IRS Instructions 1120-F 2024-2026 free printable template

Show details

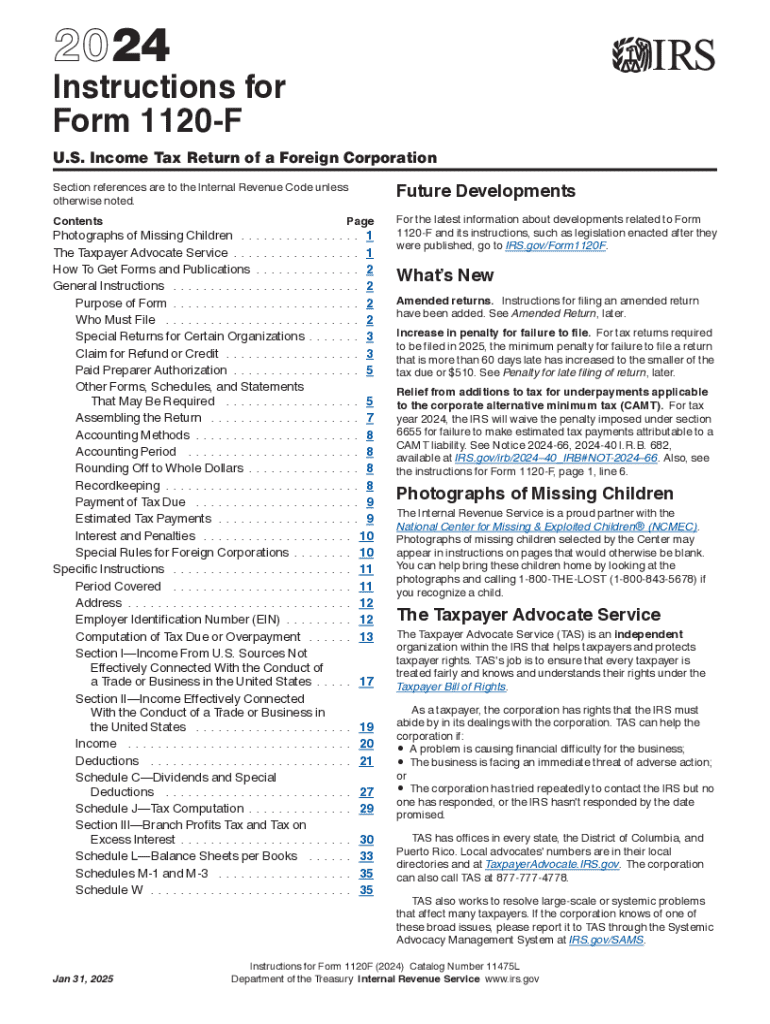

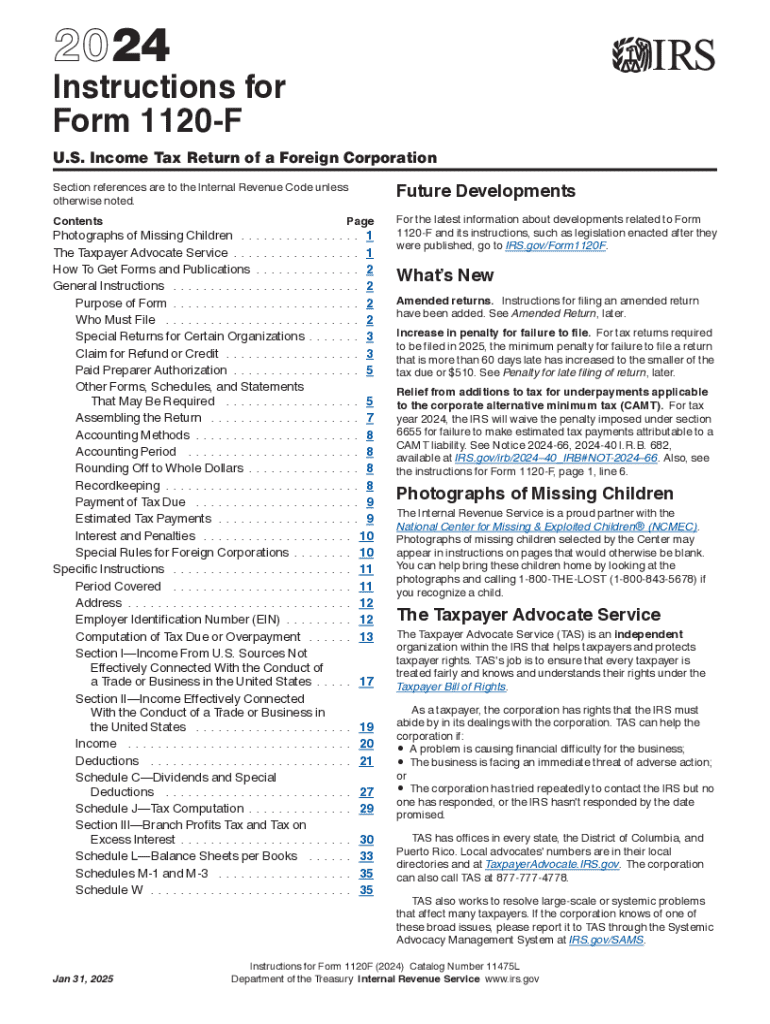

Form 1120-F is used by foreign corporations to report their income, gains, losses, deductions, and to calculate the U.S. income tax liability. It is also utilized to claim any refund that may be due,

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 1120-F

Edit your IRS Instructions 1120-F form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 1120-F form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Instructions 1120-F online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS Instructions 1120-F. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 1120-F Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 1120-F

How to fill out form 1120-f

01

Obtain Form 1120-F from the IRS website or other resources.

02

Ensure that you have the necessary financial records for the foreign corporation.

03

Fill out the basic information, including the corporation's name, address, and Employer Identification Number (EIN).

04

Complete the income section by reporting all U.S. source income.

05

Fill in the deductions section with allowable deductions applicable to the corporation.

06

Calculate the taxable income by subtracting deductions from income.

07

Complete the tax computation section, applying the corporate tax rate to the taxable income.

08

Review the form for accuracy and completeness.

09

Sign and date the form, ensuring it is signed by an authorized person.

10

File the form with the IRS by the due date, typically the 15th day of the 6th month after the end of the corporation's tax year.

Who needs form 1120-f?

01

Foreign corporations that engage in trade or business in the United States.

02

Foreign entities that have U.S. source income.

03

Corporations that meet certain thresholds of income as outlined by the IRS.

Fill

form

: Try Risk Free

People Also Ask about

What are the benefits of form 8821?

Form 8821 Benefits Form 8821 allows your tax professional to receive your transcripts, account information, and payments made to an account. This allows them to get a clear picture on your financial situation and find the best solutions to whatever you're facing.

What is line 16 instructions 1040?

Line 16 is a manual entry of tax in the far right-hand column. Review the Form 1040 instructions for the three checkboxes. Do not check any of the boxes or enter any information associated with these checkboxes unless you are instructed to do so.

How do I get IRS form and instructions?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

How long does it take IRS to process form 8821?

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.

What is a Schedule 1 for taxes?

Schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

What does Schedule 1 mean?

Schedule I drugs, substances, or chemicals are defined as drugs with no currently accepted medical use and a high potential for abuse. Some examples of Schedule I drugs are: heroin, lysergic acid diethylamide (LSD), marijuana (cannabis), 3,4-methylenedioxymethamphetamine (ecstasy), methaqualone, and peyote.

What is line 22 minus Schedule 2?

Income tax paid is the total amount of IRS Form 1040-line 22 minus Schedule 2-line 2. See the images below that show you where to find IRS Form 1040-line 22 and Schedule 2-line 2.

What is a Schedule 1?

Schedule I drugs, substances, or chemicals are defined as drugs with no currently accepted medical use and a high potential for abuse. Some examples of Schedule I drugs are: heroin, lysergic acid diethylamide (LSD), marijuana (cannabis), 3,4-methylenedioxymethamphetamine (ecstasy), methaqualone, and peyote.

What are the different types of tax returns?

There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS. Differences in the forms, however, could cost you if you're not paying attention.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS Instructions 1120-F?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific IRS Instructions 1120-F and other forms. Find the template you want and tweak it with powerful editing tools.

Can I edit IRS Instructions 1120-F on an Android device?

You can make any changes to PDF files, such as IRS Instructions 1120-F, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete IRS Instructions 1120-F on an Android device?

Use the pdfFiller Android app to finish your IRS Instructions 1120-F and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is form 1120-f?

Form 1120-F is a tax return that must be filed by foreign corporations that are doing business in the United States or have income from U.S. sources.

Who is required to file form 1120-f?

Foreign corporations engaged in a trade or business in the U.S. or those with income from U.S. sources are required to file Form 1120-F.

How to fill out form 1120-f?

To fill out Form 1120-F, gather financial information, report income and expenses, allocate income to U.S. sources, and complete all required sections of the form.

What is the purpose of form 1120-f?

The purpose of Form 1120-F is to report the income, gains, losses, deductions, and credits of foreign corporations that are liable for U.S. tax.

What information must be reported on form 1120-f?

Form 1120-F requires reporting information such as gross income, deductions, tax liabilities, and details about U.S. source income.

Fill out your IRS Instructions 1120-F online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 1120-F is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.