Get the free ACCOUNTING PROCESS: RECTIFICATION OF ERRORS

Show details

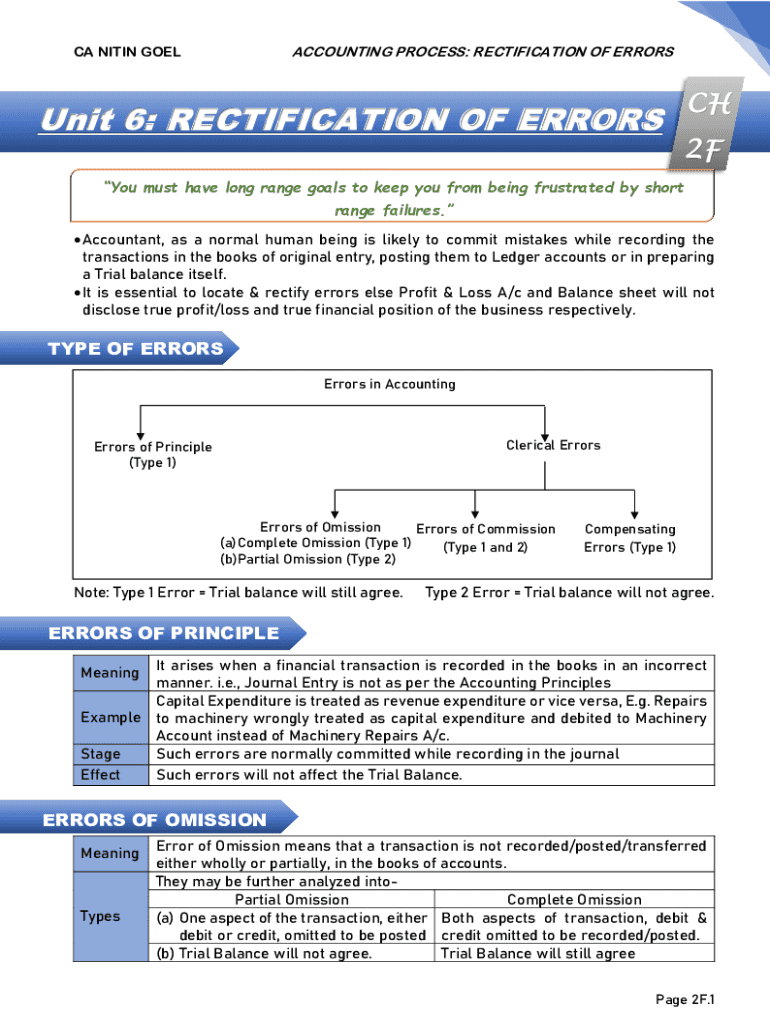

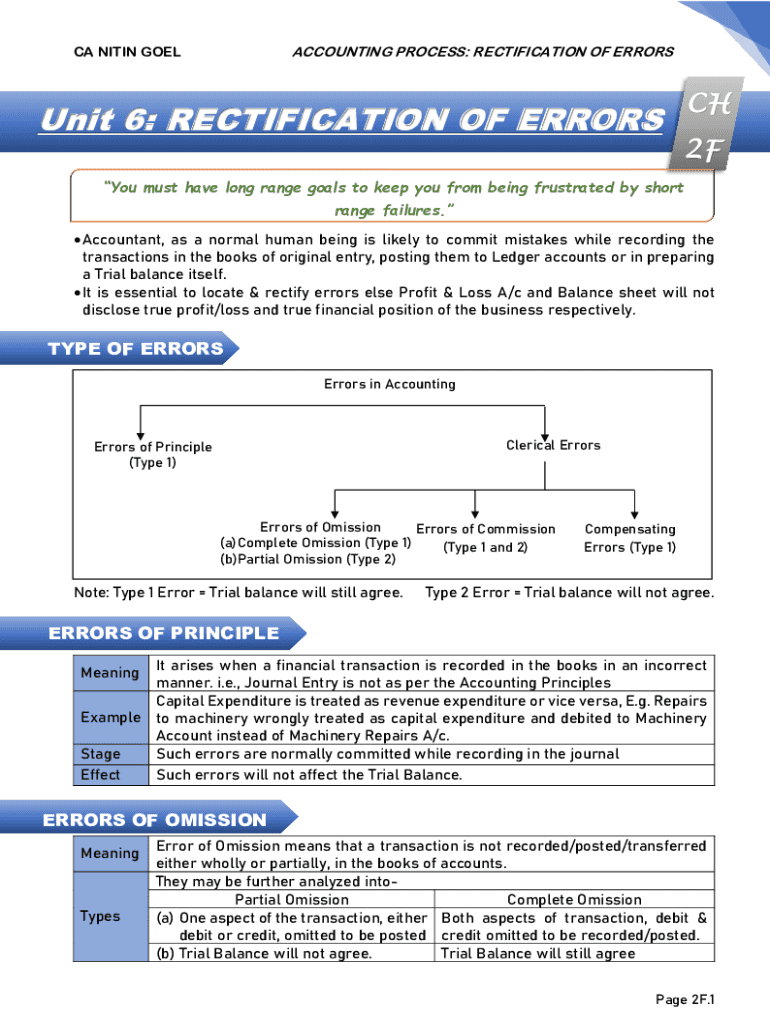

ACCOUNTING PROCESS: RECTIFICATION OF ERRORSCA NITIN GOELUnit 6: RECTIFICATION OF ERRORS PARTFYou must have long range goals to keep you from being frustrated by short range failures. Accountant, as a normal human being is likely to commit mistakes while recording the transactions in the books of original entry, posting them to Ledger accounts or in preparing a Trial balance itself. It is essential to locate & rectify errors else Profit & Loss A/c and Balance sheet will not disclose

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting process rectification of

Edit your accounting process rectification of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting process rectification of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounting process rectification of online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit accounting process rectification of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting process rectification of

How to fill out accounting process rectification of

01

Identify the errors in the accounting records that require rectification.

02

Gather necessary documentation and information to support the adjustments.

03

Determine the appropriate accounting entries needed to correct the errors.

04

Prepare journal entries that accurately reflect the corrections.

05

Update the accounting software or ledger to include the new entries.

06

Review the corrected financial statements for accuracy.

07

Document the rectification process for future reference and compliance.

Who needs accounting process rectification of?

01

Businesses with accounting discrepancies.

02

Accounting professionals responsible for financial reporting.

03

Auditors reviewing financial statements.

04

Organizations undergoing audits or compliance checks.

05

Any entity requiring accurate financial records for decision-making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit accounting process rectification of from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your accounting process rectification of into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send accounting process rectification of to be eSigned by others?

Once your accounting process rectification of is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out accounting process rectification of on an Android device?

On an Android device, use the pdfFiller mobile app to finish your accounting process rectification of. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is accounting process rectification of?

Accounting process rectification refers to the adjustment or correction of errors or discrepancies found in the accounting records or financial statements to ensure that they accurately reflect the financial position of an organization.

Who is required to file accounting process rectification of?

Individuals or entities who discover errors in their financial statements or accounting records, including businesses, accountants, and financial auditors, are required to file for accounting process rectification.

How to fill out accounting process rectification of?

To fill out an accounting process rectification, one must identify the errors, provide explanations for corrections, complete the necessary forms or documentation required by the governing authority, and submit supporting evidence to validate the corrections.

What is the purpose of accounting process rectification of?

The purpose of accounting process rectification is to correct inaccuracies, comply with regulatory requirements, maintain the integrity of financial reporting, and ensure that stakeholders receive reliable financial information.

What information must be reported on accounting process rectification of?

Information that must be reported includes the nature of the errors, the amount involved, the corrected figures, supporting documentation for the rectification, and an explanation of why the rectification is necessary.

Fill out your accounting process rectification of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Process Rectification Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.