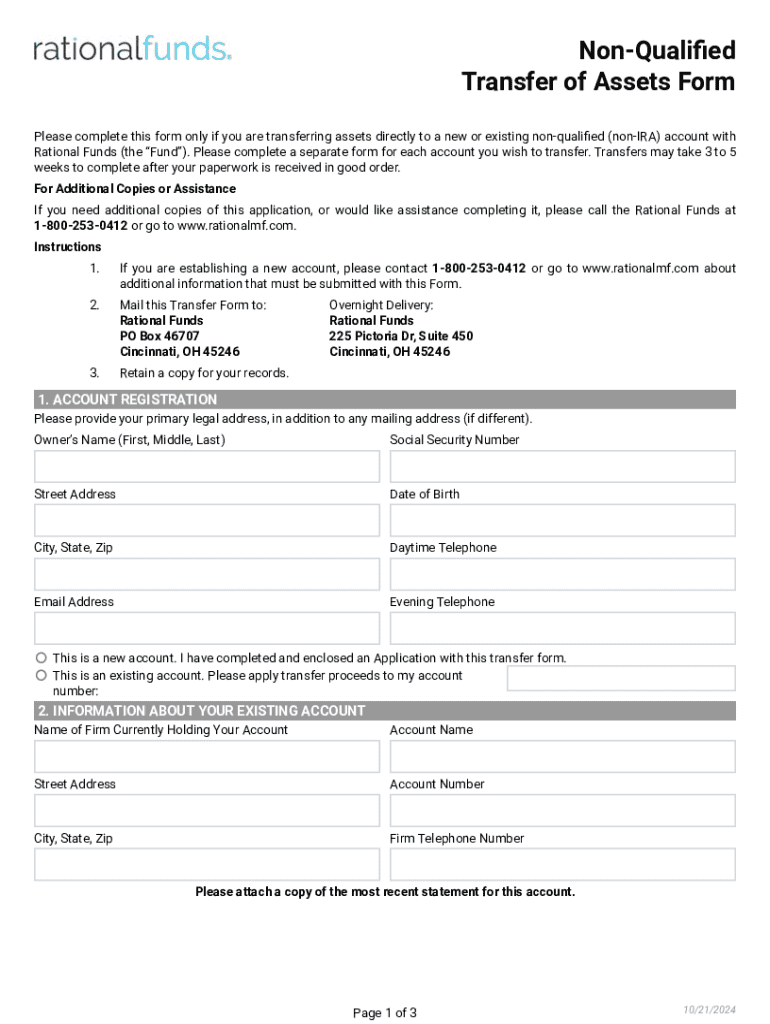

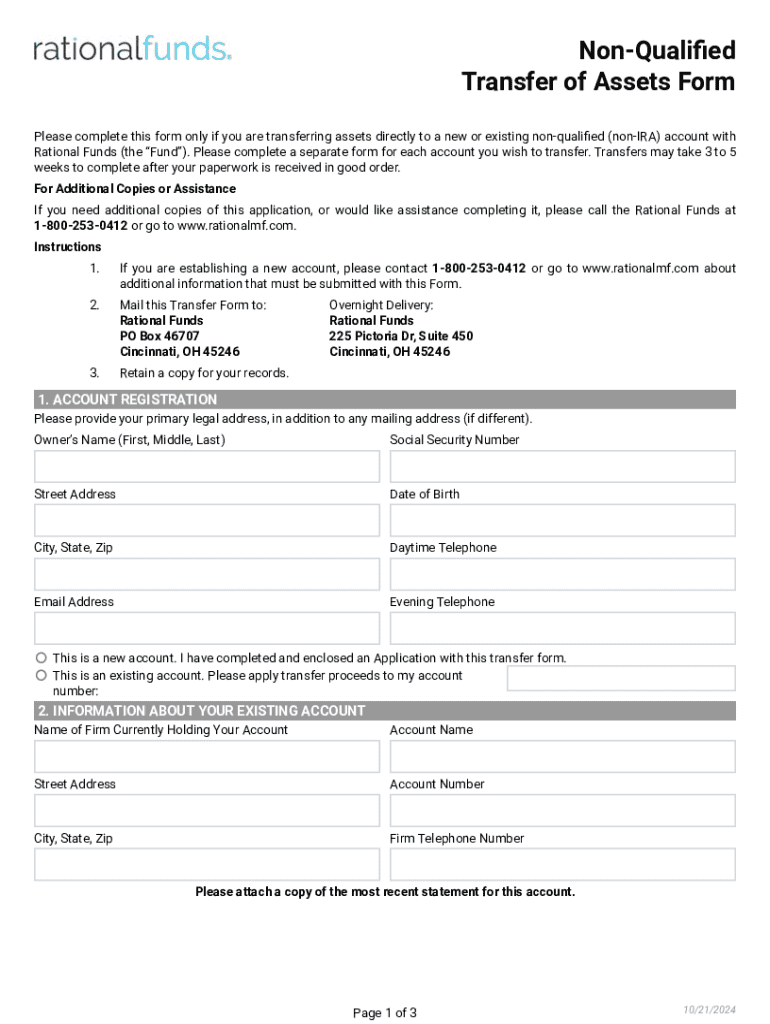

Get the free Non-qualified Transfer of Assets Form

Show details

Este formulario debe completarse solo si está transfiriendo activos directamente a una cuenta no calificada (no IRA) nueva o existente con Rational Funds. Complete un formulario separado para cada cuenta que desee transferir. Las transferencias pueden tardar de 3 a 5 semanas en completarse después de que se reciba su documentación en buen estado.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-qualified transfer of assets

Edit your non-qualified transfer of assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-qualified transfer of assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-qualified transfer of assets online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non-qualified transfer of assets. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-qualified transfer of assets

How to fill out non-qualified transfer of assets

01

Obtain the non-qualified transfer of assets form from the relevant institution or regulatory agency.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide details about the asset being transferred, including a description, value, and any relevant account numbers.

04

Indicate the recipient's information, including their name, address, and relationship to you.

05

Sign the form, verifying that all information provided is accurate and that you understand the implications of the transfer.

06

Submit the completed form to the institution or agency handling the transfer, either by mail or electronically, if allowed.

Who needs non-qualified transfer of assets?

01

Individuals transferring assets to family members or non-family entities.

02

Wealth managers or financial advisors assisting clients with asset transfers.

03

Trustees managing estate distributions that are not under a qualified plan.

04

Anyone looking to gift assets without the constraints of qualified plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non-qualified transfer of assets in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your non-qualified transfer of assets and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I fill out non-qualified transfer of assets on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your non-qualified transfer of assets, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit non-qualified transfer of assets on an Android device?

The pdfFiller app for Android allows you to edit PDF files like non-qualified transfer of assets. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is non-qualified transfer of assets?

A non-qualified transfer of assets refers to the transfer of assets that does not meet the requirements for qualified transfers under relevant tax laws, typically lacking certain formalities or exemptions that would otherwise allow for favorable tax treatment.

Who is required to file non-qualified transfer of assets?

Individuals or entities that engage in transferring assets that do not qualify for special tax treatments or exemptions are required to file non-qualified transfers. This includes taxpayers who have made such transfers for various purposes, including gifts or sales.

How to fill out non-qualified transfer of assets?

To fill out non-qualified transfer of assets, individuals must gather relevant information about the asset being transferred, the parties involved, and the nature of the transfer. They typically need to complete specific tax forms as per the IRS guidelines and include pertinent details such as fair market value and dates of transfer.

What is the purpose of non-qualified transfer of assets?

The purpose of non-qualified transfer of assets includes facilitating asset management, estate planning, or satisfying personal or business transactions that may not benefit from favorable tax treatment.

What information must be reported on non-qualified transfer of assets?

Information that must be reported on non-qualified transfer of assets includes the description of the asset, the fair market value at the time of transfer, the identity of the transferor and transferee, the date of the transfer, and the nature of the transaction (gift, sale, etc.).

Fill out your non-qualified transfer of assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Qualified Transfer Of Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.