Get the free fE-&,

Show details

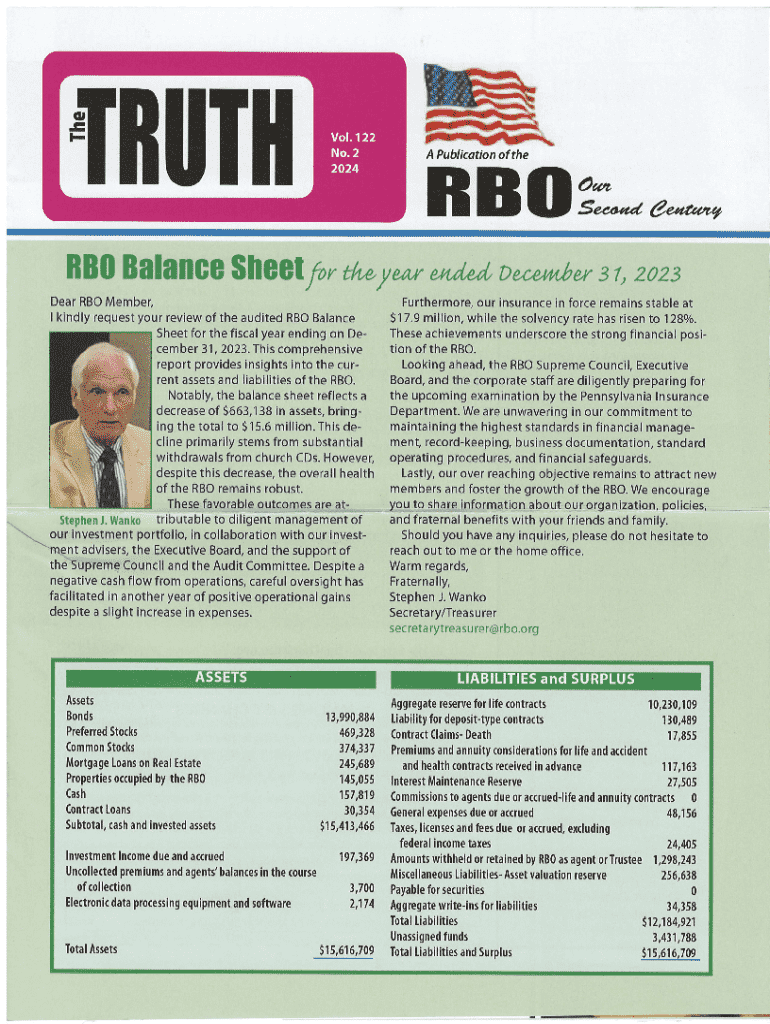

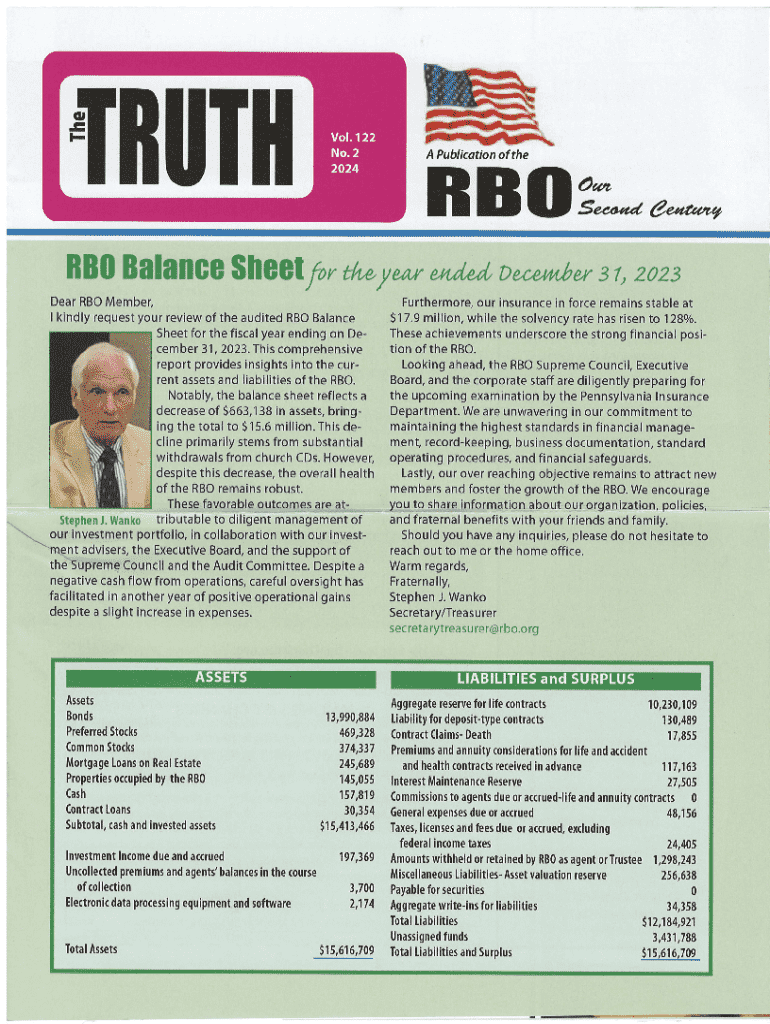

H fE&, lrrFl ffiYoL122 No.2 2024A Publication of theRBOOqnSeii4d, O\"*rt*rr4RBO BalanGG ShGGt for tlwyear endti, De/a44,bex st, 202s Dear RBO Membel Ikindly request your review of the audited RBO

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fe

Edit your fe form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fe form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fe online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fe. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fe

How to fill out fe

01

Obtain the form: Download or request the official form from the relevant authority.

02

Read the instructions: Carefully review any guidelines provided with the form.

03

Fill in personal details: Enter your full name, address, and any other required personal information.

04

Provide necessary information: Complete sections related to your situation, ensuring accuracy.

05

Attach supporting documents: Gather and attach any required documents that support your application.

06

Review your form: Check for any errors or missing information before submission.

07

Submit the form: Send the completed form and attachments to the specified address or submit online if available.

Who needs fe?

01

Individuals applying for financial assistance.

02

Students seeking grants or scholarships.

03

People applying for loans or mortgages.

04

Anyone needing to submit a formal request for funding.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fe?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific fe and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit fe on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign fe on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit fe on an Android device?

You can make any changes to PDF files, like fe, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is fe?

Fe refers to Federal Form 706, which is used to report the estate of a deceased person for federal tax purposes.

Who is required to file fe?

The personal representative of an estate is required to file Form 706 if the gross estate exceeds the federal estate tax exemption amount, which is adjusted periodically.

How to fill out fe?

Form 706 must be completed with details about the decedent's assets, liabilities, and any deductions. It can be filled out using tax software or by following the forms and instructions provided by the IRS.

What is the purpose of fe?

The purpose of Form 706 is to calculate and report the taxable estate of a deceased individual to determine if estate taxes are owed.

What information must be reported on fe?

Form 706 must report information such as the value of the decedent's assets, outstanding debts, deductions for funeral expenses, estate administration costs, and any applicable exclusions or credits.

Fill out your fe online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fe is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.