Get the free Anti-tax Evasion Policy

Show details

Este documento establece la política de Transporte de Londres en relación con la evasión de impuestos, especificando un enfoque de tolerancia cero hacia todas las formas de evasión fiscal y detallando las responsabilidades de los empleados y asociados en el cumplimiento de esta política.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-tax evasion policy

Edit your anti-tax evasion policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-tax evasion policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing anti-tax evasion policy online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit anti-tax evasion policy. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-tax evasion policy

How to fill out anti-tax evasion policy

01

Begin with a clear introduction stating the purpose of the anti-tax evasion policy.

02

Define key terms related to tax evasion and compliance.

03

Outline the scope of the policy, specifying which departments and employees it applies to.

04

Detail the procedures for identifying potential tax evasion activities.

05

Describe the reporting mechanisms for suspicious behavior.

06

Specify training requirements for employees to understand tax compliance.

07

Establish consequences for violations of the policy.

08

Include a review and revision schedule to keep the policy up-to-date with legal requirements.

Who needs anti-tax evasion policy?

01

Businesses operating in jurisdictions with strict tax regulations.

02

Non-profit organizations that engage in financial activities.

03

Financial institutions that handle large transactions.

04

Companies with international operations and cross-border transactions.

05

Any entity subject to tax audits or scrutiny from tax authorities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in anti-tax evasion policy?

The editing procedure is simple with pdfFiller. Open your anti-tax evasion policy in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit anti-tax evasion policy in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your anti-tax evasion policy, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an eSignature for the anti-tax evasion policy in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your anti-tax evasion policy right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

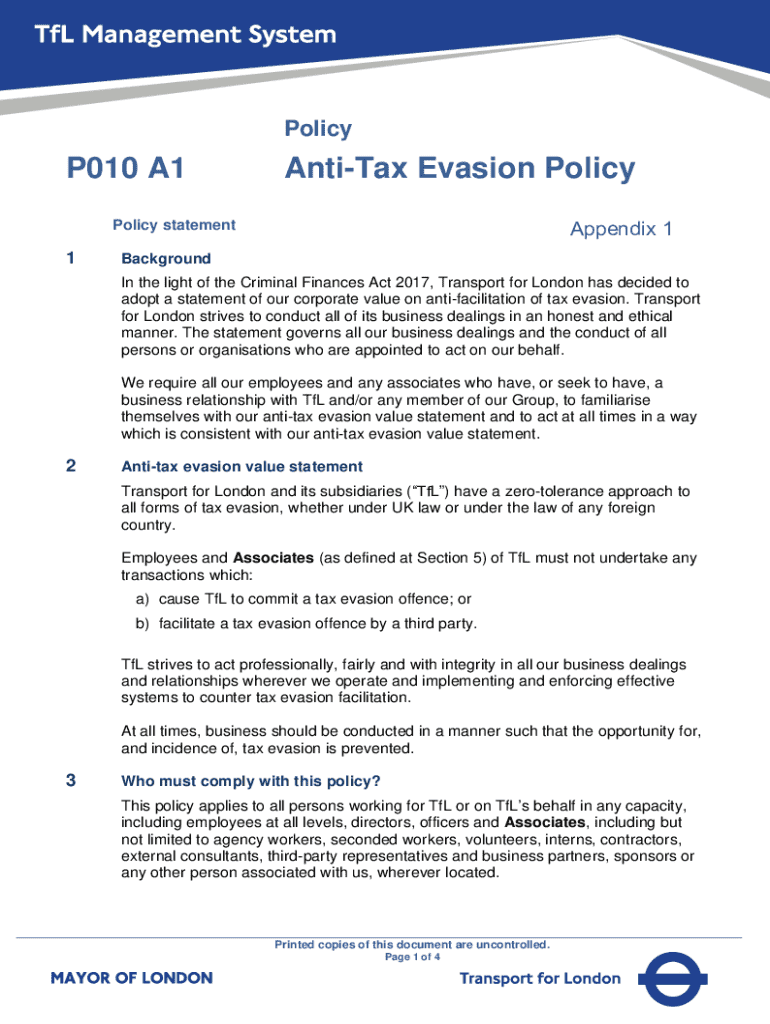

What is anti-tax evasion policy?

Anti-tax evasion policy refers to a set of rules and regulations put in place by governments to prevent individuals and corporations from illegally avoiding tax payments. These policies are designed to promote transparency and compliance with tax obligations.

Who is required to file anti-tax evasion policy?

Individuals, businesses, and financial institutions that engage in activities that may involve tax liabilities are typically required to comply with anti-tax evasion policies. This includes tax professionals and anyone engaged in transactions above a certain threshold.

How to fill out anti-tax evasion policy?

Filling out an anti-tax evasion policy usually involves detailing financial transactions, disclosing relevant income, and providing necessary documentation to verify tax obligations. Specific requirements may vary by jurisdiction.

What is the purpose of anti-tax evasion policy?

The purpose of anti-tax evasion policy is to deter individuals and entities from engaging in illegal tax avoidance practices, ensure fair tax collection, and maintain the integrity of the tax system for funding public services.

What information must be reported on anti-tax evasion policy?

Typically, the information that must be reported includes income sources, financial transactions, ownership of assets, and any other relevant financial data that helps tax authorities assess tax compliance.

Fill out your anti-tax evasion policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Tax Evasion Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.