Get the free Balance Sheet as at 31/10/2024

Show details

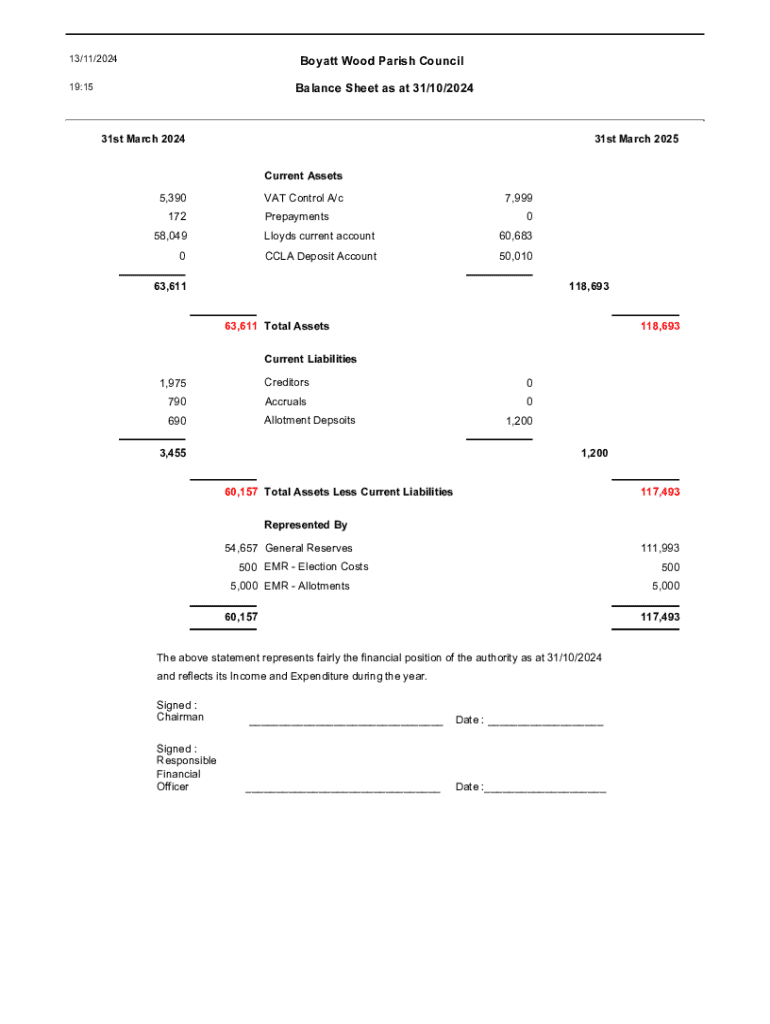

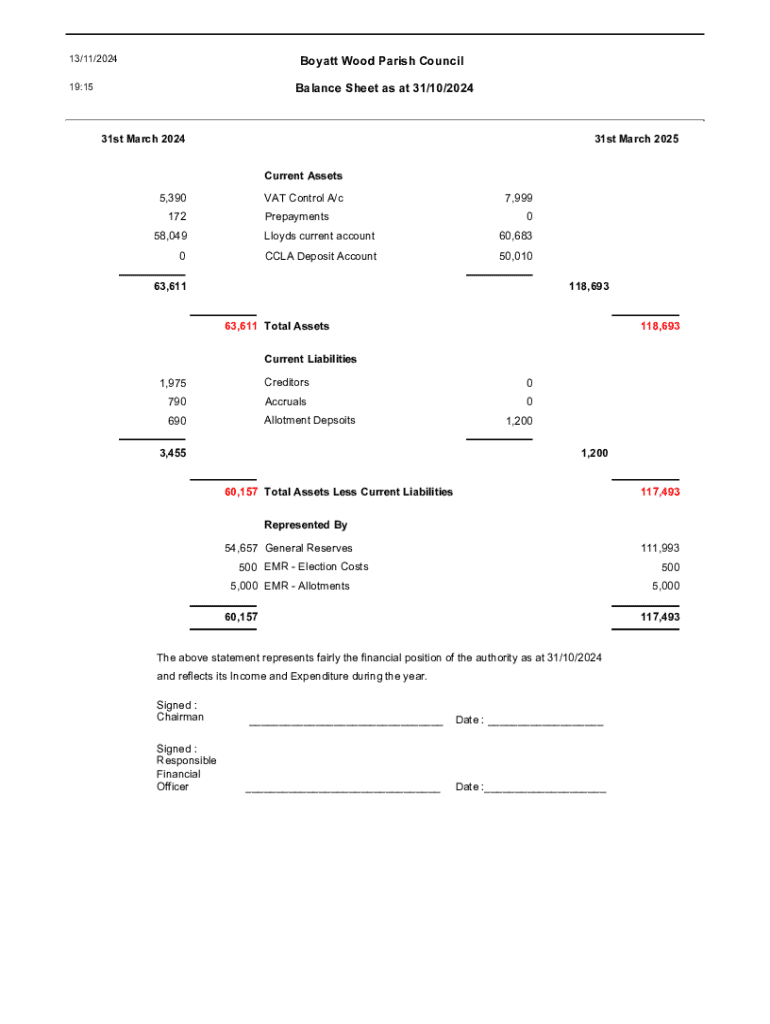

13/11/2024Boyatt Wood Parish Council19:15Balance Sheet as at 31/10/202431st March 202431st March 2025 Current Assets5,390VAT Control A/c172Prepayments7,999 058,049Lloyds current account60,6830CCLA

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign balance sheet as at

Edit your balance sheet as at form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your balance sheet as at form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing balance sheet as at online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit balance sheet as at. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out balance sheet as at

How to fill out balance sheet as at

01

Gather all financial data including assets, liabilities, and equity.

02

List down all assets on the left side, starting with current assets followed by non-current assets.

03

Total all assets at the bottom of the assets section.

04

On the right side, list all liabilities starting with current liabilities followed by long-term liabilities.

05

Total all liabilities at the bottom of the liabilities section.

06

Calculate equity by subtracting total liabilities from total assets.

07

Present the total equity at the bottom of the equity section.

Who needs balance sheet as at?

01

Business owners to assess financial health.

02

Investors to make informed decisions.

03

Creditors to evaluate loan eligibility.

04

Management for internal decision-making.

05

Regulatory bodies for compliance purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my balance sheet as at directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign balance sheet as at and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find balance sheet as at?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the balance sheet as at. Open it immediately and start altering it with sophisticated capabilities.

How do I complete balance sheet as at on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your balance sheet as at. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is balance sheet as at?

A balance sheet as at is a financial statement that summarizes a company's assets, liabilities, and equity at a specific point in time, providing a snapshot of the financial position of the business.

Who is required to file balance sheet as at?

Typically, corporations, partnerships, and limited liability companies are required to file a balance sheet as part of their financial reporting obligations, especially for tax purposes or compliance with regulatory authorities.

How to fill out balance sheet as at?

To fill out a balance sheet as at, list all assets, liabilities, and equity. Start with assets (current and non-current), total them, then list liabilities (current and non-current), total these, and finally report the equity, ensuring that the equation Assets = Liabilities + Equity holds true.

What is the purpose of balance sheet as at?

The purpose of a balance sheet as at is to provide an overview of a company's financial position, allowing stakeholders to assess its stability, liquidity, and financial structure, and to make informed decisions based on this information.

What information must be reported on balance sheet as at?

A balance sheet as at must report the company's total assets, total liabilities, and total equity. It should categorize assets into current and non-current, and similarly categorize liabilities into current and non-current, providing detailed line items for each category.

Fill out your balance sheet as at online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Balance Sheet As At is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.