Get the free Business Loan Failure to Survive Application Form

Show details

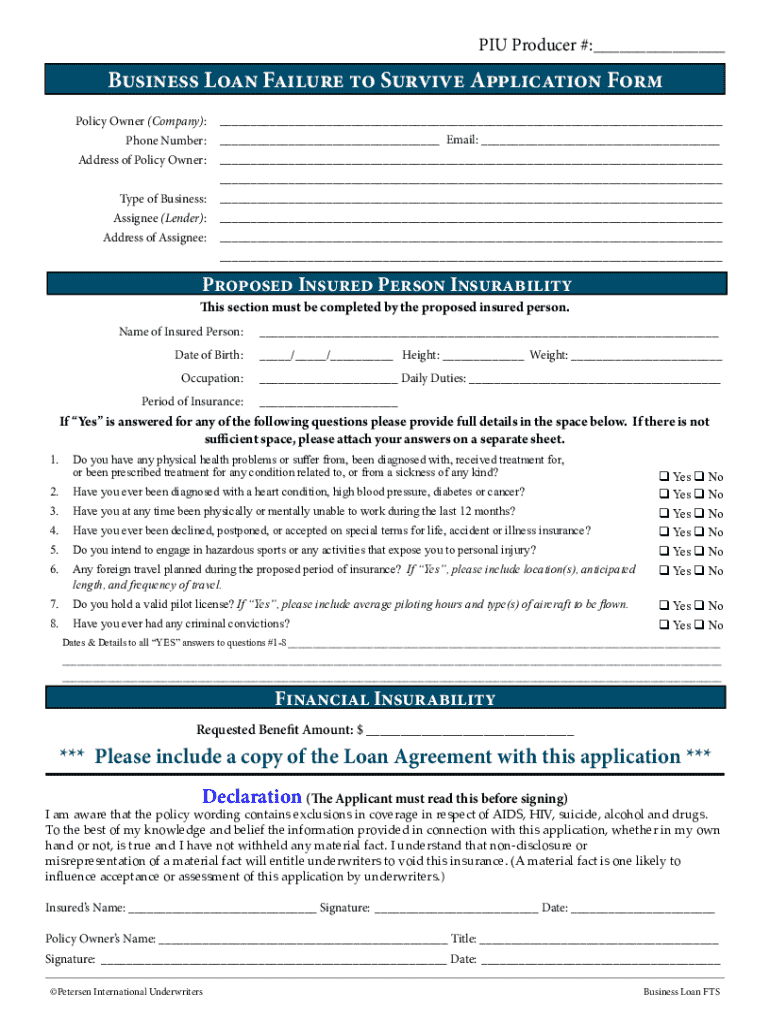

Este formulario se utiliza para solicitar un seguro de vida relacionado con un préstamo comercial, incluyendo detalles sobre la salud y la financiación del asegurado.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loan failure to

Edit your business loan failure to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loan failure to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business loan failure to online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business loan failure to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loan failure to

How to fill out business loan failure to

01

Determine the reason for the loan failure.

02

Gather all necessary documentation related to the business loan application.

03

Review and understand the lender's criteria for loan approval.

04

Identify areas of improvement in the business model or financials.

05

Consult with a financial advisor to discuss potential options.

06

Consider restructuring the loan application with clearer financial projections.

07

Submit the revised application with any additional documentation required.

08

Follow up with the lender for feedback and further instructions.

Who needs business loan failure to?

01

Entrepreneurs whose business loan applications have been denied.

02

Small business owners looking to understand reasons for loan rejection.

03

Individuals seeking to improve their chances of future loan applications.

04

Startups needing to address issues that led to loan failure.

05

Business owners wanting to restructure their finances for better outcomes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business loan failure to from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your business loan failure to into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the business loan failure to electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your business loan failure to in seconds.

How do I edit business loan failure to on an Android device?

The pdfFiller app for Android allows you to edit PDF files like business loan failure to. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is business loan failure to?

Business loan failure to refers to the inability of a business to meet its loan obligations, which can result in defaulting on the loan agreement.

Who is required to file business loan failure to?

Typically, the business owner or an authorized representative of the business is required to file for business loan failure to report any defaults or issues related to the loan.

How to fill out business loan failure to?

To fill out a business loan failure to, you should provide details such as the business name, loan amount, loan provider, reasons for failure, and any relevant financial statements or documentation supporting the claim.

What is the purpose of business loan failure to?

The purpose of business loan failure to is to formally document the default and communicate the reasons behind it to the lender, which may help in renegotiating terms or preventing further penalties.

What information must be reported on business loan failure to?

Information that must be reported includes the business's identification details, loan specifics, the nature of the default, outstanding balance, and any communication with creditors regarding the failure.

Fill out your business loan failure to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loan Failure To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.