Get the free LC 2810.5 Notice (Revised 11 2014)

Show details

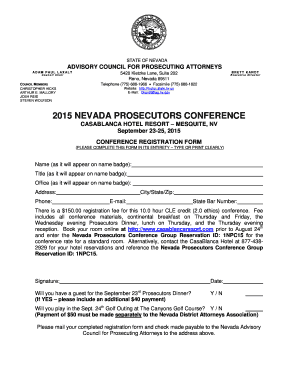

NOTICE TO EMPLOYEE Labor Code section 2810.5 EMPLOYEE Name: Start Date: EMPLOYER Legal Name of Hiring Employer: Is hiring employer a staffing agency/business (e.g., Temporary Services Agency; Employee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lc 28105 notice revised

Edit your lc 28105 notice revised form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lc 28105 notice revised form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lc 28105 notice revised online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lc 28105 notice revised. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

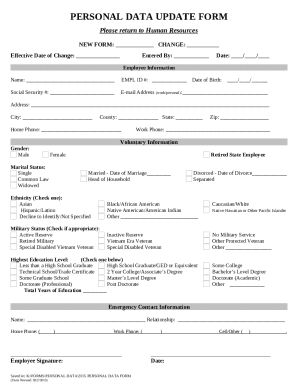

How to fill out lc 28105 notice revised

How to fill out lc 28105 notice revised:

01

Start by carefully reading the instructions provided on the notice. Make sure you understand the purpose and requirements of the form.

02

Gather all the necessary information and documents that are required to complete the form. This may include personal details, relevant dates, financial information, or any other specific information mentioned in the notice.

03

Fill out the form accurately and legibly. Double-check your entries to ensure they are correct and complete. Use a black pen or type the information if the notice allows for it.

04

If there are any sections or questions that you are uncertain about, seek clarification from the appropriate authority or consult any available resources. It is important to provide accurate and truthful information.

05

Once you have completed the form, review it one final time to make sure there are no errors or omissions. Sign and date the form as required.

06

Make copies of the completed form for your records, and submit the original to the designated recipient or authority mentioned in the notice.

Who needs lc 28105 notice revised:

01

Individuals who have received the lc 28105 notice revised from a specific organization or governmental entity.

02

Individuals who are required to provide updated or revised information based on the instructions outlined in the notice.

03

Anyone who has a legal or contractual obligation to complete and submit the lc 28105 notice revised as part of a specific process or procedure.

Fill

form

: Try Risk Free

People Also Ask about

What is the California Wage Theft Prevention Act?

What is the Wage Theft Prevention Act? California's Wage Theft Prevention Act of 2011 (WTPA) went into effect on January 1, 2012, and requires that all employers provide each non-exempt employee with a written notice containing specified information regarding their pay and other benefits.

Can employers change payday without notice?

Can a company alter its payday schedule? The Fair Labor Standards Act (FLSA) does not prohibit employers from changing paydays. But the law states that wages must be paid when due, which typically means the next regularly scheduled payday.

Is wage theft a crime in California?

The Labor Commissioner's Office inspects workplaces for wage and hour violations, adjudicates wage claims, and investigates retaliation complaints. Wage theft is a crime–the Labor Commissioner's Office can partner with other law enforcement agencies to criminally prosecute employers that engage in wage theft.

How is wage theft calculated?

Salaried workers who do not meet the requirements that would exclude them from the overtime provisions of the FLSA (or state overtime laws) are also victims of wage theft if their employers fail to pay them at 1.5 times their regular hourly rate for all hours worked beyond 40 in a single week.

How long does an employer have to correct a payroll when it is wrong California?

When it comes to a final paycheck, though, the employer should correct the underpayment immediately. If the employer makes you wait, it could face waiting time penalties – and those equal one full day's wages up to a maximum of 30 days.

What is a CA wage notice?

The notice is required under California's Wage Theft Protection Act of 2011. That law says that all private employers must give workers specific information about their employment.

Is it legal to decrease someone's pay in California?

In general, your employer can reduce your salary for any lawful reason. There is no specific California labor law that prohibits an employer from reducing an employee's compensation. However, your employer cannot reduce your salary to a rate below the minimum wage.

What is the most common form of wage theft?

The most blatant form of wage theft is for an employee to not be paid for work done. An employee being asked to work overtime, working through breaks, or being asked to report early and/or leave late without pay is being subjected to wage theft.

How far back can you claim unpaid wages in California?

You must file claims for violations of minimum wage, overtime, illegal deductions from pay or unpaid reimbursements within three years. You must file claims based on an oral promise to pay more than minimum wage within two years. You must file claims based on a written contract within four years.

What are the penalties for wage theft in California?

Misdemeanor grand theft carries: up to 364 days in county jail and/or $1,000 in fines to the court, and. restitution to you for the back wages you are owed.

Is wage theft illegal in California?

Wage theft in California occurs when employers intentionally fail to pay their employees or independent contractors. You can try recovering your back wages through the Labor Commissioner or by filing a lawsuit. Because wage theft is also a criminal offense in California, you can also report your employer to the police.

What is a CA 2810.5 form?

Wage and Employment Notice to Employees (Labor Code section 2810.5) Free. Provide this form to all nonexempt employees at the time of hire.

Can an employer take away your raise in California?

Some states, such as California, require a company to follow policies in an employee manual or handbook when rescinding raises. If your job provides a guarantee for 40 hours per week and a set rate of pay, you are entitled to that pay rate and can pursue a claim through the Department of Labor or civil court.

Can an employer change your pay without notice California?

The California Wage Theft Protection Act does require notice within seven days of making a change to a pay date or period, but it has no notice requirements prior to the change.

What is a 2810.5 form?

Labor Code section 2810.5(b) requires that the employer notify you in writing of any changes to the information set forth in this Notice within seven calendar days after the time of the changes, unless one of the following applies: (a) All changes are reflected on a timely wage statement furnished in accordance with

Can my employer change my pay structure California?

Whether you are an hourly or salaried employee in California, you are entitled to receive the agreed-upon, legal rate of pay for the work you've already done. Bosses have the discretion to reduce hourly pay and salary rates just as they can raise them.

Is wage theft a felony in California?

Rare criminal charges Most of California's wage theft cases aren't handled this way. Wage theft has been a federal crime for decades but in California, where felony cases are punishable by up to three years in jail, prosecutors across the state rarely filed criminal charges based solely on wage theft.

How much notice does an employer have to give for a schedule change in California?

Covered employers must provide employees with their schedules two weeks in advance, and if the schedule is changed within 7 days, to pay compensation of 1 to 4 hours depending on the amount of notice and length of the shift.

What is considered wage theft in California?

Wage theft occurs when employers do not pay workers according to the law. Examples of wage theft include paying less than minimum wage, not paying workers overtime, not allowing workers to take meal and rest breaks, requiring off-the-clock work, or taking workers' tips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get lc 28105 notice revised?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the lc 28105 notice revised in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the lc 28105 notice revised in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your lc 28105 notice revised and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit lc 28105 notice revised straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing lc 28105 notice revised right away.

What is lc 28105 notice revised?

LC 28105 notice revised is a form used to inform parties involved in a legal matter about specific rights, modifications, or requirements that have been updated.

Who is required to file lc 28105 notice revised?

Typically, parties involved in a legal process, such as employers or organizations that are undergoing changes that necessitate notifying affected individuals, are required to file the LC 28105 notice revised.

How to fill out lc 28105 notice revised?

To fill out the LC 28105 notice revised, individuals should provide accurate information regarding the legal matter, including details like the parties involved, nature of the notice, and any pertinent dates or modifications.

What is the purpose of lc 28105 notice revised?

The purpose of LC 28105 notice revised is to ensure transparency and compliance in legal matters by informing affected parties about changes that may impact their rights or obligations.

What information must be reported on lc 28105 notice revised?

The LC 28105 notice revised must report information such as the identifying details of the parties involved, a description of the change or notice, relevant dates, and any actions required by the recipients.

Fill out your lc 28105 notice revised online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lc 28105 Notice Revised is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.