Get the free Initial Public Offering and New Business Formation:

Show details

Initial Public Offering and New Business Formation: The Role of Public Firm Disclosures*John M. Barrios Washington University in St. Louis & NBERJung Ho Choi Stanford UniversityJinhwan Kim Stanford

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign initial public offering and

Edit your initial public offering and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your initial public offering and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

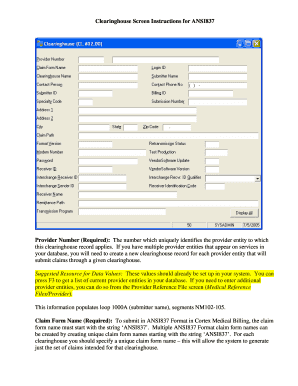

Editing initial public offering and online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit initial public offering and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

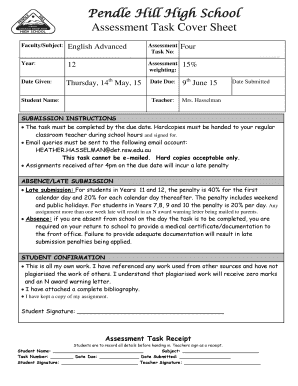

How to fill out initial public offering and

How to fill out initial public offering and

01

Prepare a business plan outlining the company's objectives, strategies, and financial projections.

02

Engage with investment bankers or underwriters to guide the IPO process.

03

Conduct thorough due diligence and prepare all required financial statements and disclosures.

04

File the registration statement (Form S-1) with the SEC, including details about the business, financials, and risks.

05

Answer any SEC comments or requests for additional information regarding the filing.

06

Set a price range for the shares and finalize the underwriting agreement.

07

Market the IPO through a roadshow to attract potential investors.

08

Set the final offer price and issue the shares for public trading.

Who needs initial public offering and?

01

Private companies looking to raise capital for expansion or debt reduction.

02

Companies seeking to increase their market visibility and credibility.

03

Businesses wanting to provide liquidity for early investors and employees through stock sales.

04

Firms aiming to use their publicly traded stock as currency for mergers and acquisitions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

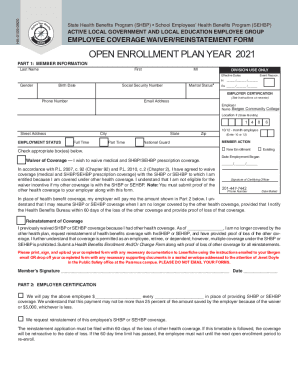

How can I send initial public offering and for eSignature?

To distribute your initial public offering and, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the initial public offering and electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your initial public offering and.

Can I edit initial public offering and on an Android device?

With the pdfFiller Android app, you can edit, sign, and share initial public offering and on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

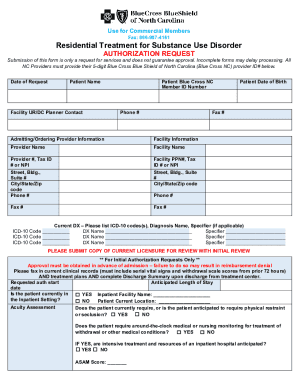

What is initial public offering?

An initial public offering (IPO) is the first sale of shares by a company to the public, allowing it to raise capital from public investors.

Who is required to file initial public offering?

A company looking to go public and sell its shares to the public is required to file for an initial public offering with the appropriate regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States.

How to fill out initial public offering?

To fill out an initial public offering, a company must prepare and submit a registration statement including a prospectus that outlines its business model, financial situation, management, and risks to potential investors.

What is the purpose of initial public offering?

The purpose of an initial public offering is to raise capital for the company, provide liquidity for existing shareholders, and increase its public profile.

What information must be reported on initial public offering?

An initial public offering must report detailed information including financial statements, risk factors, use of proceeds, management background, and the number of shares being offered.

Fill out your initial public offering and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Initial Public Offering And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.