Get the free Wolfsberg Group Correspondent Banking Due Diligence Questionnaire (cbddq) V1.4

Show details

Este questionário é exigido para ser respondido em nível de entidade legal (LE), abordando os processos de diligência devida no setor bancário correspondente, visando o cumprimento das normas

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wolfsberg group correspondent banking

Edit your wolfsberg group correspondent banking form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wolfsberg group correspondent banking form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wolfsberg group correspondent banking online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit wolfsberg group correspondent banking. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wolfsberg group correspondent banking

How to fill out wolfsberg group correspondent banking

01

Gather necessary documentation: Collect all required documents related to your banking activities.

02

Identify your correspondent banking relationships: Clearly define each relationship you have with other banks.

03

Fill out the risk assessment: Assess the risk levels for each correspondent bank based on factors such as jurisdiction, clientele, and products offered.

04

Complete the entity information: Provide detailed information about the banks involved, including their ownership structures and relevant regulatory details.

05

Evaluate AML/CFT controls: Review and document the anti-money laundering (AML) and counter-financing of terrorism (CFT) controls of the correspondent banks.

06

Verify compliance: Ensure all information is accurate and compliant with Wolfsberg Group recommendations.

07

Submit the documentation: Send the completed forms to the appropriate regulatory bodies or use them for internal assessments.

Who needs wolfsberg group correspondent banking?

01

Financial institutions engaged in cross-border transactions.

02

Banks seeking to establish correspondent banking relationships.

03

Compliance officers ensuring adherence to AML/CFT regulations.

04

Regulators monitoring banking activities for risk assessment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit wolfsberg group correspondent banking from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including wolfsberg group correspondent banking. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete wolfsberg group correspondent banking online?

pdfFiller makes it easy to finish and sign wolfsberg group correspondent banking online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I edit wolfsberg group correspondent banking on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing wolfsberg group correspondent banking, you can start right away.

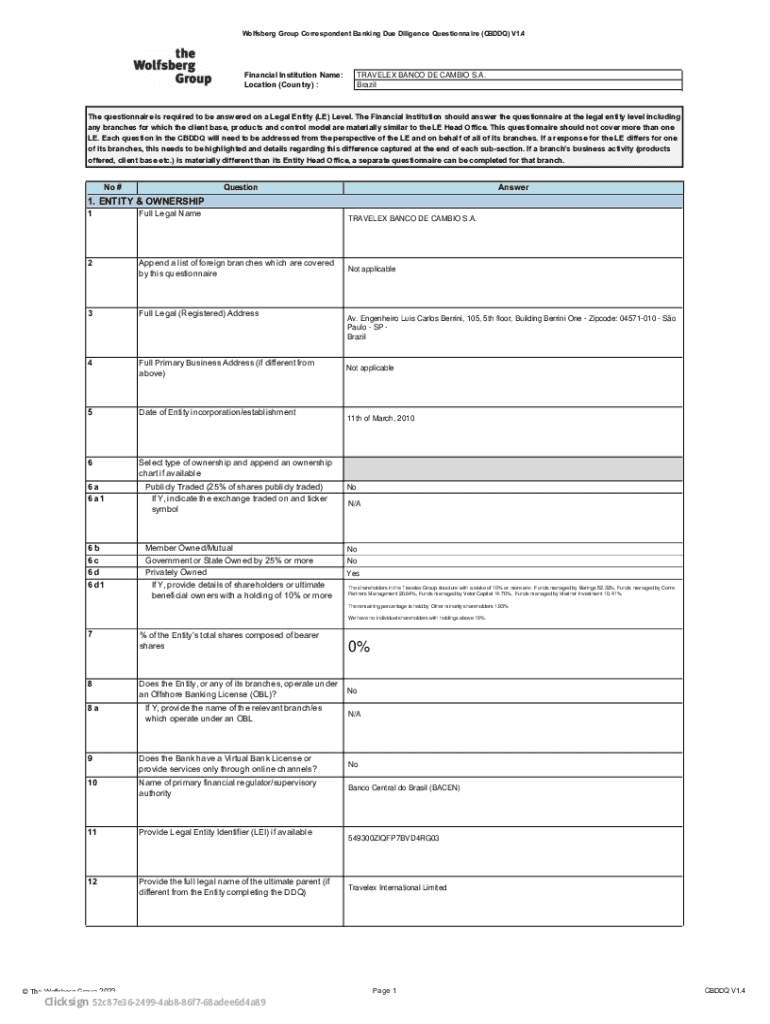

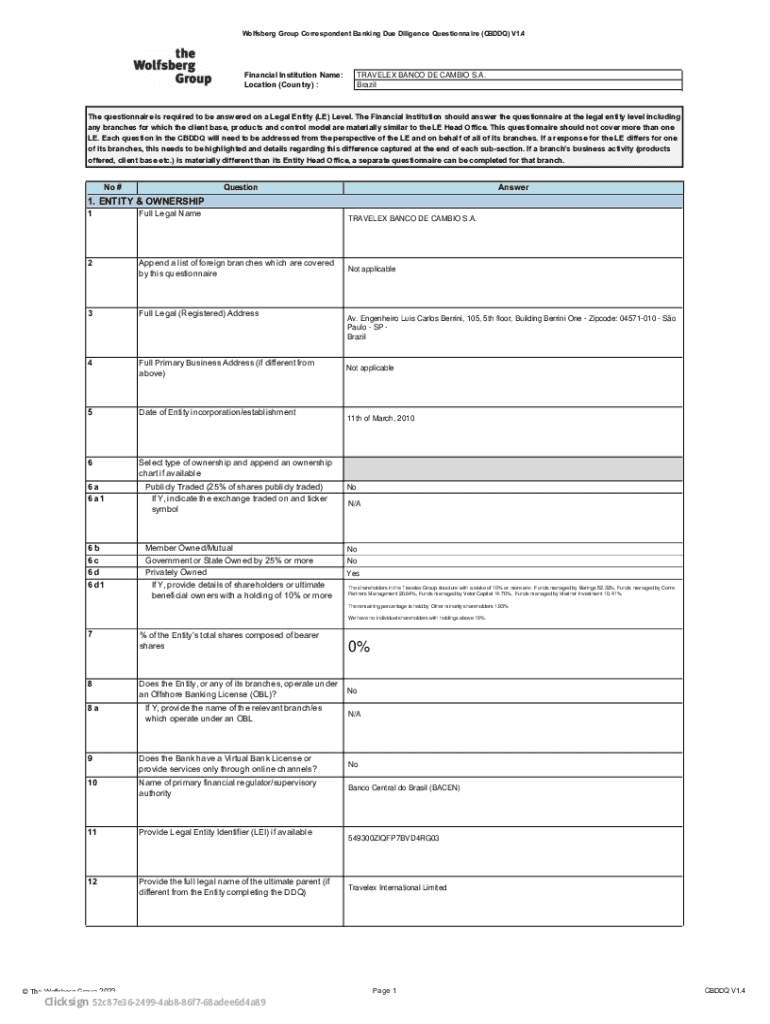

What is wolfsberg group correspondent banking?

The Wolfsberg Group Correspondent Banking is a set of guidelines and best practices aimed at enhancing the risk management framework for banks engaged in correspondent banking relationships. It provides a framework to help institutions mitigate and manage risks related to money laundering and terrorist financing.

Who is required to file wolfsberg group correspondent banking?

Banks and financial institutions that engage in correspondent banking relationships are required to file and adhere to the principles established by the Wolfsberg Group in order to ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

How to fill out wolfsberg group correspondent banking?

Filling out the Wolfsberg Group Correspondent Banking questionnaire involves providing detailed information on the bank's KYC (Know Your Customer) policies, customer due diligence practices, and the nature of the correspondent banking relationship, as well as disclosing ownership and control structures.

What is the purpose of wolfsberg group correspondent banking?

The purpose of the Wolfsberg Group Correspondent Banking guidelines is to promote a standardized approach to risk management in correspondent banking, enhance transparency, and prevent illicit financial activities through established best practices.

What information must be reported on wolfsberg group correspondent banking?

Information to be reported includes details about the financial institution, KYC policies, the nature of financial services provided, the jurisdictions involved, and other pertinent risk factors that may impact the correspondent banking relationship.

Fill out your wolfsberg group correspondent banking online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wolfsberg Group Correspondent Banking is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.