Get the free Compliance with KYC Guidelines - Public Notice

Show details

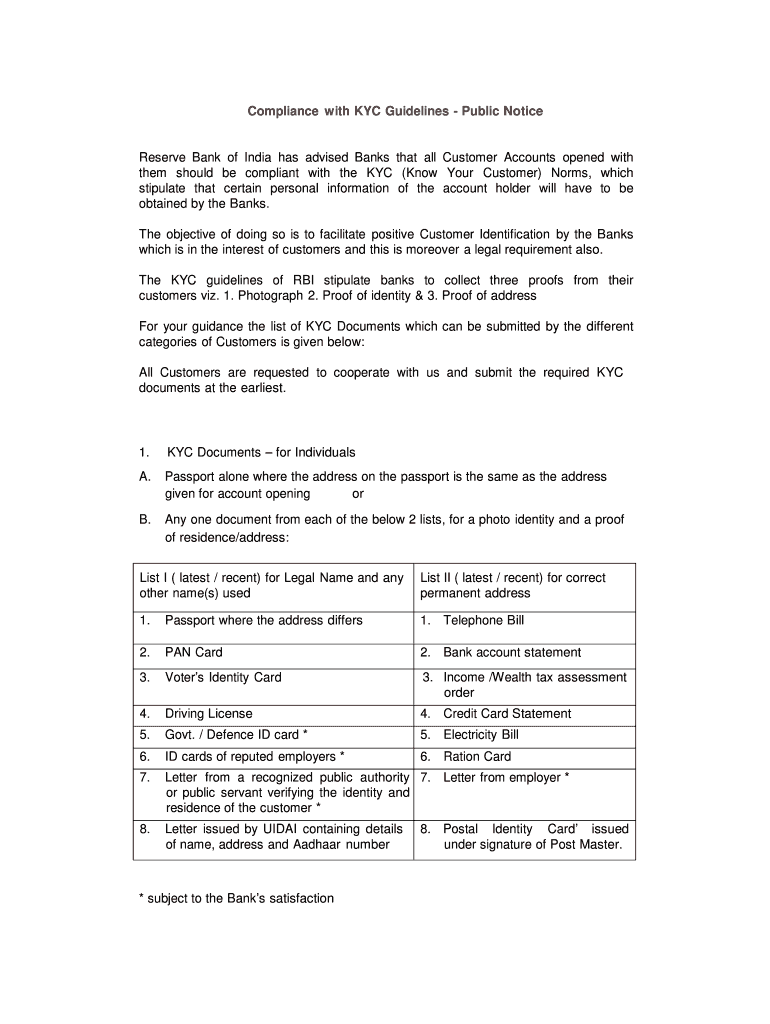

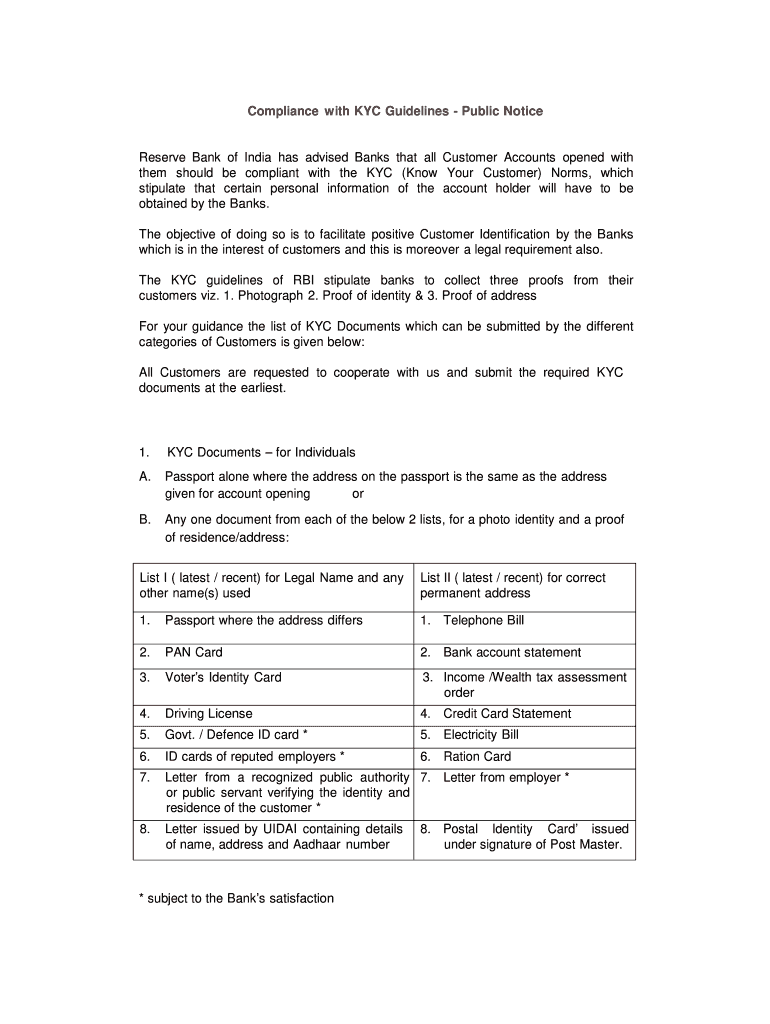

Compliance with KYC Guidelines Public NoticeReserve Bank of India has advised Banks that all Customer Accounts opened with

them should be compliant with the KYC (Know Your Customer) Norms, which

stipulate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign compliance with kyc guidelines

Edit your compliance with kyc guidelines form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your compliance with kyc guidelines form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing compliance with kyc guidelines online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit compliance with kyc guidelines. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out compliance with kyc guidelines

How to fill out compliance with KYC guidelines?

01

Identify the purpose of the KYC guidelines: Understand why these guidelines exist and what their purpose is. KYC stands for "Know Your Customer," and the main goal is to prevent money laundering, fraud, and other illicit activities.

02

Collect customer information: Begin by gathering all necessary information about the customer, including their full name, address, date of birth, and contact details. This data will be used to create the customer profile.

03

Verify customer identity: Ensure that the customer's identity is valid and accurate. This can be done by requesting and verifying official documents such as a passport, driver's license, or national identification card. Some organizations may use technology solutions to perform identity verification, such as facial recognition or document scanning.

04

Assess the customer's risk level: Evaluate the risk associated with the customer and their potential activities. This could involve assessing factors such as the customer's country of residence, occupation, or financial behavior. Different customers may pose different levels of risk, and it is essential to categorize them accordingly.

05

Conduct ongoing monitoring: KYC compliance is not a one-time process. Regularly monitor customer activities and promptly report any suspicious or unusual behavior. This could include monitoring transactions, reviewing account activity, and maintaining contact with the customer to gather updated information.

Who needs compliance with KYC guidelines?

01

Financial institutions: Banks, credit unions, insurance companies, and other financial institutions are typically required to comply with KYC guidelines. This ensures that they are well-informed about their customers and can prevent financial crimes within their operations.

02

Money service businesses: Money transfer operators, currency exchanges, and other money service businesses must also comply with KYC guidelines. Due to the nature of their services, these businesses often deal with large amounts of money and are at risk of being targets for money laundering or terrorist financing.

03

Cryptocurrency exchanges: With the rise of cryptocurrencies, KYC compliance has become increasingly important in the digital asset space. Cryptocurrency exchanges are now required to follow KYC regulations to mitigate the risks of fraud and money laundering.

04

Online payment processors: Companies providing online payment services such as PayPal, Stripe, or Square are subject to KYC guidelines. As they facilitate financial transactions on behalf of customers, verifying user identities and monitoring transactions is crucial to prevent illegal activities.

05

Non-profit organizations: Although not commonly associated with financial activities, non-profit organizations engaged in money transfers, fundraising, or charitable work may need to comply with KYC regulations. This helps ensure transparency, avoid misuse of funds, and prevent funding of illegal activities.

Overall, compliance with KYC guidelines is essential for organizations and industries involved in financial transactions, as it helps maintain integrity, safeguard against financial crimes, and protect both businesses and customers alike.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is compliance with kyc guidelines?

Compliance with KYC guidelines refers to following the regulations and procedures set forth to verify the identity of customers.

Who is required to file compliance with kyc guidelines?

Financial institutions and businesses that deal with financial transactions are required to file compliance with KYC guidelines.

How to fill out compliance with kyc guidelines?

Compliance with KYC guidelines can be filled out by collecting necessary information and documentation from customers to verify their identity.

What is the purpose of compliance with kyc guidelines?

The purpose of compliance with KYC guidelines is to prevent money laundering, terrorist financing, and other illegal activities.

What information must be reported on compliance with kyc guidelines?

Personal information such as name, address, date of birth, and identification documents must be reported on compliance with KYC guidelines.

How can I send compliance with kyc guidelines for eSignature?

Once your compliance with kyc guidelines is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find compliance with kyc guidelines?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the compliance with kyc guidelines in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for signing my compliance with kyc guidelines in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your compliance with kyc guidelines and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your compliance with kyc guidelines online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Compliance With Kyc Guidelines is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.