Get the free Self-employed Workers and Small Businesses Form

Show details

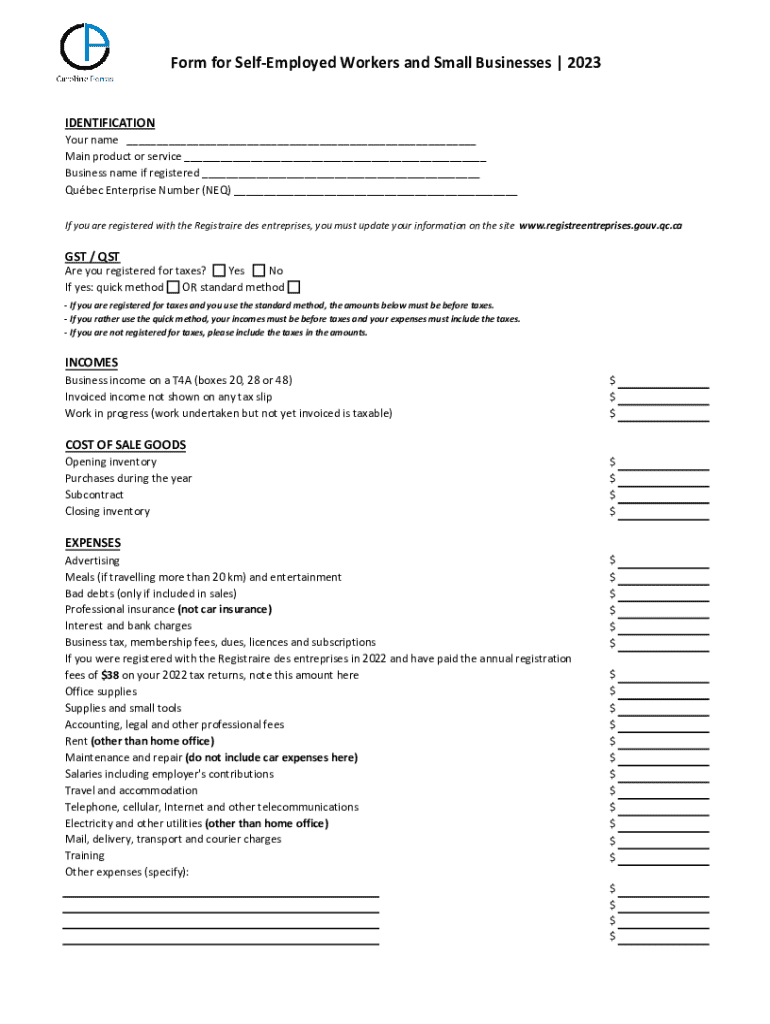

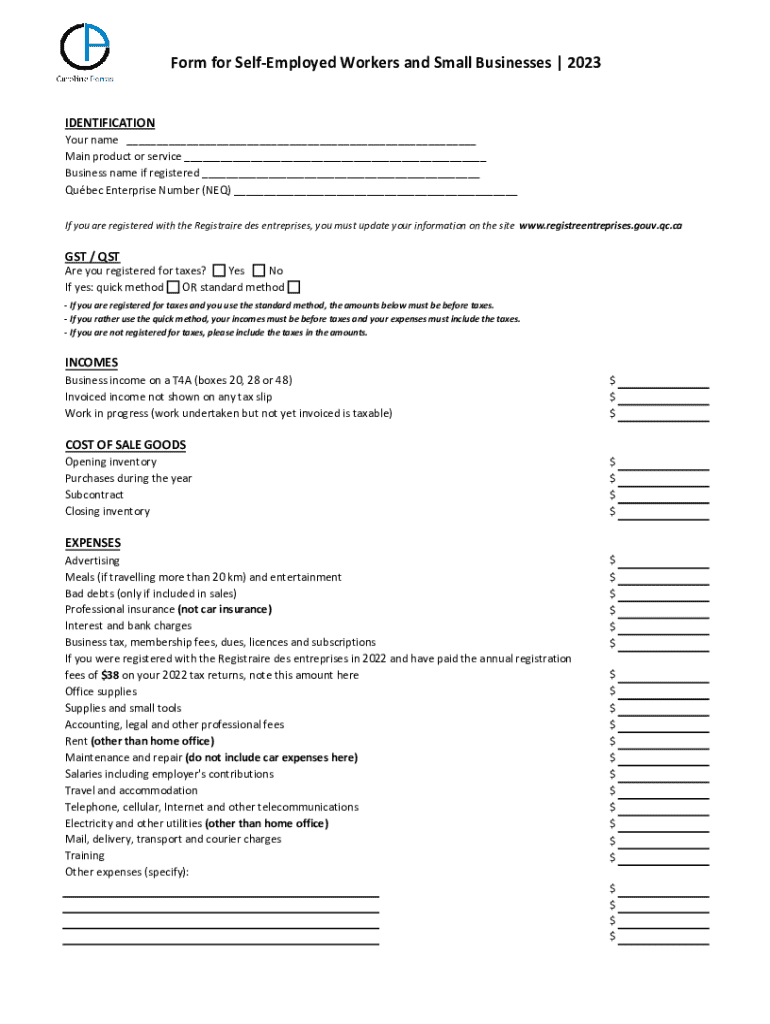

Ce formulaire est destiné aux travailleurs autonomes et aux petites entreprises pour la déclaration de leurs revenus, dépenses, et autres informations financières pertinentes pour l\'année 2023.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-employed workers and small

Edit your self-employed workers and small form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-employed workers and small form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self-employed workers and small online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit self-employed workers and small. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self-employed workers and small

How to fill out self-employed workers and small

01

Gather necessary personal information such as your name, address, and contact details.

02

Collect information about your business, including its name, type, and location.

03

Prepare financial documentation, including income, expenses, and tax returns for the previous year.

04

Complete the required self-employment forms, ensuring all information is accurate.

05

Submit the forms through the designated online platform or by mail, depending on local regulations.

06

Keep copies of all submitted documents for your records.

Who needs self-employed workers and small?

01

Businesses that require flexible workforce solutions to meet varying demands.

02

Companies looking for specialized skills or expertise for short-term projects.

03

Startups that prefer to hire freelancers to minimize overhead costs.

04

Individuals or organizations needing unique services that are not easily filled by full-time employees.

05

Organizations aiming to diversify their labor sources and leverage the gig economy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send self-employed workers and small to be eSigned by others?

Once your self-employed workers and small is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in self-employed workers and small without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing self-employed workers and small and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the self-employed workers and small in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your self-employed workers and small and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is self-employed workers and small?

Self-employed workers are individuals who work for themselves rather than for an employer. They run their own businesses and may include freelancers, independent contractors, and small business owners.

Who is required to file self-employed workers and small?

Individuals who earn income through self-employment, including sole proprietors and independent contractors, are required to file self-employed income. This includes those whose net earnings exceed a certain threshold, typically around $400.

How to fill out self-employed workers and small?

To fill out self-employed income forms, individuals must gather their income documents, record expenses, and complete the appropriate tax forms such as Schedule C for reporting earnings and expenses, as well as Schedule SE for calculating self-employment tax.

What is the purpose of self-employed workers and small?

The purpose of reporting self-employed income is to ensure that individuals are paying the appropriate amount of tax on their earnings and to help track business expenses that may be deducted from taxable income.

What information must be reported on self-employed workers and small?

Self-employed individuals must report their gross income, deductible business expenses, net profit or loss, and any taxes owed, along with any necessary personal identifying information.

Fill out your self-employed workers and small online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Employed Workers And Small is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.