Get the free (Japanese accounting standards)

Show details

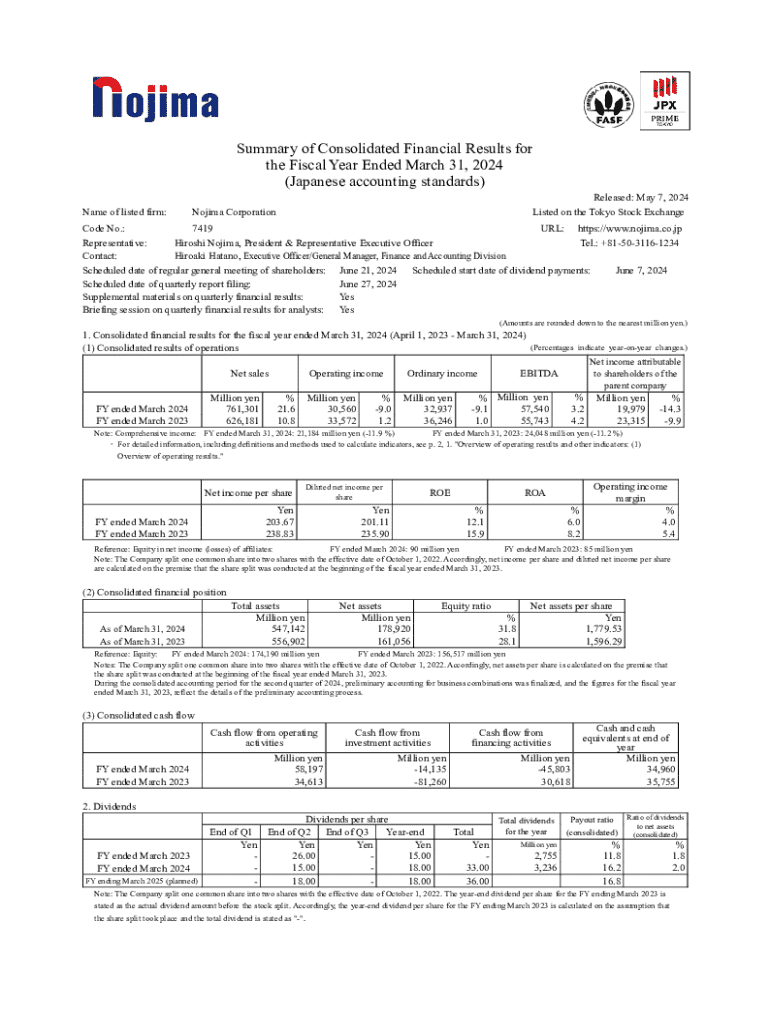

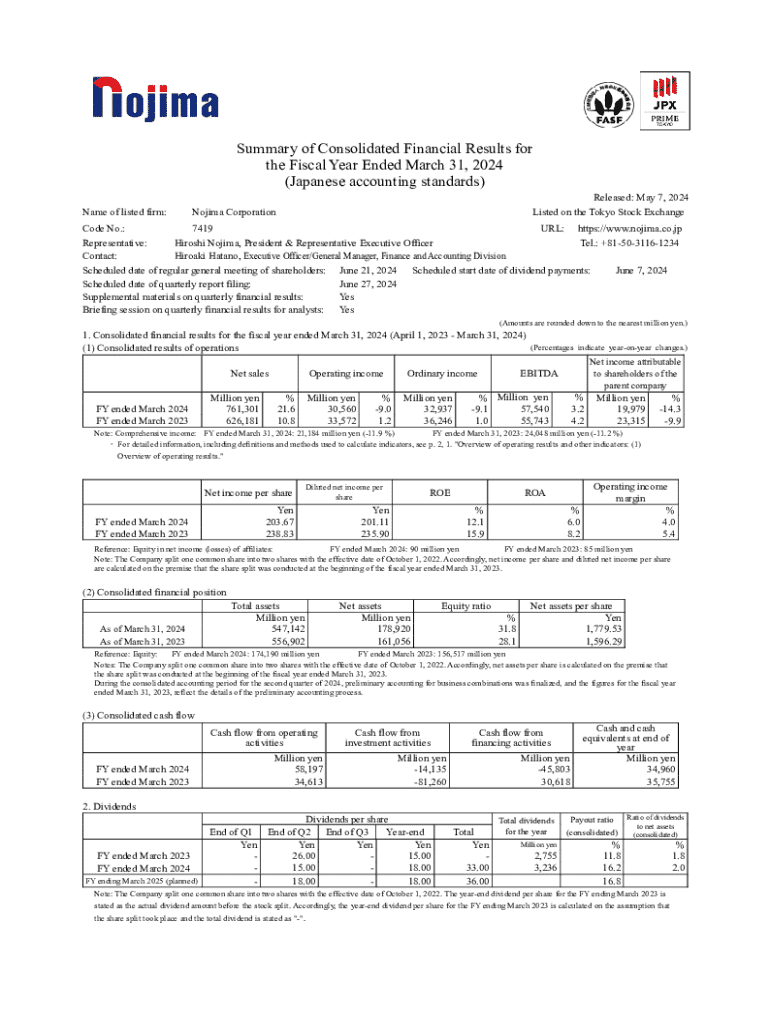

Summary of Consolidated Financial Results for the Fiscal Year Ended March 31, 2024 (Japanese accounting standards) Released: May 7, 2024 Name of listed firm:Nojima CorporationCode No.:7419Listed on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign japanese accounting standards

Edit your japanese accounting standards form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your japanese accounting standards form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing japanese accounting standards online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit japanese accounting standards. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out japanese accounting standards

How to fill out japanese accounting standards

01

Gather all relevant financial documents, including balance sheets, income statements, and cash flow statements.

02

Ensure financial documents are prepared based on the historical cost principle and conservatism concept.

03

Categorize assets and liabilities into current and non-current for clarity.

04

Adhere to specific accounting policies defined under Japanese GAAP, including revenue recognition and expense matching.

05

Confirm compliance with the Corporate Code and the Financial Instruments and Exchange Act.

06

Ensure disclosures are complete, explaining accounting policies, risks, and contingencies.

07

Use appropriate accounting software that supports Japanese accounting standards for accuracy.

08

Review and audit the completed financial statements for errors or omissions before submission.

Who needs japanese accounting standards?

01

Companies operating in Japan that must comply with local regulations.

02

Foreign entities that have a subsidiary or branch office in Japan.

03

Investors looking to analyze the financial statements of Japanese firms.

04

Auditors responsible for validating financial statements against recognized standards.

05

Businesses intending to raise capital through public offerings in Japan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify japanese accounting standards without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including japanese accounting standards, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit japanese accounting standards straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing japanese accounting standards, you need to install and log in to the app.

Can I edit japanese accounting standards on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as japanese accounting standards. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is japanese accounting standards?

Japanese Accounting Standards (JGAAP) are the principles and guidelines that govern financial accounting and reporting in Japan. They are designed to ensure transparency, consistency, and reliability in financial statements.

Who is required to file japanese accounting standards?

Entities that are publicly traded, as well as certain other companies that meet specific criteria, are required to file financial statements prepared in accordance with Japanese Accounting Standards.

How to fill out japanese accounting standards?

To fill out Japanese Accounting Standards, companies must follow the guidelines outlined in JGAAP, which include defining the accounting policies, preparation of financial statements, and proper disclosures in accordance with the regulations.

What is the purpose of japanese accounting standards?

The purpose of Japanese Accounting Standards is to provide a set framework for financial reporting that promotes comparability, reliability, and transparency for investors and stakeholders.

What information must be reported on japanese accounting standards?

Under Japanese Accounting Standards, companies must report comprehensive financial statements, including the balance sheet, income statement, statement of changes in equity, cash flow statement, and comprehensive disclosure notes.

Fill out your japanese accounting standards online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Japanese Accounting Standards is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.