Get the free Wage Distribution Information for Partial Transfer of Compensation Experience

Show details

Este formulario se utiliza para la distribución de salarios en caso de transferencia parcial de experiencia de compensación, requiriendo datos de salarios de al menos cuatro años previos al año de adquisición.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wage distribution information for

Edit your wage distribution information for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wage distribution information for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wage distribution information for online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wage distribution information for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

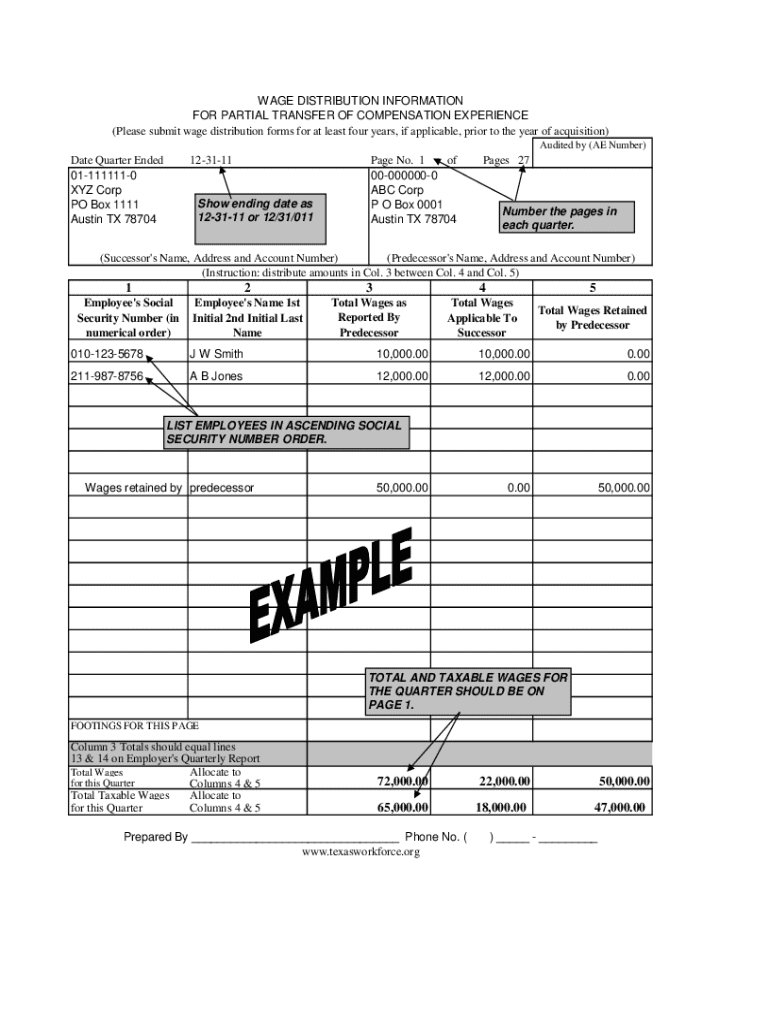

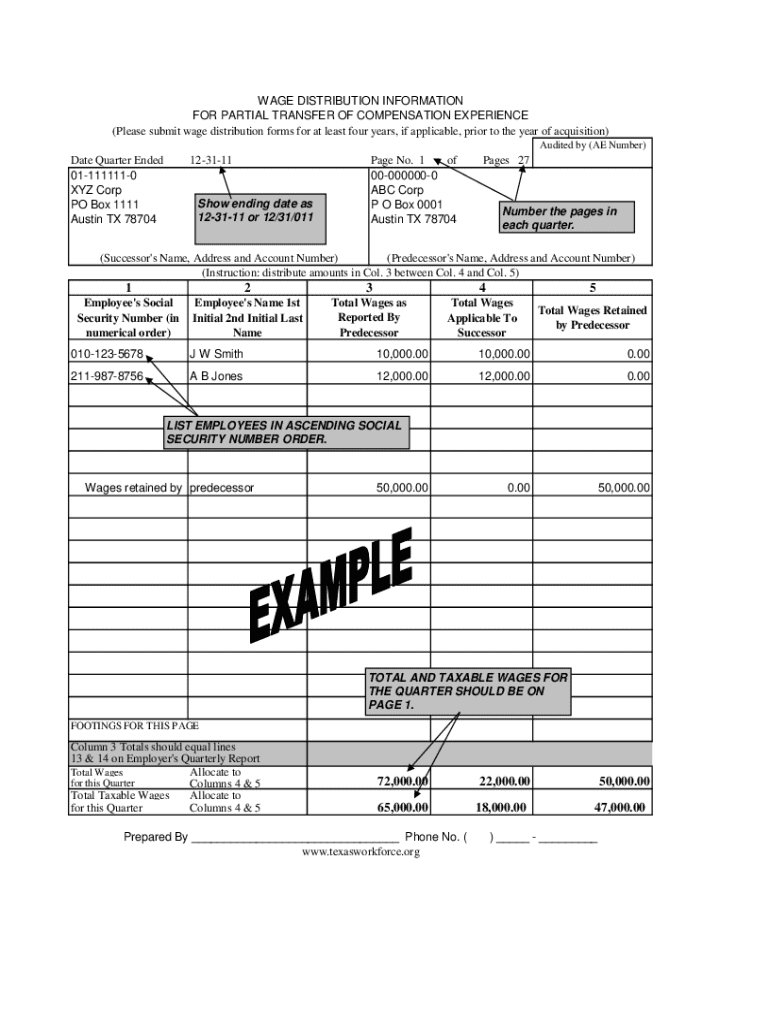

How to fill out wage distribution information for

How to fill out wage distribution information for

01

Gather all relevant payroll data for the employees.

02

Identify the various wage categories that need to be reported, such as base salary, bonuses, and overtime.

03

Organize the data by department or job function if necessary.

04

Fill out the wage distribution form starting with the employee’s name and their corresponding wage figures.

05

Ensure that all calculations are accurate and match the payroll records.

06

Double-check for any discrepancies or missing information before submitting.

Who needs wage distribution information for?

01

HR departments for compliance and reporting purposes.

02

Management for budget planning and salary negotiations.

03

Government agencies for tax and labor regulation compliance.

04

Employees to understand wage distribution within the organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete wage distribution information for online?

pdfFiller has made filling out and eSigning wage distribution information for easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit wage distribution information for on an iOS device?

Create, modify, and share wage distribution information for using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete wage distribution information for on an Android device?

Complete your wage distribution information for and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is wage distribution information for?

Wage distribution information is used to analyze and report the distribution of wages among employees within a company or across an industry. It helps in understanding pay equity and identifying disparities in compensation.

Who is required to file wage distribution information for?

Employers who meet certain criteria, such as having a specific number of employees or being subject to equal employment opportunity reporting requirements, are typically required to file wage distribution information.

How to fill out wage distribution information for?

To fill out wage distribution information, employers need to gather data on employee wages, categorize employees by demographic factors such as gender and race, and report this information according to the specified guidelines provided by the relevant authority.

What is the purpose of wage distribution information for?

The purpose of wage distribution information is to promote transparency in pay practices, ensure compliance with equal pay laws, and assist policymakers in monitoring wage equity and development of programs to address wage disparities.

What information must be reported on wage distribution information for?

The information that must be reported typically includes employee job categories, wage ranges, demographic information such as gender and race, and total employees within each category. Specific requirements may vary by jurisdiction.

Fill out your wage distribution information for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wage Distribution Information For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.