Get the free Personal Tax Letter of Engagement

Show details

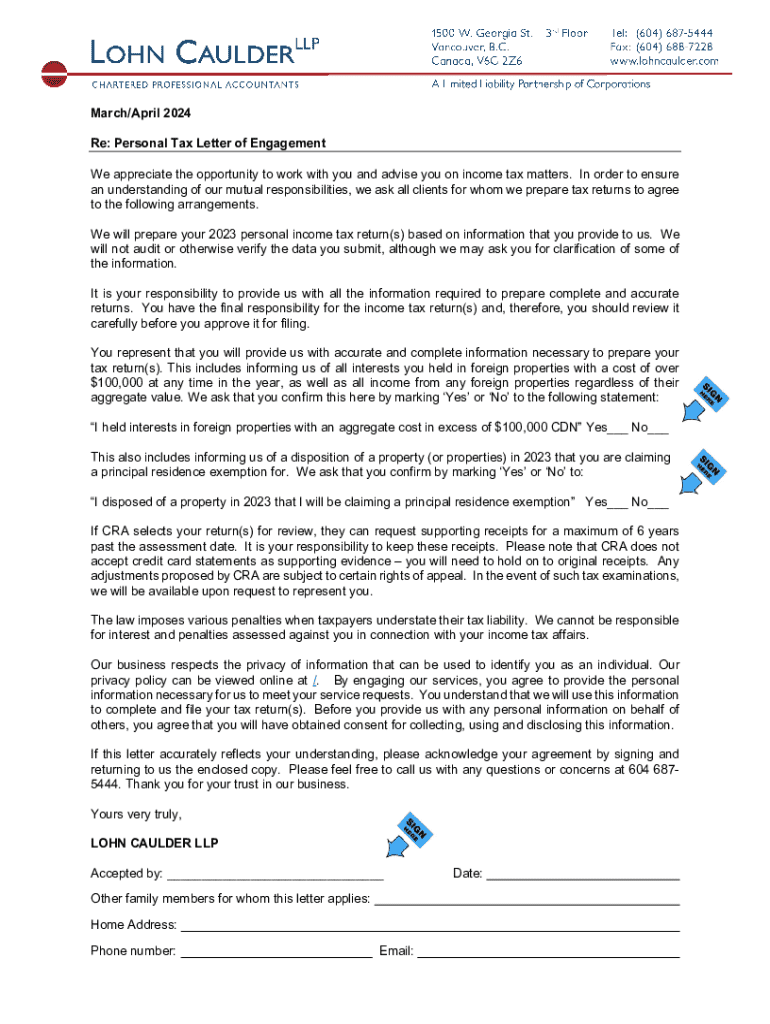

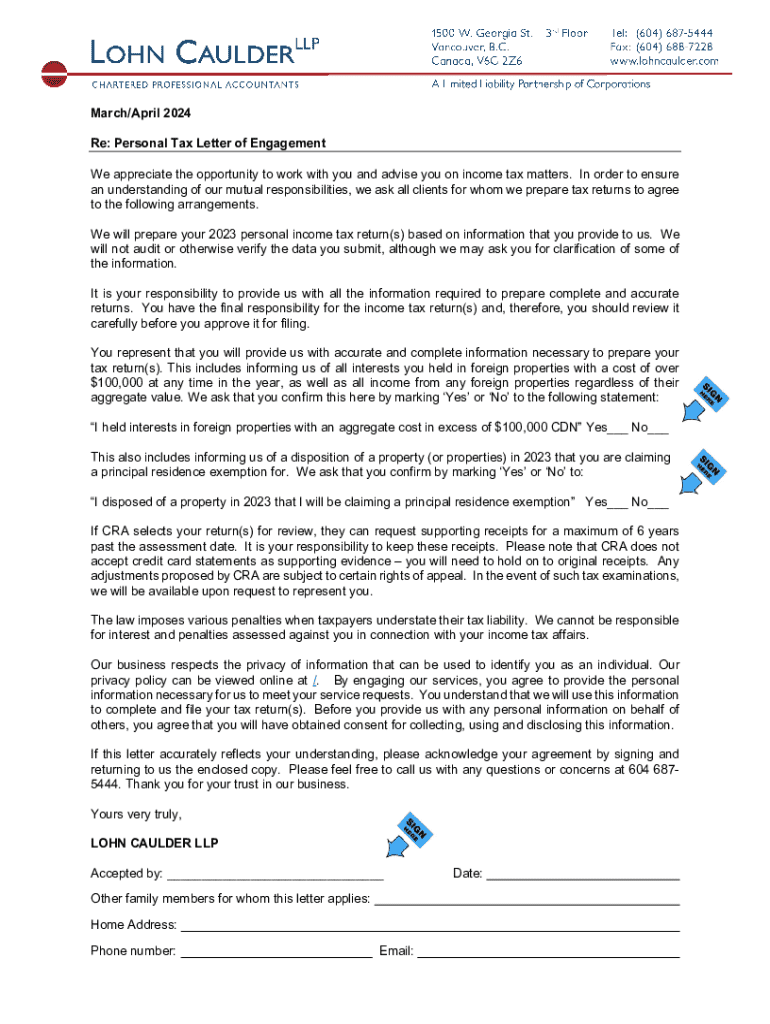

Este documento establece los términos y condiciones entre el cliente y LOHN CAULDER LLP para la preparación de la declaración de impuestos sobre la renta personal del año 2023. Incluye la responsabilidad del cliente de proporcionar información precisa y completa, así como las obligaciones de la empresa respecto a la gestión de la información personal y la representación en caso de auditorías por parte de la CRA.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal tax letter of

Edit your personal tax letter of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal tax letter of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal tax letter of online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit personal tax letter of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal tax letter of

How to fill out personal tax letter of

01

Gather all necessary documents including your income statements, deductions, and any applicable tax credits.

02

Obtain a blank personal tax letter form from the relevant tax authority or online.

03

Fill in your personal details such as your name, address, and Social Security number.

04

Report your income accurately, including wages, interest, dividends, and any other sources.

05

List allowable deductions and credits that apply to your situation.

06

Review the form for accuracy and completeness before submission.

07

Sign and date the form where indicated.

08

Submit the tax letter by the specified deadline, either electronically or by mail.

Who needs personal tax letter of?

01

Individuals who are required to report their income to tax authorities.

02

Self-employed persons needing to declare income and expenses.

03

Individuals seeking to claim deductions and credits.

04

Students who may need to file taxes due to part-time work or scholarships.

05

Anyone who has received income from investments, rental properties, or freelance work.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get personal tax letter of?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the personal tax letter of in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in personal tax letter of?

The editing procedure is simple with pdfFiller. Open your personal tax letter of in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my personal tax letter of in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your personal tax letter of and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is personal tax letter of?

A personal tax letter of is a document issued by tax authorities that summarizes an individual's or entity's tax obligations and compliance status for a specified period.

Who is required to file personal tax letter of?

Individuals and entities that have tax obligations or who have received taxable income during a given tax year are typically required to file a personal tax letter of.

How to fill out personal tax letter of?

To fill out a personal tax letter of, one must gather all relevant financial data, complete the necessary sections of the form accurately, and ensure that all required documents and schedules are attached before submission.

What is the purpose of personal tax letter of?

The purpose of a personal tax letter of is to provide an official record of an individual's tax situation, facilitate communication with tax authorities, and assist in financial planning and reporting.

What information must be reported on personal tax letter of?

Information that must be reported includes personal identification details, income sources, deductions, credits claimed, and any tax payments made or owed during the reporting period.

Fill out your personal tax letter of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Tax Letter Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.