Get the free Pit-rss

Show details

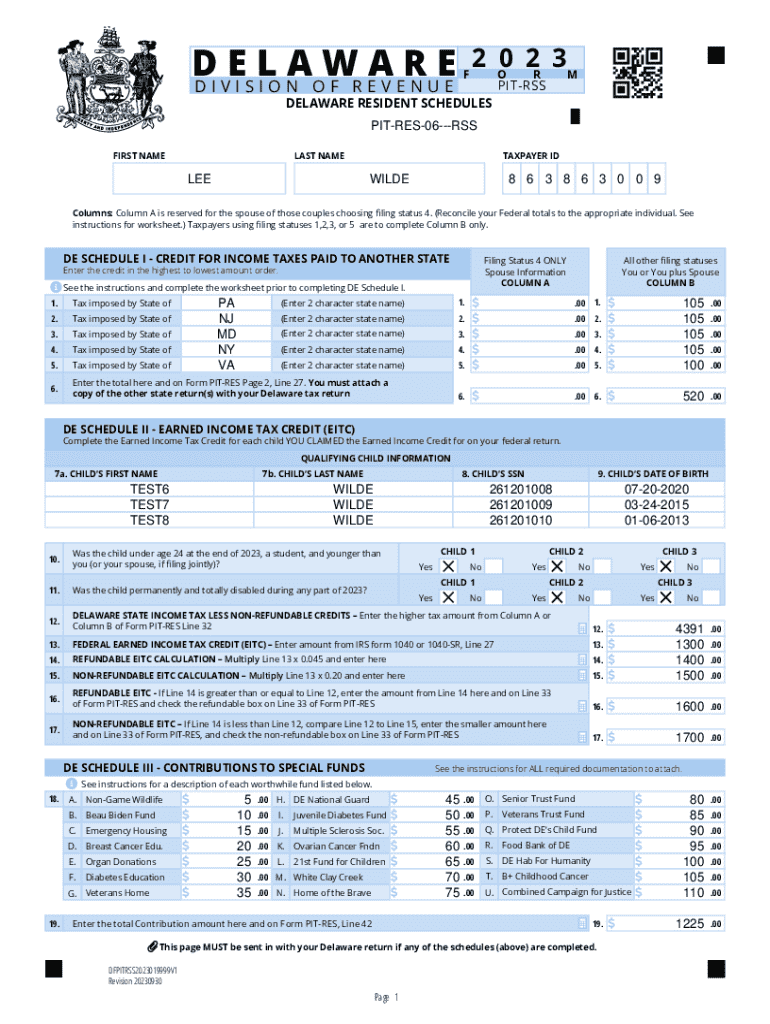

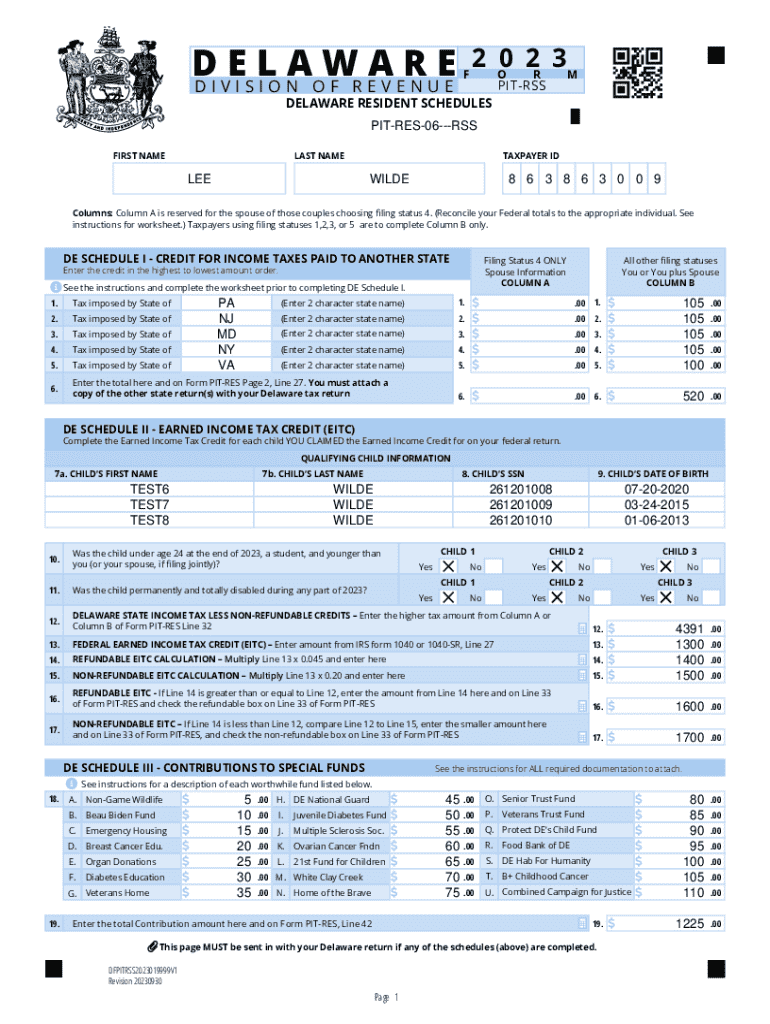

Este formulario es utilizado por los residentes de Delaware para reportar sus ingresos y calcular sus créditos fiscales. Incluye secciones para responder a información sobre el estado civil del contribuyente, créditos por impuestos pagados a otros estados, y detalles sobre el Crédito Fiscal por Ingreso Ganado. Es necesario adjuntar formulaciones relacionadas como W-2 y 1099-R.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pit-rss

Edit your pit-rss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pit-rss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pit-rss online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pit-rss. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pit-rss

How to fill out pit-rss

01

Gather all necessary information about the team and the project.

02

Log into the PIT-RSS system using your credentials.

03

Locate the 'Create New Report' section.

04

Fill in the project title and description in the designated fields.

05

Input the team members involved in the project in the members section.

06

Specify the start and end dates of the project.

07

Add relevant metrics and performance indicators.

08

Review the information for accuracy.

09

Click 'Submit' to finalize the entry.

Who needs pit-rss?

01

Project Managers who oversee project execution.

02

Team Members who are directly involved in project tasks.

03

Stakeholders who require updates on project progress.

04

Executives who need insights for strategic decision-making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the pit-rss in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your pit-rss and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the pit-rss form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign pit-rss and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit pit-rss on an iOS device?

Create, edit, and share pit-rss from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is pit-rss?

PIT-RSS refers to the Personal Income Tax - Reconciliation Statement submitted by individuals or entities to report their income and taxes for a specific fiscal year.

Who is required to file pit-rss?

Individuals and businesses that have earned income during the tax year and are subject to personal income tax obligations are required to file PIT-RSS.

How to fill out pit-rss?

To fill out PIT-RSS, individuals must gather their income information, complete the required forms accurately, ensure all necessary documentation is attached, and submit the form by the designated deadline.

What is the purpose of pit-rss?

The purpose of PIT-RSS is to provide a comprehensive account of an individual's or entity's income and tax obligations, ensuring compliance with tax laws and facilitating accurate tax assessments.

What information must be reported on pit-rss?

The information that must be reported on PIT-RSS includes total income earned, applicable deductions, tax credits claimed, and the total taxes owed or refund due.

Fill out your pit-rss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pit-Rss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.