Get the free Application for personal loan - STATE BANK STAFF... - sbsukc

Show details

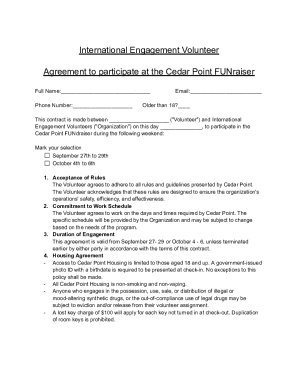

Appendix II APPLICATION FOR PERSONAL LOAN (To be submitted in duplicate) Name of the applicant : P.F. Index No. Designation : Branch/Dept. : Date of appointment : Intercom No. Date of confirmation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for personal loan

Edit your application for personal loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for personal loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for personal loan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for personal loan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for personal loan

How to fill out an application for a personal loan:

01

Start by gathering all the necessary documents and information. This usually includes proof of income, identification documents, proof of residence, and any additional documents required by the lender.

02

Research different lenders and compare their loan terms, interest rates, and eligibility requirements. Choose the lender that best suits your needs and preferences.

03

Carefully read the application form and make sure you understand all the questions and requirements. Take your time to fill out the form accurately and truthfully.

04

Begin by providing your personal information such as your full name, date of birth, social security number, and contact details. Be cautious when sharing sensitive information and ensure the application is secure.

05

Provide details about your employment status, including your current employer's name, your position, and how long you have been employed. If you're self-employed, provide information about your business.

06

Proceed to the section regarding your income and financial information. Provide details about your salary or wages, additional sources of income, and any outstanding debts or financial obligations you may have.

07

Indicate the purpose of the loan, whether it's for home improvement, debt consolidation, education, or any other acceptable reason.

08

If the loan requires collateral, state the details of the asset you are willing to use as security. This could be a vehicle, property, or any valuable possession.

09

Carefully review the application form once again to ensure all the information provided is accurate and complete. Double-check for any errors or missing information.

10

Sign the application form, either digitally or physically, depending on the lender's requirements. By signing, you confirm that all the information provided is true and accurate to the best of your knowledge.

Who needs an application for a personal loan?

01

Individuals who require financial assistance for various purposes such as home renovations, medical expenses, debt consolidation, education, or other personal needs may need to complete a personal loan application.

02

People who do not have enough savings or financial resources to fulfill their desired expenses may opt for a personal loan to bridge the gap.

03

Applicants who have a good credit history and credit score may find it easier to qualify for a personal loan, as lenders typically use these factors to assess lending risk.

04

Those who are willing to meet the eligibility requirements set by a lending institution, including providing necessary documentation, proof of income, and meeting the age requirement, may fill out a personal loan application.

05

Individuals who are confident in their ability to repay the loan within the agreed-upon terms may be interested in completing a personal loan application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is application for personal loan?

An application for a personal loan is a formal request to a financial institution or lender for a specific sum of money to be borrowed for personal use.

Who is required to file application for personal loan?

Individuals who are in need of financial assistance and meet the eligibility requirements set by the lender are required to file an application for a personal loan.

How to fill out application for personal loan?

To fill out an application for a personal loan, one must provide personal information, financial details, employment history, and any other documentation required by the lender.

What is the purpose of application for personal loan?

The purpose of an application for a personal loan is to request funds for various personal needs such as debt consolidation, home improvements, or unexpected expenses.

What information must be reported on application for personal loan?

Information such as personal identification, income details, credit history, employment status, and the purpose of the loan must be reported on the application for a personal loan.

How can I send application for personal loan to be eSigned by others?

application for personal loan is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I execute application for personal loan online?

pdfFiller has made it easy to fill out and sign application for personal loan. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my application for personal loan in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your application for personal loan directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your application for personal loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Personal Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.