal information, sign the necessary forms, and adhere to any specific requirements of the financial institution.

What is the purpose of individual joint account opening?

The purpose of individual joint account opening is to allow multiple individuals to access and manage funds in a single account.

What information must be reported on individual joint account opening?

Information such as names, addresses, identification numbers, signatures, and any joint account agreements must be reported on individual joint account opening.

Fill out your individual joint account opening online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Joint Account Opening is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.