MY NCB Recovery/Request for NCB Letter 2007-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

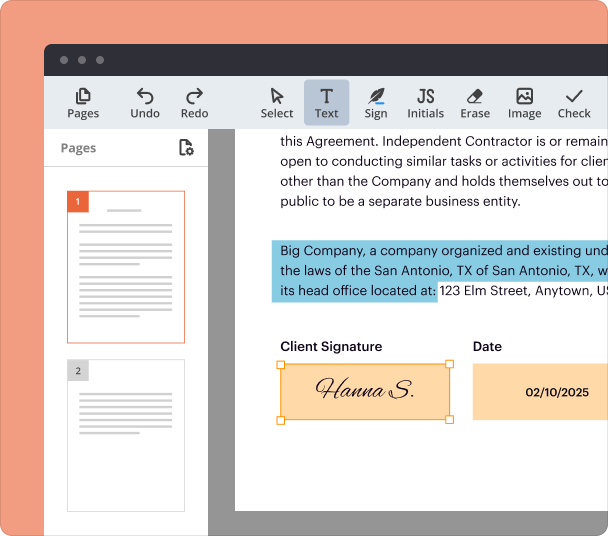

Edit and sign in one place

Create professional forms

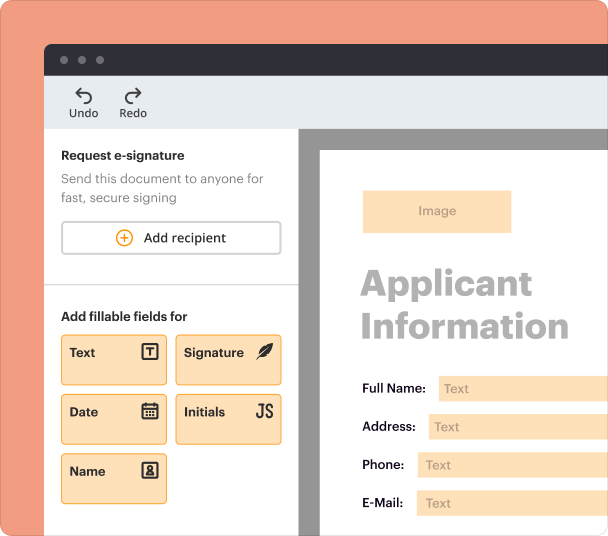

Simplify data collection

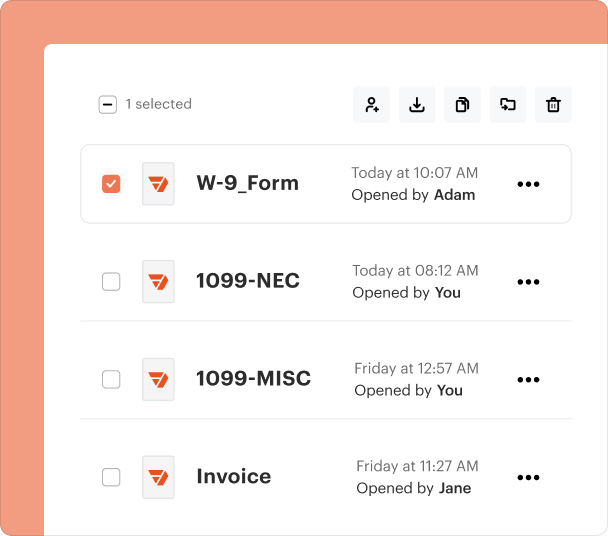

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

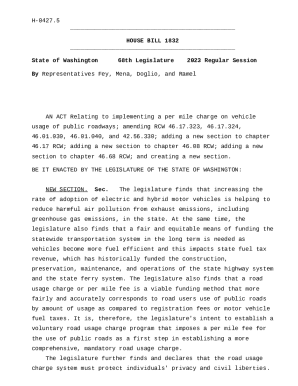

End-to-end document management

Accessible from anywhere

Secure and compliant

Understanding the NCB Recovery Request Form

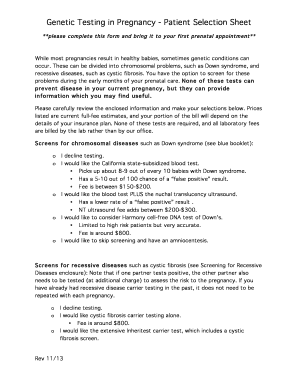

What is the NCB Recovery Request Form?

The NCB Recovery Request Form is a document used by policyholders to request the recovery of their No Claim Bonus (NCB). The form facilitates the process of documenting the entitlement to an NCB, which is a discount provided by insurance companies for claim-free years.

Key Features of the NCB Recovery Request Form

This form is designed to be user-friendly, ensuring that all necessary information is collected clearly and efficiently. Important features include:

-

Includes sections for personal details, vehicle information, and insurance policy specifics.

-

Guides the user on how and where to submit the request for processing.

-

Allows users to ask for a formal letter confirming their NCB status.

Required Documents and Information

When filling out the NCB Recovery Request Form, it is essential to provide specific details and documentation to support your request. The necessary information typically includes:

-

Full name, address, phone number, and email.

-

Details of the vehicle associated with the NCB, such as the vehicle number and model.

-

Certificate number, cover note number, and the duration of coverage.

How to Fill the NCB Recovery Request Form

Completing the NCB Recovery Request Form involves several straightforward steps to ensure all necessary information is provided. It is helpful to:

-

Have all required personal and vehicle information readily available.

-

Carefully read any instructions on the form to avoid misunderstandings.

-

Review all entries for accuracy before submitting to minimize processing delays.

Common Errors and Troubleshooting

When submitting the NCB Recovery Request Form, it's important to be aware of potential errors that could arise, such as:

-

Leaving fields blank or omitting required details can lead to delays.

-

Make sure to enter the correct certificate and cover note numbers as listed in your insurance documents.

-

Ensure you are using the correct method of submission as outlined in the form instructions.

Benefits of Using the NCB Recovery Request Form

Utilizing the NCB Recovery Request Form offers several advantages for policyholders, including:

-

Simplifies the recovery of discounts for claim-free years.

-

Provides a clear record of your request and entitlement to the NCB.

-

Facilitates direct communication with your insurance provider regarding your bonus status.

Frequently Asked Questions about ncb reserving letter form

What is NCB?

NCB stands for No Claim Bonus, a discount awarded by insurers for not making claims during a policy term.

How long does it take to process an NCB request?

Processing times can vary but typically take a few business days, depending on the insurer.

pdfFiller scores top ratings on review platforms