Get the free Centrepay deductions - Pay your bills the easy way - tmc catholic edu

Show details

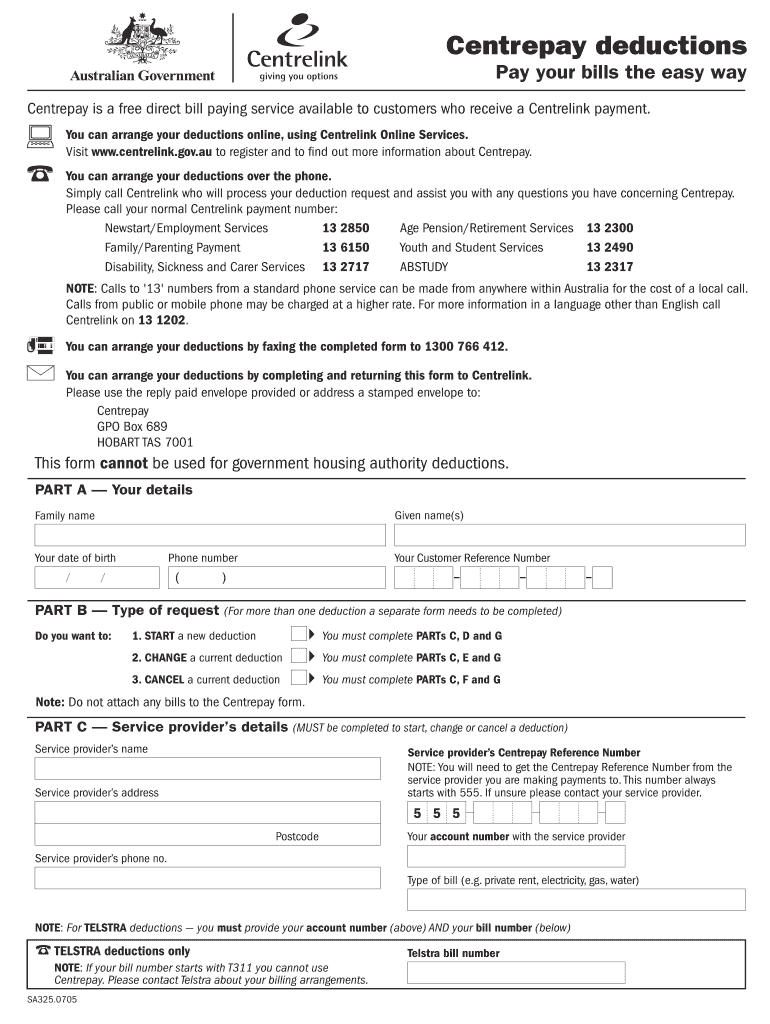

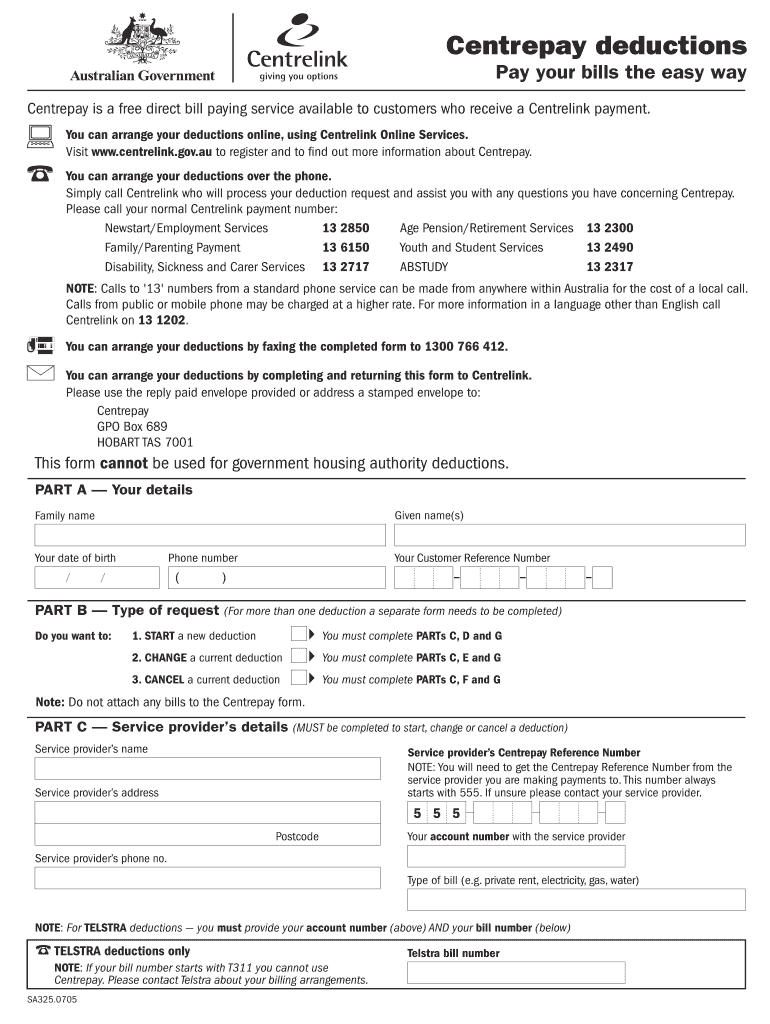

Click for Instructions Cent repay deductions Pay your bills the easy way Cent repay is a free direct bill paying service available to customers who receive a Centrelink payment. You can arrange your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign centrepay deductions - pay

Edit your centrepay deductions - pay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your centrepay deductions - pay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit centrepay deductions - pay online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit centrepay deductions - pay. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out centrepay deductions - pay

How to fill out centrepay deductions - pay:

01

Gather the necessary information and documents: Before filling out the centrepay deductions - pay form, make sure you have all the required information handy. This may include your customer reference number, income details, bank account information, and the details of the organization you wish to set up the payment with.

02

Access the centrepay deductions - pay form: You can find the centrepay deductions - pay form on the official website of Centrelink or by visiting your local Centrelink office. Alternatively, some organizations may provide the form on their own website.

03

Fill in your personal details: Start by entering your personal details, such as your name, address, phone number, and customer reference number. Ensure that all the information provided is accurate and up to date.

04

Specify the organization and payment details: Next, you will need to provide the details of the organization you wish to set up the payment with. This may include the name of the organization, their centrepay reference number, and the amount you want to deduct from your Centrelink payments.

05

Review and sign the form: Before submitting the form, carefully review all the information you have provided to ensure its accuracy. If everything looks correct, sign the form and proceed to the next step.

06

Submit the form: Depending on your preference, you can either submit the form online through Centrelink's website, mail it to the specified address, or visit your local Centrelink office and hand it in person. Follow the instructions provided on the form to ensure proper submission.

Who needs centrepay deductions - pay:

01

Low-income individuals receiving Centrelink payments: Centrepay deductions - pay is a useful service for individuals who receive Centrelink payments and wish to have certain expenses automatically deducted from their payments. This can include payments towards rent, utilities, child care, or other ongoing expenses.

02

Organizations offering goods or services: Centrepay deductions - pay is also beneficial for organizations that provide goods or services to individuals receiving Centrelink payments. By participating in the centrepay deductions - pay program, these organizations can receive regular payments directly from Centrelink, reducing the administrative burden on both parties involved.

03

Individuals looking for a hassle-free payment method: Opting for centrepay deductions - pay can simplify the payment process for individuals by automating regular expenses. This can help in ensuring timely payments and avoiding late fees or penalties. Additionally, it provides a convenient way to budget and manage expenses, as payments are deducted directly from Centrelink payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is centrepay deductions - pay?

Centrepay deductions-pay is a system that allows for a portion of an individual's Centrelink payments to be automatically deducted and paid to approved businesses or organizations.

Who is required to file centrepay deductions - pay?

Individuals who receive Centrelink payments and wish to have a portion of their payments automatically deducted and paid to approved businesses or organizations are required to file centrepay deductions-pay.

How to fill out centrepay deductions - pay?

To fill out centrepay deductions-pay, individuals need to complete the necessary forms provided by Centrelink and submit them with the required information about the businesses or organizations they want payments to go to.

What is the purpose of centrepay deductions - pay?

The purpose of centrepay deductions-pay is to assist individuals in managing their finances by automatically deducting a portion of their Centrelink payments and directing it to essential expenses or services.

What information must be reported on centrepay deductions - pay?

Information that must be reported on centrepay deductions-pay includes the name and details of the approved businesses or organizations, the amount to be deducted, and the frequency of deductions.

How can I edit centrepay deductions - pay from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including centrepay deductions - pay, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in centrepay deductions - pay without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your centrepay deductions - pay, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I fill out centrepay deductions - pay on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your centrepay deductions - pay from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your centrepay deductions - pay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Centrepay Deductions - Pay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.