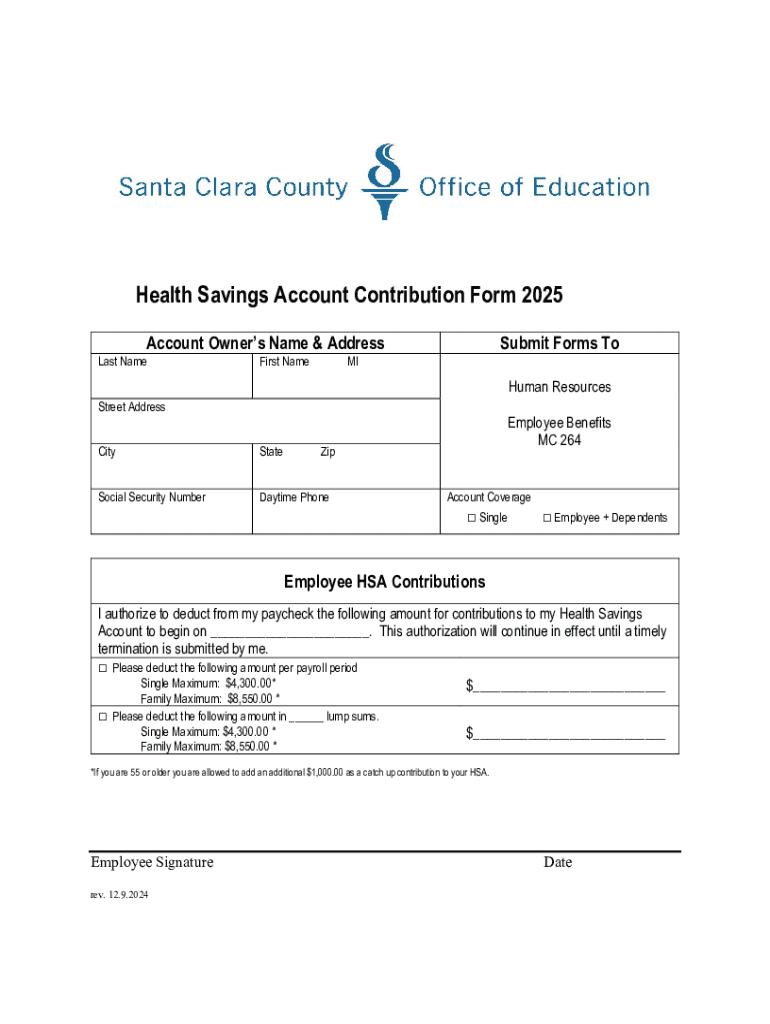

Get the free Health Savings Account Contribution Form 2025

Show details

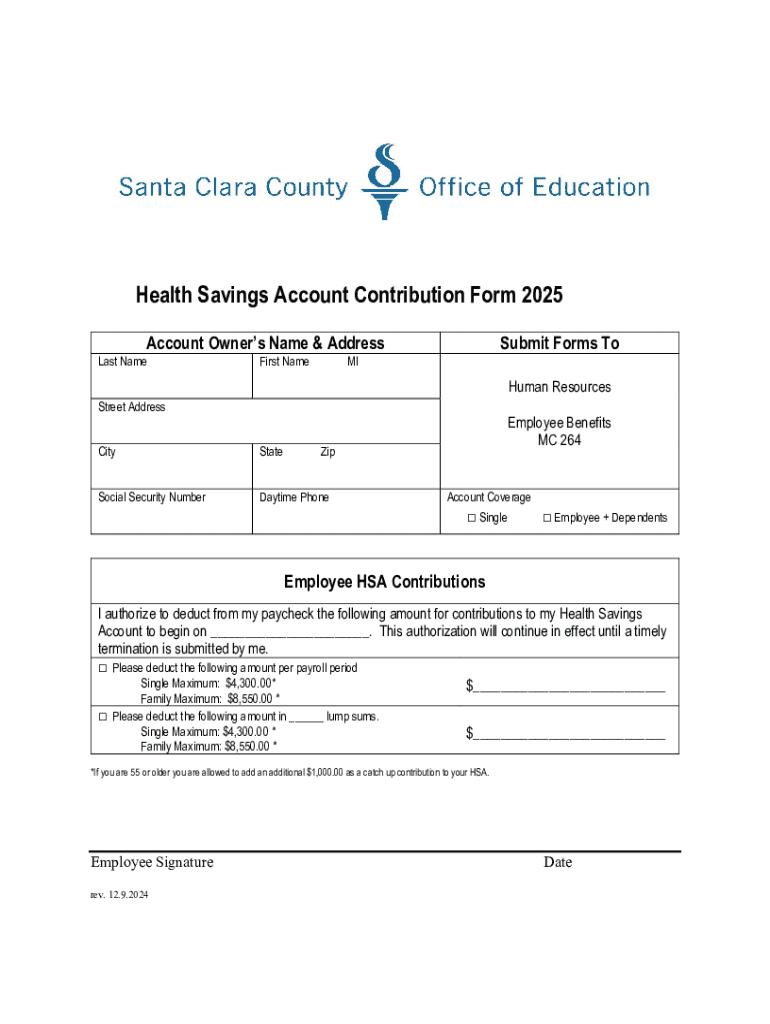

Este formulario permite a los propietarios de cuentas de ahorros para la salud (HSA) autorizar deducciones de su nómina para contribuciones a su HSA.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account contribution

Edit your health savings account contribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account contribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health savings account contribution online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit health savings account contribution. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account contribution

How to fill out health savings account contribution

01

Confirm your eligibility for a Health Savings Account (HSA) based on your high-deductible health plan (HDHP).

02

Determine the maximum contribution limit for your HSA based on IRS guidelines for the current year.

03

Gather necessary documentation, including your health insurance plan details and personal identification.

04

Choose a financial institution to open your HSA account, if you haven't already done so.

05

Complete the HSA contribution form provided by your financial institution or through your employer, if applicable.

06

Specify the amount you wish to contribute to your HSA for the tax year.

07

Decide whether to make a one-time contribution, recurring contributions, or both.

08

Provide payment information, such as direct deposit or bank transfer details.

09

Review your contributions to ensure they comply with IRS rules to avoid penalties.

10

Keep records of your contributions for tax-related documentation.

Who needs health savings account contribution?

01

Individuals who are enrolled in a high-deductible health plan (HDHP).

02

Employees whose employers offer HSA-compatible health insurance plans.

03

Self-employed individuals looking for tax-advantaged savings for medical expenses.

04

Those seeking to reduce taxable income while saving for future healthcare costs.

05

Individuals planning for retirement healthcare expenses, as HSAs can grow and be used tax-free.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify health savings account contribution without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including health savings account contribution, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete health savings account contribution online?

pdfFiller has made it simple to fill out and eSign health savings account contribution. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit health savings account contribution in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing health savings account contribution and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is health savings account contribution?

A health savings account contribution is the amount of money that individuals can deposit into a health savings account (HSA) to cover qualified medical expenses. Contributions can be made by individuals, their employers, or both, and are made on a pre-tax basis.

Who is required to file health savings account contribution?

Individuals who make contributions to a health savings account during the tax year are required to file health savings account contributions. This typically includes those enrolled in a high-deductible health plan and those who make contributions on behalf of others.

How to fill out health savings account contribution?

To fill out health savings account contribution, individuals need to complete IRS Form 8889, 'Health Savings Accounts (HSAs)', showing contributions and distributions. The form should include information regarding the total contributions made to the HSA for the tax year, as well as any withdrawals.

What is the purpose of health savings account contribution?

The purpose of health savings account contributions is to provide individuals with a tax-advantaged way to save for medical expenses. HSAs offer tax deductions for contributions, tax-free growth, and tax-free withdrawals for qualified healthcare costs.

What information must be reported on health savings account contribution?

The information that must be reported on health savings account contributions includes the total amount contributed for the tax year, any contributions made by employers, and the balance in the account if it was used for qualified medical expenses. This information is reported on Form 8889 and is included with the individual's tax return.

Fill out your health savings account contribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account Contribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.