Get the free Microsave India Focus Note 22

Show details

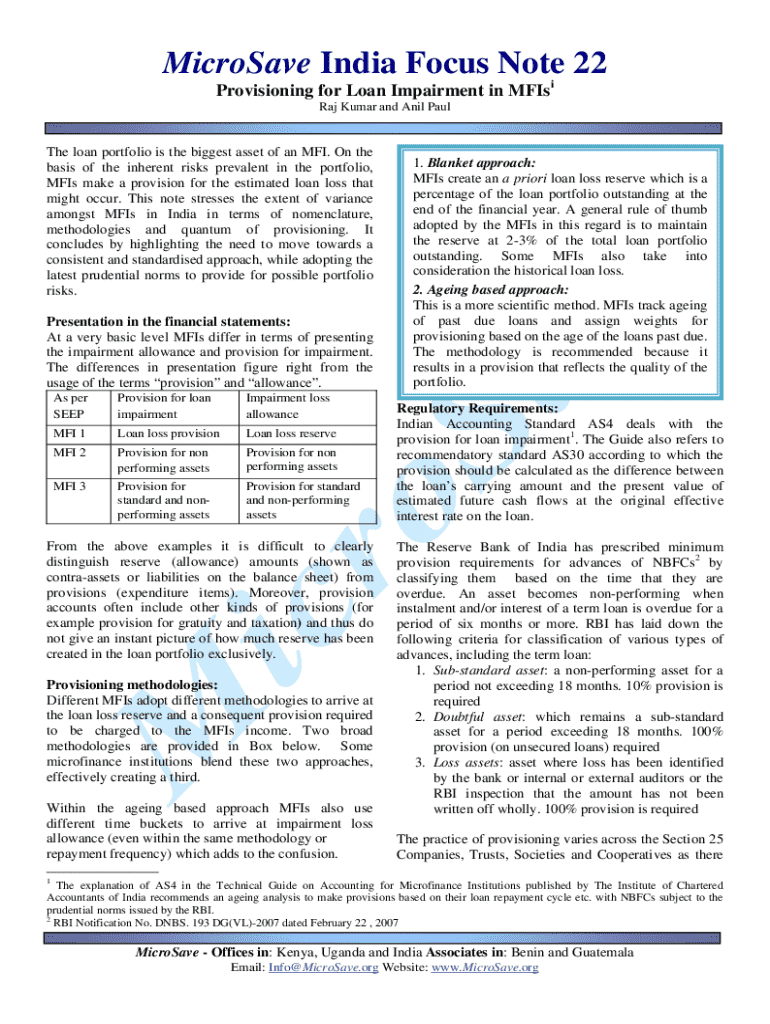

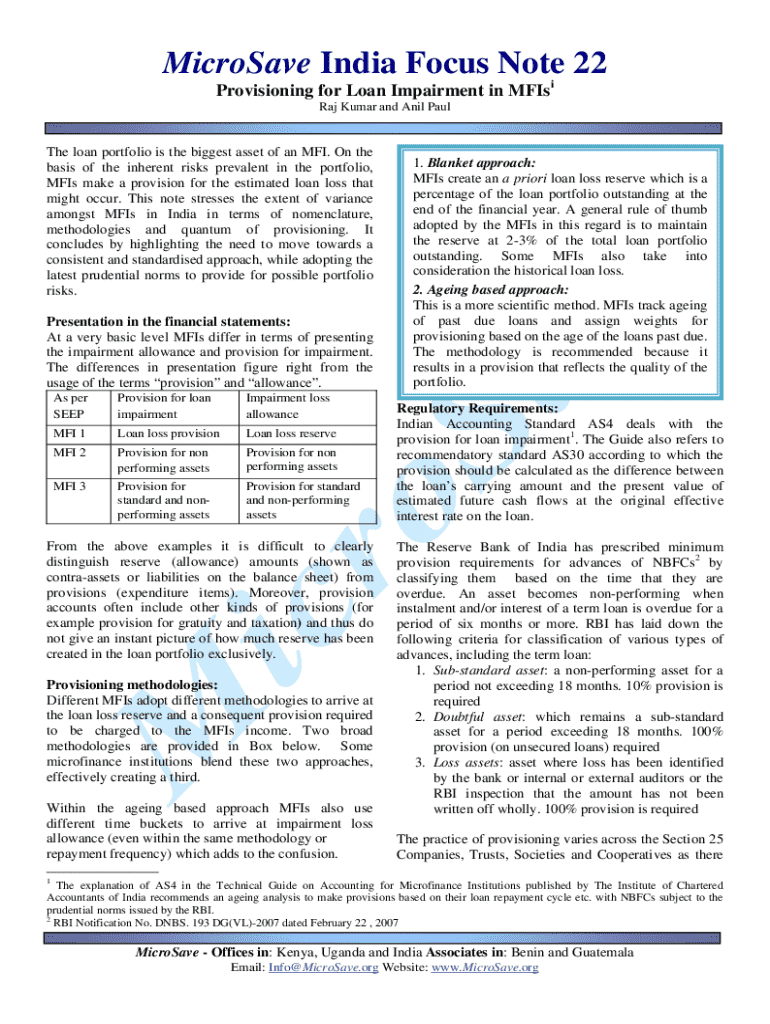

This note discusses the variation among Microfinance Institutions (MFIs) in India regarding methodologies and terminology for provisioning for loan impairment. It highlights the necessity for a standardized

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign microsave india focus note

Edit your microsave india focus note form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your microsave india focus note form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit microsave india focus note online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit microsave india focus note. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out microsave india focus note

How to fill out microsave india focus note

01

Start by opening the Microsave India focus note document.

02

Read the introduction carefully to understand the purpose of the focus note.

03

Identify the specific topic or area of interest that the focus note addresses.

04

Fill in your personal details, including name and contact information, in the designated section.

05

Review the guidelines provided for the content structure.

06

Input your data and insights point by point, using clear and concise language.

07

Ensure that all sections are thoroughly completed, including any necessary analysis or case studies.

08

Review your entries for accuracy and coherence.

09

Add any references or additional notes as required.

10

Save the document and submit it according to the provided instructions.

Who needs microsave india focus note?

01

Financial service providers seeking insights into market trends.

02

Policy makers looking to understand the financial landscape.

03

Researchers studying microfinance and related topics.

04

Students and academics interested in financial inclusion.

05

Non-governmental organizations focusing on economic development.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit microsave india focus note on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing microsave india focus note.

Can I edit microsave india focus note on an iOS device?

Create, modify, and share microsave india focus note using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out microsave india focus note on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your microsave india focus note. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is microsave india focus note?

MicroSave India Focus Note is a publication that provides insights and analysis on financial inclusion and microfinance in India, aimed at policymakers, practitioners, and researchers.

Who is required to file microsave india focus note?

Institutions and organizations involved in microfinance and financial inclusion efforts in India are typically required to file the MicroSave India Focus Note.

How to fill out microsave india focus note?

To fill out the MicroSave India Focus Note, organizations must collect relevant data, complete the prescribed template, and ensure that all required information is accurately reported and submitted on time.

What is the purpose of microsave india focus note?

The purpose of the MicroSave India Focus Note is to disseminate knowledge, promote best practices, and improve the effectiveness of financial inclusion initiatives in India.

What information must be reported on microsave india focus note?

The information that must be reported on the MicroSave India Focus Note includes financial performance metrics, outreach statistics, client demographics, and details about services offered.

Fill out your microsave india focus note online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Microsave India Focus Note is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.