Get the free Incoming Loan Agreement

Show details

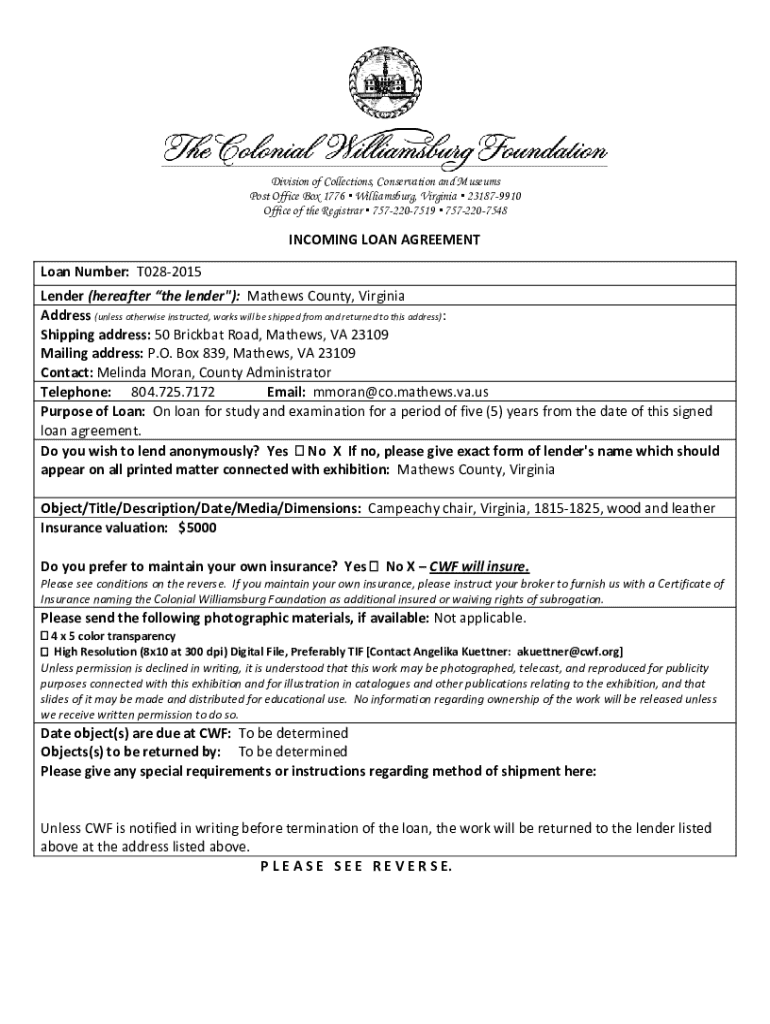

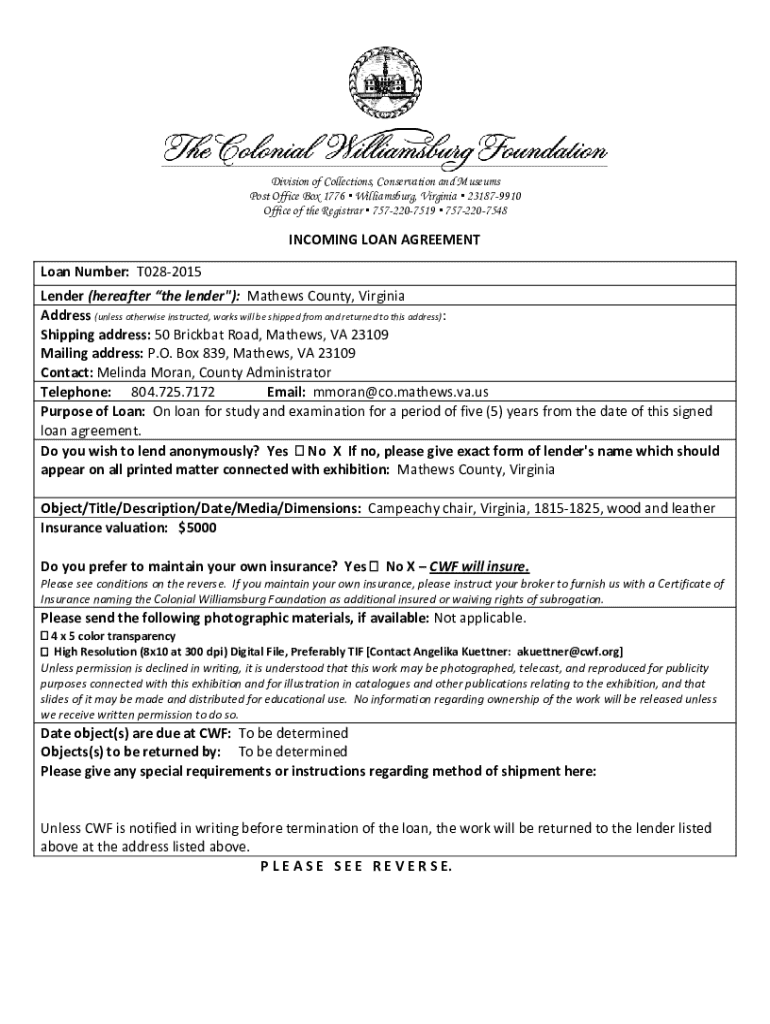

Agreement for the loan of an object for study and examination for a period of five years to the Colonial Williamsburg Foundation, outlining responsibilities, insurance, and conditions governing the loan.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign incoming loan agreement

Edit your incoming loan agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your incoming loan agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit incoming loan agreement online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit incoming loan agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out incoming loan agreement

How to fill out incoming loan agreement

01

Begin by reading the agreement carefully to understand the terms.

02

Fill in the date at the top of the document.

03

Provide the name and contact information of the borrower.

04

Include the lender's name and contact information.

05

Specify the loan amount being borrowed.

06

Detail the interest rate applicable to the loan.

07

Outline the repayment schedule (i.e., payment amounts and due dates).

08

Indicate any collateral required for the loan.

09

Include clauses regarding default and late payment penalties.

10

Ensure all parties sign and date the agreement at the end.

Who needs incoming loan agreement?

01

Individuals seeking financial assistance through loans.

02

Small business owners needing capital for operations.

03

Real estate buyers looking for mortgage funding.

04

Investors acquiring funds for projects or investments.

05

Anyone intending to formalize a loan arrangement between parties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find incoming loan agreement?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific incoming loan agreement and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit incoming loan agreement in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing incoming loan agreement and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out incoming loan agreement using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign incoming loan agreement and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is incoming loan agreement?

An incoming loan agreement is a legal document that outlines the terms and conditions under which a borrower receives funds from a lender, detailing the repayment terms, interest rates, and any obligations of both parties.

Who is required to file incoming loan agreement?

Typically, both the borrower and the lender are required to file the incoming loan agreement to ensure that the terms are legally recognized and enforceable.

How to fill out incoming loan agreement?

To fill out an incoming loan agreement, both parties need to provide their names and contact information, specify the loan amount, outline the repayment schedule and interest rates, and include any collateral or guarantees if applicable.

What is the purpose of incoming loan agreement?

The purpose of an incoming loan agreement is to protect the interests of both the borrower and the lender by clearly defining the terms of the loan, promoting transparency, and creating a legal framework for the repayment of the loan.

What information must be reported on incoming loan agreement?

The information that must be reported on an incoming loan agreement includes the names of the borrower and lender, loan amount, interest rates, repayment schedule, maturity date, any fees or penalties, and conditions for default.

Fill out your incoming loan agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Incoming Loan Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.