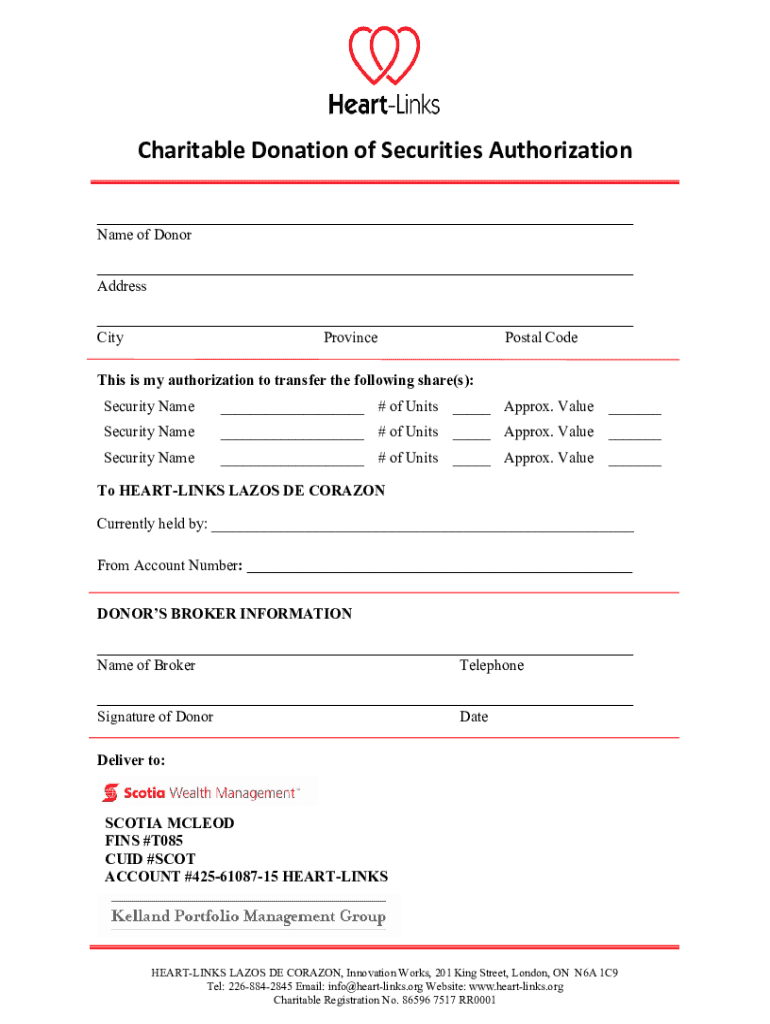

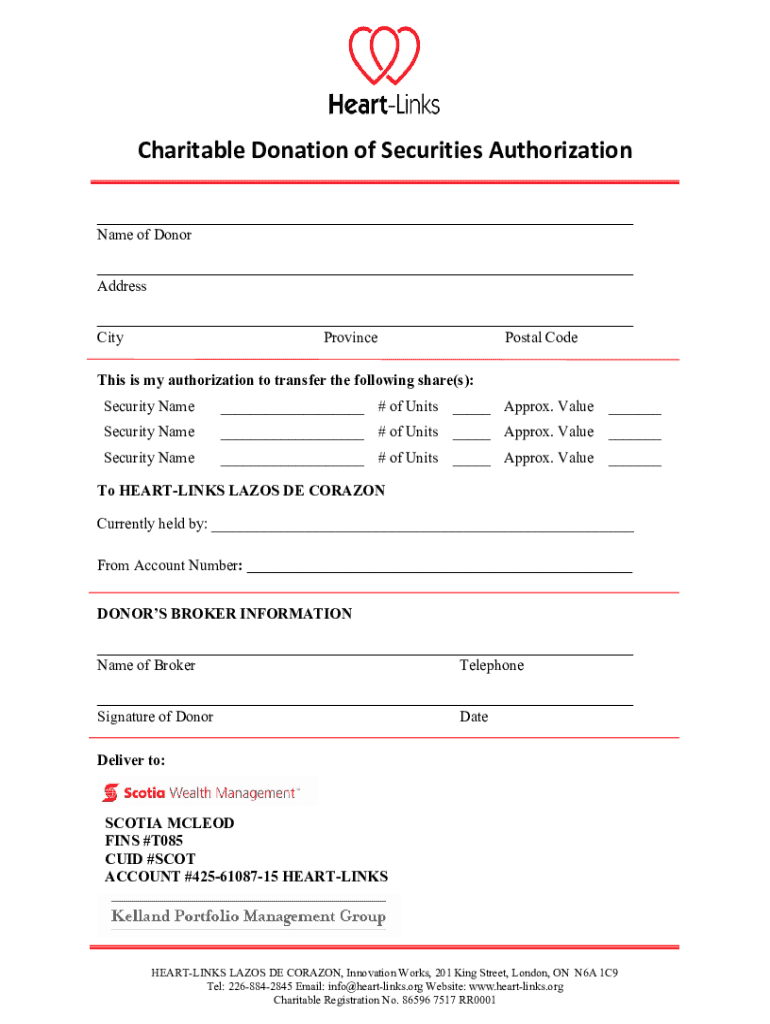

Get the free Charitable Donation of Securities Authorization

Show details

Este documento autoriza la transferencia de valores a una organización benéfica específica, incluyendo información del donante, valores a transferir, y detalles del corredor del donante.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable donation of securities

Edit your charitable donation of securities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable donation of securities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable donation of securities online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit charitable donation of securities. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable donation of securities

How to fill out charitable donation of securities

01

Determine the type of securities you wish to donate (stocks, bonds, mutual funds, etc.).

02

Consult your financial advisor or tax professional to understand the implications of your donation.

03

Choose a charity that is recognized as a 501(c)(3) organization to ensure tax-deductible contributions.

04

Review the charity's policies on accepting securities to ensure they accept donations of stocks or other securities.

05

Fill out the required forms provided by your brokerage firm to initiate the transfer of securities.

06

Obtain a valuation of the securities from your financial advisor or brokerage to establish their worth at the time of donation.

07

Instruct your broker to transfer the securities from your account to the charity’s brokerage account.

08

Keep records of the transaction and the donation receipt provided by the charity for tax purposes.

Who needs charitable donation of securities?

01

Individuals looking to support charitable organizations while maximizing their tax benefits.

02

Donors who own appreciated securities and want to avoid capital gains tax on the sale of those assets.

03

People wishing to contribute to a charity but prefer to donate securities rather than cash.

04

Nonprofit organizations that rely on donations of securities to fund their operations and programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find charitable donation of securities?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific charitable donation of securities and other forms. Find the template you need and change it using powerful tools.

How can I edit charitable donation of securities on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing charitable donation of securities, you need to install and log in to the app.

How can I fill out charitable donation of securities on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your charitable donation of securities. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is charitable donation of securities?

A charitable donation of securities refers to the act of donating stocks, bonds, or other financial instruments to a qualified charitable organization instead of cash. This allows the donor to potentially avoid capital gains taxes on appreciated assets and receive a tax deduction based on the fair market value of the securities.

Who is required to file charitable donation of securities?

Individuals or entities that donate securities valued at more than $500 must report the donation on their tax returns using IRS Form 8283. Additionally, charities receiving securities may need to provide their donors with acknowledgment receipts.

How to fill out charitable donation of securities?

To fill out a charitable donation of securities, complete IRS Form 8283 if the total deduction for the donated securities exceeds $500. Include details such as a description of the securities, the date of the donation, the fair market value, and obtain an appraisal if required for larger donations.

What is the purpose of charitable donation of securities?

The purpose of charitable donation of securities is to provide financial support to charities while allowing donors to leverage potential tax benefits. Donating appreciated assets helps charitable organizations raise funds while offering donors the opportunity to avoid capital gains taxes.

What information must be reported on charitable donation of securities?

Information that must be reported includes the name of the charity, date of donation, description of the securities, fair market value, and any required appraisals for securities valued over $5,000. Additionally, the donor’s signature and the recipient charity’s acknowledgment must be included.

Fill out your charitable donation of securities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Donation Of Securities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.