Get the free Ifta-100-mn

Show details

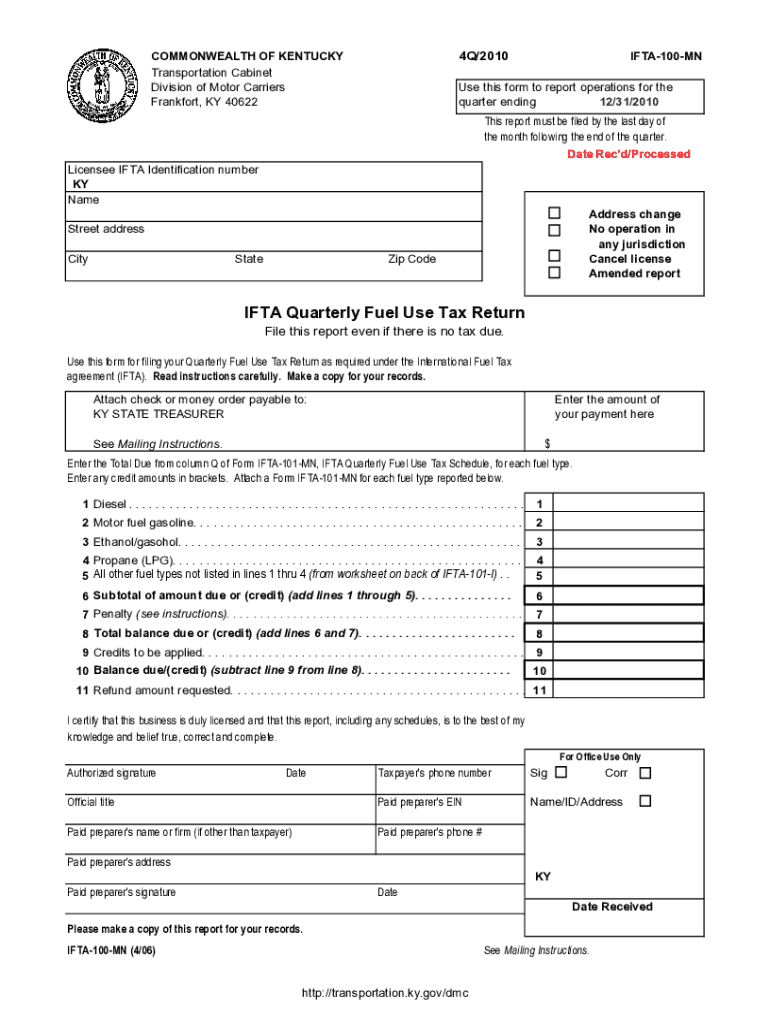

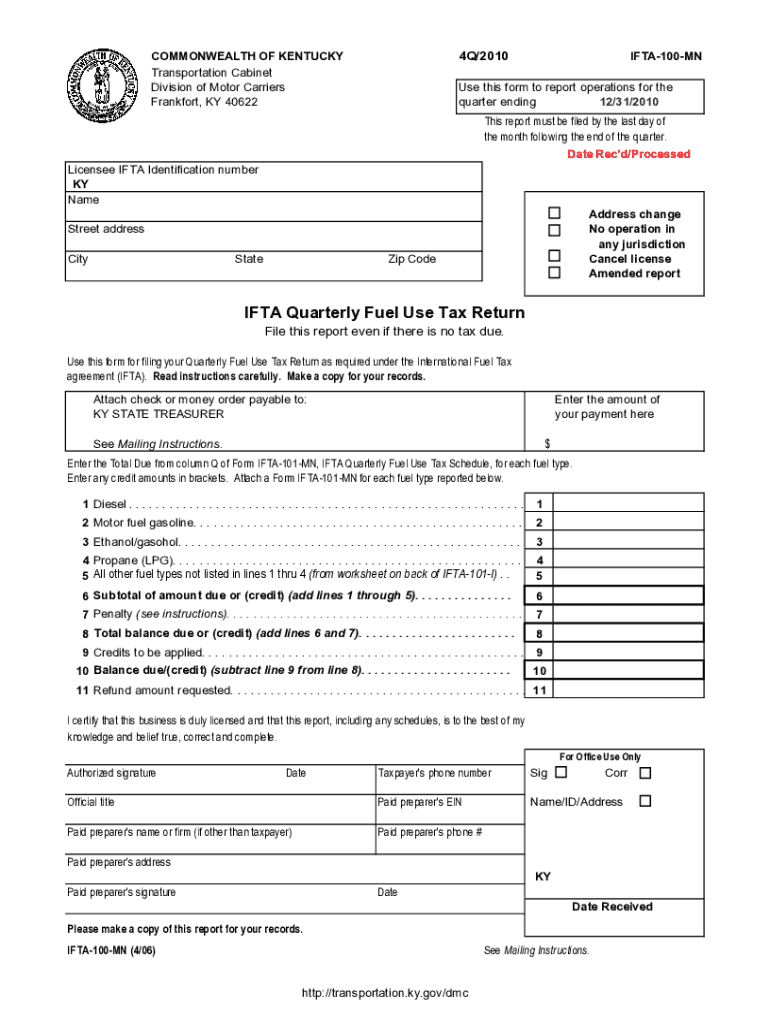

Utilisez ce formulaire pour déclarer les opérations pour le trimestre se terminant le 31/12/2010. Ce rapport doit être déposé d\'ici le dernier jour du mois suivant la fin du trimestre. Déposez ce rapport même s\'il n\'y a pas de taxes dues. Lisez attentivement les instructions et conservez une copie pour vos dossiers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ifta-100-mn

Edit your ifta-100-mn form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ifta-100-mn form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ifta-100-mn online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ifta-100-mn. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ifta-100-mn

How to fill out ifta-100-mn

01

Gather necessary information: Obtain your business details, vehicle information, and mileage records.

02

Start with the identification section: Fill in your name, address, and account number.

03

Report miles traveled: Enter the total miles driven in each jurisdiction (state or province).

04

Report taxable fuel: List the gallons of fuel purchased in each jurisdiction.

05

Calculate your total miles and gallons: Sum up all the data you've entered in the previous steps.

06

Complete the tax calculation section: Compute your tax liability based on the mileage and fuel data.

07

Sign and date the form: Certify the accuracy of your submitted information.

08

Submit the form: File the completed IFTA-100-MN with the appropriate state agency before the deadline.

Who needs ifta-100-mn?

01

Businesses and individuals operating qualified motor vehicles over a certain weight that travel across state or provincial lines in the U.S. and Canada.

02

Trucking companies that need to report their fuel usage and mileage in multiple jurisdictions for tax purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ifta-100-mn in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign ifta-100-mn and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in ifta-100-mn?

With pdfFiller, the editing process is straightforward. Open your ifta-100-mn in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete ifta-100-mn on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your ifta-100-mn. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is ifta-100-mn?

IFTA-100-MN is the International Fuel Tax Agreement (IFTA) quarterly fuel tax report used by motor carriers operating in Minnesota to report fuel usage and miles traveled in multiple jurisdictions.

Who is required to file ifta-100-mn?

Motor carriers who operate qualified vehicles in Minnesota and other jurisdictions that are part of the IFTA agreement are required to file the IFTA-100-MN report.

How to fill out ifta-100-mn?

To fill out the IFTA-100-MN, carriers must provide mileage and fuel consumption information for each jurisdiction traveled, calculate total miles and fuel usage, and report any taxes due or credits applicable.

What is the purpose of ifta-100-mn?

The purpose of IFTA-100-MN is to facilitate the collection and distribution of fuel taxes among jurisdictions for motor carriers operating across state lines.

What information must be reported on ifta-100-mn?

The IFTA-100-MN requires reporting of total miles traveled by jurisdiction, total gallons of fuel purchased, taxable miles, and any tax due or credits for overpayment.

Fill out your ifta-100-mn online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ifta-100-Mn is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.